- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

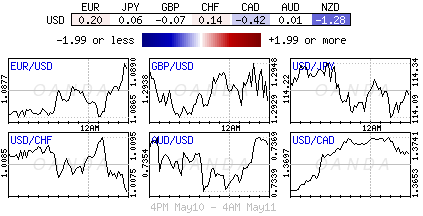

Kiwi Dollar Crash Lands, Loonie Burnt

Thursday May 11: Five things the markets are talking about

Global equities have continued their upward momentum as volatility takes a back seat after Macron victory in France’s Presidential election, corporate earnings and U.S data has maintained positive sentiment about economic growth.

Amongst signs of a strengthening U.S labor force, investors are paying closer attention to comments from Fed officials for clues on the path for interest rates this year. The odds for a June hike are already baked in, but where to from there?

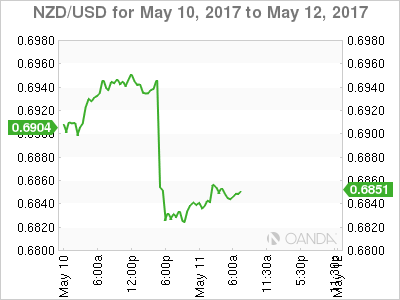

The kiwi dollar crashed, falling more than -1.5% as the Reserve Bank of New Zealand (RBNZ) fails to live up to expectations, while Canada’s loonie lost some of its shine after Moody’s cut its credit ratings on six Canadian banks.

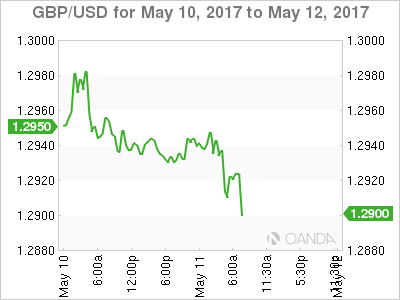

It’s show time for the BoE – will sterling’s double top £1.30 handle be penetrated today?

1. Global bourses hover near highs

Global stocks continue their advance, trading atop of their multi-year highs, supported mostly by a rebound in oil boosted energy producers.

In Japan, the broader TOPIX index rose +0.1%, while the Nikkei 225 climbed +0.3% aided by a weaker yen (¥114.11) helping exporters.

In China, the Shanghai Composite Index rallied +0.3%, the first positive day in seven sessions – investors continue to evaluate regulatory intervention in their financial markets.

In Hong Kong, the Hang Seng added +0.5%, while in New Zealand, the S&P/NZX 50 surged +0.9% to its highest level in 10-months on an unexpected ‘dovish’ RBNZ (see below).

In Europe, the Stoxx Europe 600 fell -0.1%, after gaining +0.2% yesterday to its highest level in two-years. The FTSE is seeking guidance from today’s BoE rate announcement.

U.S stocks are set to open in the red (-0.1%).

Indices: Stoxx50 -0.1% at 3641, FTSE flat at 7386, DAX flat at 12763, CAC 40 +0.1% at 5404, IBEX 35 -0.7% at 10961, FTSE MIB +0.2% at 21603, SMI +0.2% at 9107, S&P 500 Futures -0.1%

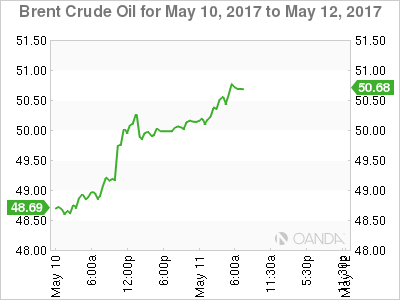

2. Oil up on falling U.S inventories, Saudi cuts to Asia

Ahead of the U.S open, oil prices remain better bid after yesterday’s U.S data recorded a larger than expected fall in inventories and as the Saudi’s announced a bigger than expected cut in supplies to Asia.

Brent futures are up +30c at +$50.52 a barrel, while U.S light crude (WTI) is up +35c at +$47.68.

U.S. EIA data showed that crude inventories fell -5.2m barrels in the week to May 5, and at +522.5m barrels, crude stocks were the lowest since February.

Also tightening the market is Saudi Aramco announcement that they will reduce supplies to Asian customers by about -7m barrels in June.

Capping price gains is higher crude output from the U.S, particularly shale producers.

Note: OPEC meets on May 25 to decide on production policy for H2, 2017. The market expects the group to extend cuts until at least the end of the year.

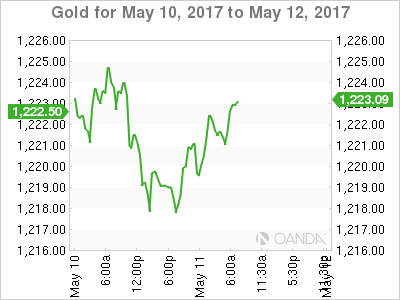

Gold (+0.2% to +$1,222.02) is steady ahead of the open, holding just above its two month low (+$1,2212) hit earlier this week, as the U.S. dollar and stocks firm on expectations of a June rate hike.

3. BoE’s “Super Thursday”

It’s the trifecta of events from the BoE today – rate announcement, quarterly inflation report and minutes (07:00 am GMT). Thirty minutes later (07:30 am GMT), Governor Carney will give a press conference.

The market consensus expects the BoE to revise higher its inflation outlook for the year and keep the benchmark rate unchanged at +0.25%. However, Governor Carney is bound to talk down expectations for a rate increase anytime soon. Fixed income dealers will be focusing on whether more than one person among those voting calls for a rate increase.

Elsewhere, Fed member turned ‘hawk’ Eric Rosengren has warned that the central bank was in danger of lifting its foot off the policy accelerator too slowly, and called for more aggressive action to prevent the economy from overheating.

Dallas President Kaplan said his base-case for rate hikes this year is still three, but indicated that he’s “very cognizant” of the fact inflation pressures have been more muted.

The yield on U.S. 10’s has fallen -2 bps to +2.40%, after rising for the past three sessions. In New Zealand, its equivalent benchmark yield slipped -5bps to +3.02% on a ‘dovish’ RBNZ (see below).

4. Kiwi Dollar Crash Lands, loonie burnt

NZD (N$0.6844) was ‘burnt’ overnight, falling -1.5% outright, its lowest print in 11-months, when the RBNZ failed to promote the idea that it will raise interest rates this year (+1.75%).

Governor Wheeler suggested that the next move would be up, but not until the end of 2019. Markets had been pricing in tightening commencing in early 2018. The Governor cited “extensive political uncertainty” around U.S trade and economic policy among reasons for holding rates steady.

Elsewhere, the loonie has lost its way in the overnight session with USD/CAD rallying +70 pips to a high print of C$1.3740 after Moody’s cut its rating on Canada’s top banks. However, CAD has found some support from the energy sector, capping those gains (C$1.3702) ahead of the U.S open.

Ahead of the BoE rate announcement, the GBP (£1.2911) is weaker following data misses for March production data and wider trade deficits (see below). Next move depends on how ‘hawkish’ members are.

5. U.K Industrial output disappoints, trade deficit widens

U.K. industrial production contracted in March (-0.5% vs. -0.4e m/m) as manufacturing output declined unexpectedly and unseasonably warm temperatures reduced demand for energy. Compared with the same month last year, industrial output was up +1.4%, missing market expectations of +1.9% growth.

Manufacturing output also disappointed, it declined by -0.6% versus market consensus of no change. Annual growth in manufacturing also missed expectations, with factory output growing by +2.3% vs. +2.5%e.

Other data also showed that the U.K’s trade deficit (-£5.7B in Q1) with the world widened in March.

Related Articles

We haven’t had to change our subjective probabilities for our three alternative economic scenarios for quite some time. We are doing so today and may have to do so more frequently...

The US, Japan, and parts of Europe had a rough week, while China, Germany, France, and the Euro Stoxx 50 stayed steady. Tariffs, central banks, and the war in Ukraine keep...

We haven’t discussed global monetary inflation for a while, mainly because very little was happening and what was happening was having minimal effect on asset prices or economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.