- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

‘Pound’ For Your Thoughts?

Monday October 31: Five things the markets are talking about

This is a massive week for capital markets.

There are four central banks, including the Bank of England (BoE), Bank of Japan (BoJ), Reserve Bank of Australia (RBA) and the Federal Open Market Committee (FOMC) who will be keeping the various asset classes on their toes with their monetary policy announcements. None are anticipated to alter their current policies, but their noted intentions will have a lasting impact on asset prices. Perhaps, it’s a good time for the Fed to signpost a December rate hike?

Elsewhere, there is also a copious supply of updated economic releases globally. Japan updates its industrial production and retail sales for last month. October services, manufacturing and composite PMI’s will be released for a plethora of countries.

Rounding off this busy week will be Canada and the U.S posting their individual employment data and in between all these reports there is the race to the White House to consider, where tension is growing as Trump narrows the gap on Clinton.

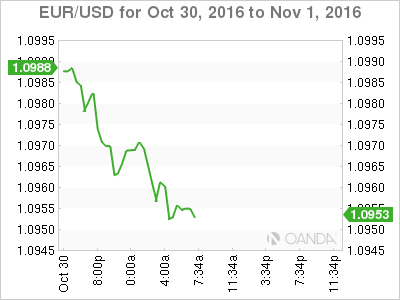

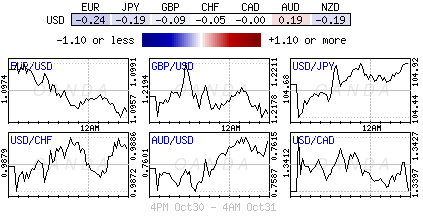

Since Friday, the mighty U.S dollar has struggled, hurt by another Clinton FBI e-mail probe. Nevertheless, be alert, it should be a messy week!

1. Politics dominate stock prices

Asian stocks were mixed overnight, weighed down by Friday’s U.S. losses as the race to the White House gets even tighter between the two U.S. presidential candidates in next weeks Nov. 8 election and by energy stocks.

The Nikkei Stock Average closed down -0.1%, the Shanghai Composite Index fell -0.1%, Korea’s KOSPI ended down -0.6%, while both the S&P/ASX 200 and Hang Seng closed out in the black, up +0.6% and +0.2% respectively.

European equities are also trading lower as market sentiment continues to wane with ongoing uncertainty over the Presidential elections and as participants await inflation data out of the U.S this morning. Financial and energy stocks are leading the losses in the Eurostoxx and the FTSE 100 respectively.

Futures on the S&P 500 Index have rallied +0.1%, after earlier retreating as much as -0.4%.

Indices: Stoxx50 -0.7% at 3,056, FTSE 100 -0.5% at 6,963, DAX -0.5% at 10,643, CAC 40 -0.8% at 4,512, IBEX 35 -0.9% at 9,115, FTSE MIB -0.9% at 17,167, SMI -0.7% at 7,855, S&P 500 Futures +0.1%

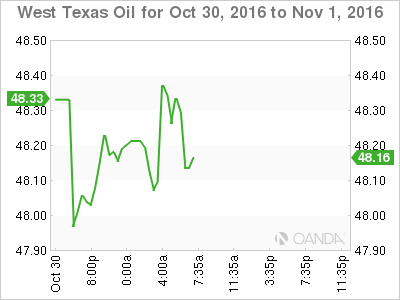

2. Crude Oil: All talk, no decision

Oil prices are extending last Friday’s declines this morning after non-OPEC producers made no specific commitment over the weekend to join OPEC in limiting output levels to support prices.

Officials from OPEC and non-OPEC nations met in Vienna on Saturday and only agreed to meet again in November before their scheduled regular OPEC meeting on Nov. 30.

To date, crude prices have fluctuated around the +$50 handle in uncertainty about whether OPEC can implement their first supply cut in eight-years next month.

Brent crude futures for Dec. are down -29c, or -0.6%, at +$49.42 a barrel. West Texas Intermediary (WTI) is trading down -29c, or -0.6% at +$48.41 a barrel.

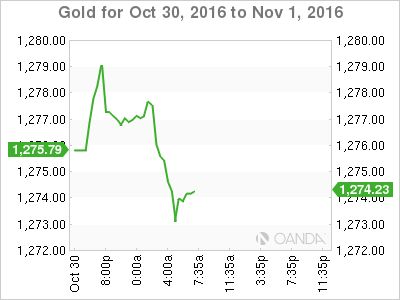

Gold is little changed at about +$1,275 an ounce after closing out last week rallying +0.6% on Friday. The ‘yellow’ metal’s gains represent some safe-haven buying after the FBI reopened its inquiry into Clinton’s use of a private e-mail server.

3. Sovereign bond yield rally takes a breather

The sell off in U.S treasuries seems to be taking a well-earned breather in early Monday trading as the FBI’s investigation of Clinton is supporting some investor safe-haven demand. Last weeks global selloff pushed sovereign yields to five-month highs.

The yield on U.S 10's is little changed at +1.84%, after touching a five-month high of +1.88% on Friday. This month’s bond rout on the back of the markets speculation that the end of “free” money is upon us, has seen U.S debt lose -1.2% this month, their worst performance in nearly two-years.

In China, one-year interest-rate swaps have rallied +5bps to an 18-month high of +2.76% as dealers speculate that the People’s Bank of China (PBoC) will seek to keep money rates high as they tackle asset bubbles and try to stem declines in the yuan (¥6.7641).

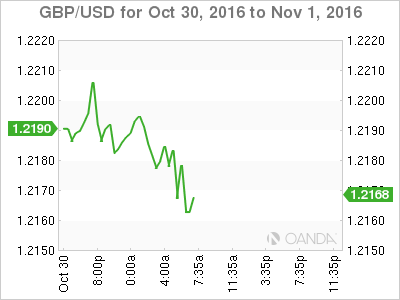

4. A pound for your troubles?

Expect sterling to remain on tenterhooks this week for two reasons, Governor Carney’s employment position and Thursday’s BoE rate decision.

The pound (£1.2169) continues to trade atop of its 30-year lows since the June Brexit vote and has remained fragile this month as pro-Brexit politicians urge PM May to replace Bank of England (BoE) Governor Carney. There was a brief reprieve overnight for sterling on reports that Carney would make a statement this week clarifying whether he would serve out his full eight-year term – apparently he has told close friends he intends to stay.

On Thursday, the BoE is expected to leave its main rate and QE program unchanged while revising its inflation projections higher. Since the BoE’s last meeting in August, the pound has weakened further while crude oil prices have risen around +25% in sterling terms, which argues for higher domestic inflation.

5. German retail sales plummet

German retail sales plunged last month, their second consecutive decline, a possible sign that global economic uncertainties are starting to undermine household consumption in Europe’s largest economy.

Retail sales, adjusted for inflation and seasonal swings, fell -1.4% in September, their sharpest one month fall in two-years. The market had expected a monthly gain of +0.2%. Compared with September last year, retail sales were up +0.4%, in inflation-adjusted terms.

Note, German retail sales data tends to be rather volatile and is prone to some deep revisions.

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.