- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

D-Day For NFP

Friday February 3: Five things the markets are talking about

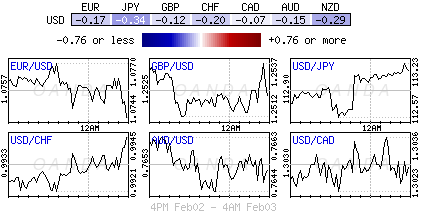

Will the dollar get any relief from a strong nonfarm payroll (NFP) report today?

Yesterday, the dollar fell to its lowest level in more than two-months across the board, as doubts grow about whether Trump’s administration would prioritize promises to cut taxes and boost fiscal spending.

Many remain concerned that he is perhaps focusing too much on trade issues and diplomatic matters, rather than the promised tax reductions and infrastructure spending that fueled the Trumponomic trade since last November.

Despite central bank decisions having dominated the financial markets all week, policy makers’ direct influence on asset prices is beginning to wane as investors become sensitive to more genuine drivers that influence productivity, trade and corporate investment. Today its nonfarm payroll (NFP) and market expectations anticipate a +180k print for January (08:30am EST). Again, the focus on the jobs report will center on wage pressures.

1. Global equities a mixed bag ahead of NFP

In Japan, the Nikkei ended flat in choppy trade as investors awaited the release of NFP – this will set the tone for the Fed’s policy outlook. The benchmark index has fallen -2.8% this week.

In Hong Kong, stocks suffered their fourth consecutive session of declines amid uncertainty over global growth and fresh signs of policy tightening in China – the Hang Seng index fell another -0.2%, for the week, the index has dropped -1%.

In China, stocks snapped their five-day winning streak after Beijing unexpectedly raised short-term interest rates on the first trading day after the Lunar New Year holiday, in a further sign it has moved to a tightening policy bias. The Shanghai Composite Index lost -0.6%.

Note: The PBoC raised money market rates by +10bps, and reinforced their views that they are opting for a “prudent and neutral” monetary policy stance this year. They also raised rates on short-term lending facility (SLF) loans.

In Europe, equity indices are trading higher ahead of the U.S employment data. Financial stocks again are leading the gains across in the Eurostoxx 60 on higher global yields. Commodity and mining stocks are weighing in the FTSE 100.

U.S equities are set to open a tad higher (+0.1%).

Indices: Stoxx50 +0.3% at 3,268, FTSE +0.4% at 7,168, DAX +0.1% at 11,637, CAC-40 +0.7% at 4,827, IBEX-35 +0.4% at 9,440, FTSE MIB +0.6% at 19,002, SMI +0.6% at 8,328, S&P 500 Futures +0.1%

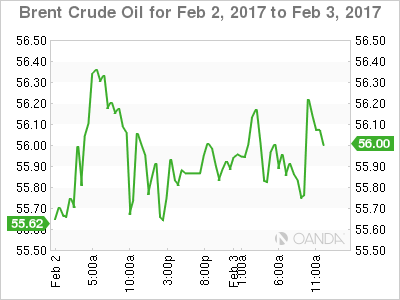

2. Oil higher on geopolitics, gold profits booked

Ahead of the U.S open, oil prices are higher on news that Trump could be set to impose new sanctions on multiple Iranian entities following Tehran’s ballistic missile test.

Also, Russian comments that their domestic oil producers had cut their output in accordance with a pact agreed in December is also supporting prices.

Brent crude is up +45c, or +0.8%, to +$57.01 a barrel (or +2.6% this week), while U.S. WTI has climbed +48c, or +0.9%, to +$54.02 a barrel (up a little over +1% this week).

Note: Market consensus expects oil prices to average around the mid- to high $50’s in Q1 and Q2.

In metals, ahead of U.S. jobs data it seems that investors are happy to book some gold profits after the metal hit an 11-week high yesterday ($1,225.30). Prices have slipped -0.3% to +$1,212.91 overnight as the dollar outperforms the yen after Japan offered to buy government bonds. The precious metal is up +1.8% this week.

3. BoJ disappoint in bond repurchases, China raises rates

Government bonds on both sides of the Atlantic strengthened yesterday after the BoE signaled it was in no rush to tighten monetary policy despite a recent pickup in inflation. Governor Carney is prepared to tolerate a long spell of above-target inflation to support the economy as the U.K. charts its exit from the EU.

The yield on the benchmark 10-year U.S. Treasury note is trading atop of +2.439%. The yield on the 10-year U.K. gilt has dropped to +1.374% from +1.460% before the BoE decision, while the yield on the 10-year German bund has declined to +0.420%.

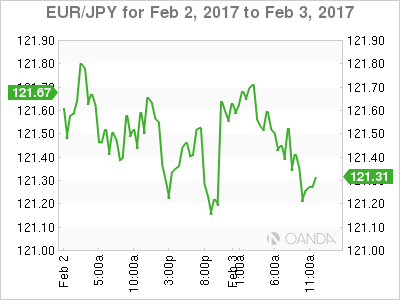

In Japan, the BoJ conducted another fixed-rate JGB operation.

Nevertheless, dealers’ confidence in the BoJ’s capability to hold down rates is beginning to wane, especially as Japanese policy makers offered only a ‘limited’ expansion of debt purchases in a regular operation – this sent both the yen (¥112.36) and JGB yields higher.

Japan’s 10-year yield surged as much as +4bps to +0.15%, the highest since the BoJ implemented its negative-rate policy in January 2016. Expect the market to continue to focus on whether the BoJ will deliver further to rein in the rise in yields.

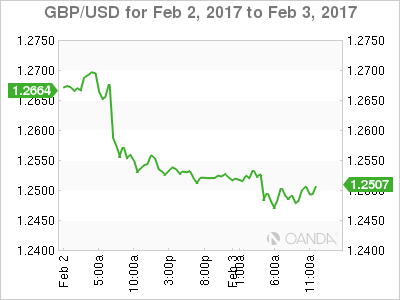

4. Sterling falls after disappointing data

The pound (£1.2488) has turned lower this morning after a weaker-than-expected PMI for services – which makes up a substantial proportion of U.K. economic activity – fell to 54.5 last month from 56.2 in December. Consensus was expecting a print of 55.8. The euro has rallied to €0.8611, up +0.15%.

Elsewhere, the ‘big’ dollar is trying to find some strength from its recent losses. The EUR/USD (€1.0741) is little changed despite numerous ECB and German official downplaying the recent pick-up in inflation data. USD/JPY is a tad higher, up +0.3% and holding above the psychological ¥113 level.

5. Pan Asian PMI’s a slight disappointment

Overnight, the PMI reports for China, Honk Kong and Australia were all slightly disappointing.

China’s Caixin PMI was in expansion for the seventh consecutive month (51.0 vs. 51.8e), but missed consensus amid a slower increase in output and new order activity as well as reduction in employment.

After last month’s jump in Hong Kong PMI to expansion, the figure was back below the 50-threshold (49.9 vs. 50.3 – in contraction for the 22nd out of 23-months) – also in contraction was output, new orders, and falling business confidence. Employment, however, saw some marginal improvement.

In Australia, services PMI slowed to 54.4 from multi-year high of 57.7 last month, but remains in expansion for the fourth successive month. Further evidence of a strong Aussie economy (this week’s record high trade surplus) has put the probability of an RBA rate hike this year somewhere at +40% and rising.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.