- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Stocks Take Their Cue From Wall Street

Thursday May 18: Five things the markets are talking about

Investor bets that President Trump’s policies would boost growth and inflation has been unwinding for months, but, those moves have intensified this week.

Global stocks, the mighty U.S. dollar and government bond yields have been under pressure as investors pull back from their bets on the swift passage of the Trump administration’s agenda.

Despite Trump continuing to hold the support of most Republicans, the market is becoming increasingly concerned that deeper cracks could emerge.

Since yesterday, the flight from risk assets has managed to send the VIX +30% higher, and trading a tad shy of +16, has filled the gap made into the French election.

It’s not just the political anxiety, but combined with some softer U.S. data of late, retail sales and inflation, is lowering the odds of a June rate hike.

1. Stocks take their cue from Wall Street

Equities in Asia followed the U.S lead, where the Dow and S&P 500 both sinking about -1.8% yesterday following reports that Trump tried to influence a federal probe.

In Japan, the Nikkei fell to a three-week low, falling -1.3%, as worries over Trump allegations offset a strong preliminary GDP for Q1 (+0.5%). The broader Topix saw similar pressure, falling -1.4%.

In Hong Kong, the Hang Seng Index fell -0.7% while the Hang Seng China Enterprise (CEI) retreated -1.2%.

Down-under, the Australia’s S&P/ASX 200 Index lost -0.8% despite a stronger Aussie employment change (+37.4k vs. +5k).

In Europe, ahead of the U.S. open, regional indices trade modestly lower across the board with the FTSE 100 leading the decliners, basically shadowing U.S losses.

U.S stocks are set to open in the red (-0.1%).

Indices: Stoxx50 -0.8% at 3220, FTSE -1.2% at 7415, DAX -0.7% at 12539, CAC 40 -0.9% at 5268, IBEX 35 -1.3% at 10645, FTSE MIB -1.7% at 20915, SMI -0.9% at 8922, S&P 500 Futures -0.1%

2. Oil down, as market stays well supplied, gold loses some shine

Oil prices are a tad lower on news that the market remains well supplied with crude despite efforts by OPEC to curb production and support prices.

Brent crude is down -17c at +$52.04 a barrel, while U.S light crude oil (WTI) is -16c lower at +$48.91.

Both benchmarks rose yesterday after news of a drawdown in U.S. crude inventories and a dip in U.S. output.

Note: The U.S. EIA said inventories fell -1.8m barrels in the week to May 12 to +520.8m barrels.

OPEC ministers meet in Vienna on May 25 to decide production policy for the next six-months. The market is expecting producers to prolong their agreement to limit production, perhaps by up to nine-months.

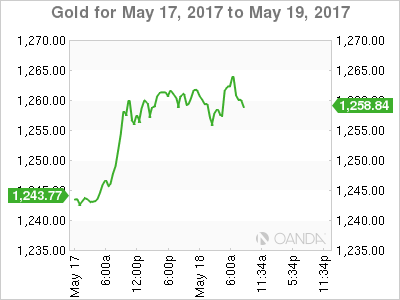

Heading into the U.S session, gold prices are a tad weaker (-0.2% at +$1,258.02 per ounce) after touching its two-week high overnight, mostly weighed down by profit taking.

The yellow metal rose about +2% yesterday, its biggest one-day percentage gain in 12-months.

3. U.S. Bond Yields Sink on Political Jitters

This week’s safe haven demand has pushed down the yield on U.S. 10’s to trade well below the psychological +2.30% handle. Yesterday, the yield touched its lowest intraday level in four-week at +2.23%.

Currently the odds that the Fed will raise its benchmark rate next month are about +63%, based on the current effective fed funds rate. That’s down from +83% before last Friday’s retail sales and inflation reports.

The odds that the Fed moves in September are also on the decline. Fed fund futures are not pricing in a full hike until November.

Elsewhere, Australian benchmark yields fell -3 bps to +2.50%, while benchmark yields in France (+0.79%) and Germany (+0.32%) were little changed after dropping six basis points in yesterday’s session.

4. Lame duck scenario has dollar on defense

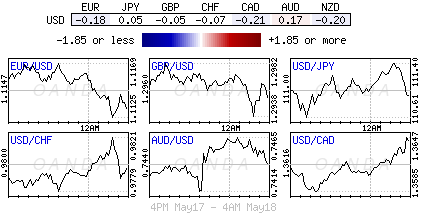

The political mess that has engulfed the Trump Administration continues to pressure the ‘mighty’ USD. Even market concerns about the momentum of the U.S economy is contributing to this week’s downfall across the board.

Despite the dollar’s small reprieve or consolidation (€1.1123, ¥110.46) heading into this morning’s session, there is a potential that the USD could see further weakness if the market believes the situation could evolve into a possible “lame duck” environment.

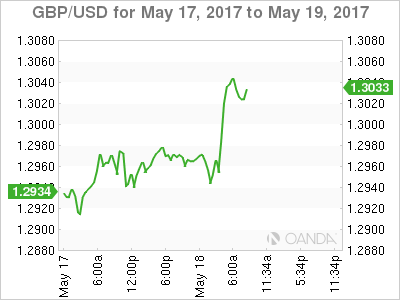

Better retail sales data from the U.K (see below) has helped push the pound (£1.3047) through the psychological £1.3000 handle for the first time in eight-months. To many, £1.3000 is the key pivot and now a lot of the structural shorts out there post-Brexit will be looking to wind back. Short-term sterling bulls are now targeting £1.3350/1.3400.

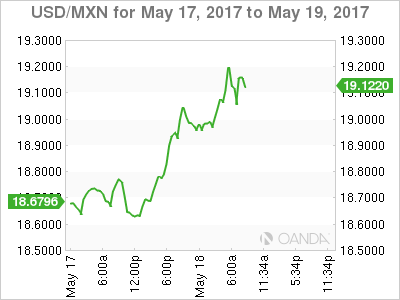

Elsewhere, MXN has fallen by over -2% overnight as a proxy for BRL as the Brazilian President gets embroiled in a corruption scandal.

5. UK Retail Sales Rebound in April

U.K data this morning sees retail sales rebounded last month – +2.3% m/m vs. +1.5% e – following a steep quarterly decline in Q1. The stronger print would suggest that the U.K economy has begun Q2 on a stronger footing.

Note: Compared with April last year, sales were +4.0% higher versus and expected +2.3% growth.

Accelerating inflation and low wage growth has weighed heavily on consumer spending in Q1, causing the whole economy to slow significantly.

Data this week showed U.K inflation hitting a three-year high of +2.7% in April, the third consecutive month of above-target price growth. The BoE expects inflation to peak at around +2.8% later this year, and gradually return to their +2% target afterwards.

Also in the U.K. today, the Conservative Party is expected to launch their election manifesto.

Related Articles

We haven’t had to change our subjective probabilities for our three alternative economic scenarios for quite some time. We are doing so today and may have to do so more frequently...

The US, Japan, and parts of Europe had a rough week, while China, Germany, France, and the Euro Stoxx 50 stayed steady. Tariffs, central banks, and the war in Ukraine keep...

We haven’t discussed global monetary inflation for a while, mainly because very little was happening and what was happening was having minimal effect on asset prices or economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.