USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support for the US dollar amid concerns that US President Donald Trump’s trade tariff policies could escalate once again.

Key Drivers Influencing USD/JPY

Trump recently announced plans to review the possibility of imposing reciprocal 25% tariffs on European cars and other goods. Additionally, he confirmed that tariffs on imports from Mexico and Canada will take effect on 2 April rather than the initially planned 4 March. These developments have intensified trade tensions, lending support to the USD.

Despite today’s consolidation, the yen remains strong, with expectations that the Bank of Japan (BoJ) may continue raising interest rates this year following Q4 inflation data.

Additionally, the JPY remains in demand as a safe-haven asset amid ongoing uncertainty and underlying risks in global financial markets.

A crucial set of economic data will be released on Friday, including figures on industrial production, retail sales, and Tokyo’s inflation rate. These reports could provide further insight into the BoJ’s future monetary policy trajectory.

Technical Analysis of USD/JPY

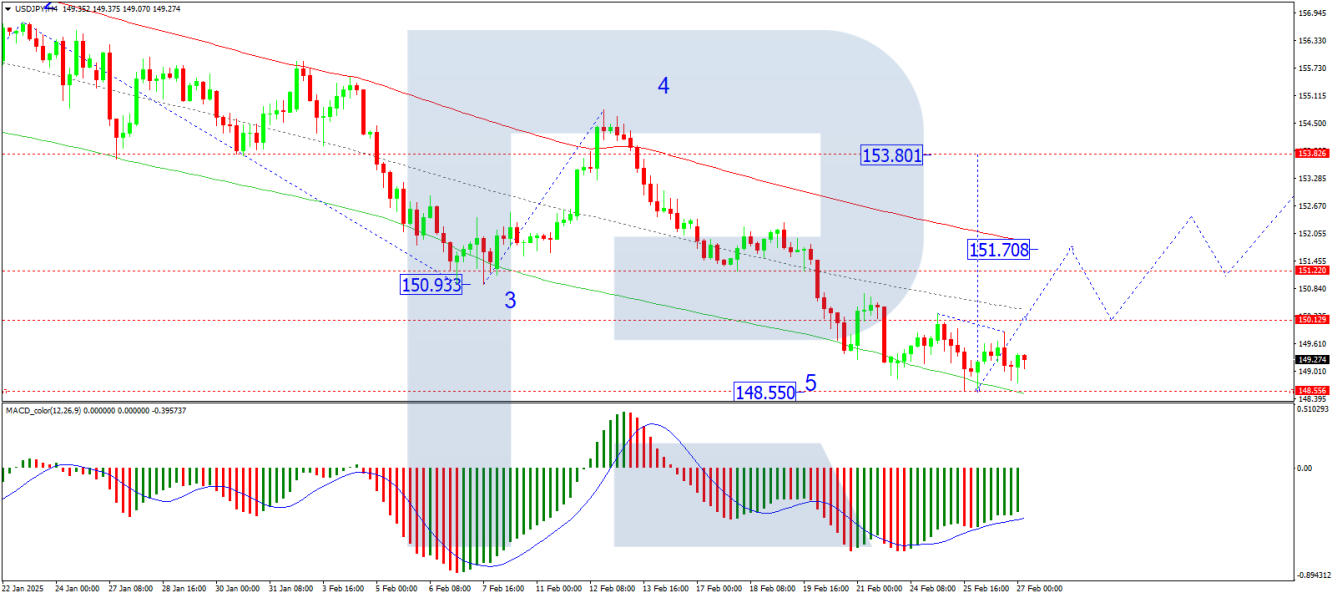

On the H4 chart, USD/JPY completed a downward wave to 148.55. The market is now forming a consolidation range at this low. A corrective move towards 151.80 could develop if the price breaks upward, marking the first key target. Upon reaching this level, a further corrective decline towards 150.20 may follow. The MACD indicator confirms this scenario, with its signal line positioned below zero but pointing upward, indicating potential correction.

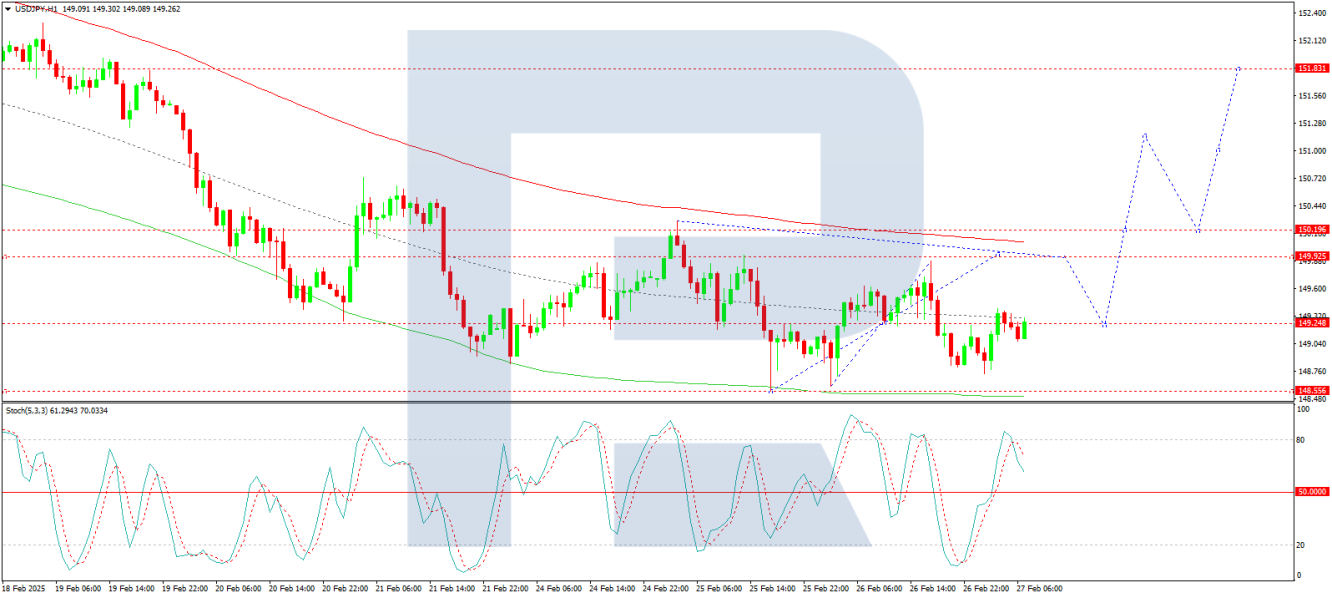

On the H1 chart, USD/JPY is forming an upward wave structure towards 150.00. A broad consolidation range is developing around 149.25. If the price breaks upwards from this range, a correction towards 151.80 could unfold. After reaching this target, the pair could pull back to 150.20. The Stochastic oscillator supports this outlook, with its signal line above 50 and pointing upwards, suggesting short-term bullish momentum.

Conclusion

USD/JPY has temporarily stabilised after recent declines, with technical indicators suggesting a potential corrective move towards 151.80. However, upcoming Japanese economic data and ongoing geopolitical uncertainties could introduce volatility. Market participants will closely monitor BoJ signals and further developments regarding US trade tariffs, which could impact the yen’s safe-haven appeal.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.