- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar In Trouble Ahead Of May Day

April 28: Five things the markets are talking about

Global equities are on the back foot; trimming their sixth consecutive monthly gain, as geopolitical worries intensifies ahead of today’s U.S GDP report for Q1 (08:30 am).

U.S data is projected to show the domestic economy expanded at a +1.0% annualized rate in Q1, the weakest pace in a year.

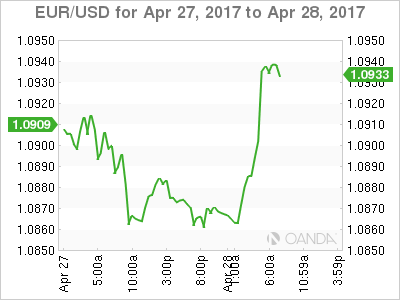

Crude prices are again trading in the black, after tumbling on concern over a supply glut. The EUR is heading for a weekly gain, reclaiming most of yesterday’s losses that came after the ECB signaled its commitment to stimulus even as the region’s economy growth firms.

And in the U.S, congress is considering a continuing resolution to avoid a government shutdown.

1. Stocks trim monthly gains

Despite the North Korea situation, global stocks remain near a record high as investors bet on improving global economic growth and stronger earnings.

In Japan, the Nikkei share average ticked down -0.3% overnight as a relief rally driven by fading Euro political worries faded. Despite this, the benchmark still managed to print its largest weekly gain in five months. The broader Topix fell -0.3% – the gauge gained +2.9% this week, the best performance this year.

In South Korea, the KOSPI slipped -0.2% from its highest level in six-years, while in Hong Kong, the Hang Seng dropped -0.4%, and the Shanghai Composite Index added +0.1% – the latter gauge is down -2.1% this month.

In Europe, equity indices are trading generally lower as market participants digest comments by ECB’s Draghi that there is not enough evidence to change the inflation outlook. Financials are mixed in the Eurostoxx, while commodity and mining stocks are providing some support in the FTSE 100.

U.S stocks are set to open flat.

Indices: Stoxx50 flat at 3,562, FTSE -0.2% at 7,222, DAX flat at 12,445, CAC 40 +0.1% at 5,275, IBEX 35 +0.1% at 10,696, FTSE MIB +0.2% at 20,647, SMI -0.1% at 8,836, S&P 500 Futures flat

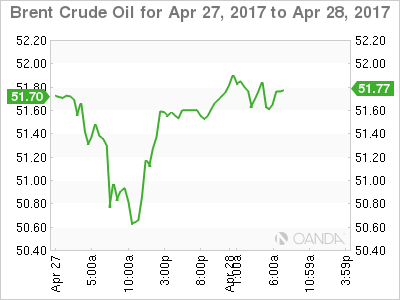

2. Oil rebounds from one-month low on hopes for output cut extension

Oil prices have rebounded overnight after dropping to a one-month low yesterday. The ‘bulls’ continue to buy product on dips believing that at next months OPEC meeting global producers will extend their output cuts for H2.

Crude prices are also getting some help from a weaker dollar and signs that non-OPEC member Russia was fully compliant with output limits agreed back in November.

Brent crude futures are trading up +33c at +$51.77 a barrel, while U.S light crude (WTI) is up +44c at +$49.41 a barrel.

The supply overhang is in part due to surging U.S production from shale producers – EIA data indicates that domestic output production has risen +10% since mid-2016 to +9.27m bpd.

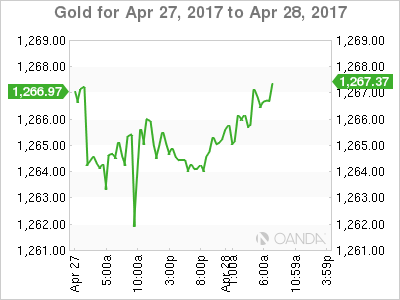

Gold is little changed ahead of the U.S open. Nevertheless, it’s poised for the biggest weekly fall in nearly two-months as investors seek out higher returns. Spot gold is up +0.1% at +$1,264.86 per ounce.

Note: Gold is on track for a weekly drop of about -1.5%, the biggest weekly percentage fall since the week of March 10, but is heading towards a gain of about +1.3% for the month.

3. Yields remain contained

U.S 10-year yields closed out below +2.30% yesterday as a drop in oil to one month lows supported prices – lower energy prices tend to keep inflation intact.

Bonds have also found support from continuing skepticism over the prospects for U.S fiscal stimulus, as well as month-end demand as some investors adjusted their portfolios to match changing indexes.

Elsewhere, yesterday the ECB kept its main interest rate charged on regular loans at +0% while the rate on overnight deposits would stay at a -0.4%. It also maintained its bond-buying program (QE) at +€60B a month. Dealers are beginning to price in ECB tapering happening in early 2018. Euro inflation numbers this morning (see below) has backed up yields on 10-year German Bunds by +4 bps to +0.34%.

Down-under, Aussie benchmark 10-year yields lost -4 bps to +2.58%.

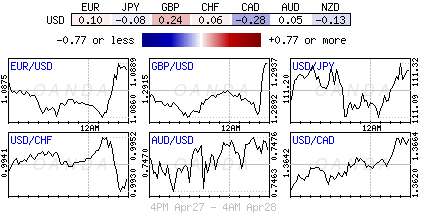

4. May Day Squaring

End-of-month and upcoming May-Day holiday on Monday is keeping FX flows at a minimum, but the USD is a tad softer ahead of the U.S open.

EUR/USD (€1.0936) is slightly higher; trading atop of this months high supported by this morning Eurozone data – April core-CPI finally broke out of its year-long trading range of +0.7-0.8% to surge to +1.2%

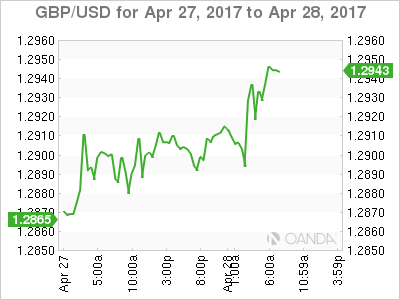

The pound is trading atop of its eight-month highs (£1.2945) and is threatening to test that psychological £1.3000 handle despite this morning disappointing data print – U.K Q1 Advance GDP data came in slightly below expectations (see below).

In Japan, a barrage of data overnight has failed to move the JPY currency much. USD/JPY is steady trading at ¥111.46 area in the session.

Expect dealers to take their cue from this morning U.S Advanced GDP headline print.

5. U.K data disappoints, Japan’s mixed, and E.U has inflation

The U.K. economy slowed sharply in Q1 as rising inflation-crimped consumer spending. The economy grew +0.3% on the quarter, as a weakness in services more than offset a strong quarter for manufacturing. Analysts expect business investment and exports will need to do more of the heavy lifting in the months ahead to sustain growth.

In Japan a barrage of economic releases pointed towards economic growth, but with soft inflation- national CPI slowed to a five-month low (+0.2% vs. +0.3%e), while industrial output decline was the biggest in nine-months (-2.1% vs. -0.8%e m/m). The number for unemployment was better than expected (+2.8% vs. +2.9%), while retail trade reached a two-year high.

Finally, in Europe, the Eurozone CPI (+1.2% vs. +1%) was higher than expected as core inflation broke out of recent 12-month range. The headline inflation reached +1.9%, touching the ECB’s target for close to, but slightly below +2%.

Related Articles

The US dollar fell last week due to Trump's inconsistent trade policies and signs of a slowing economy. February's non-farm payroll data disappointed, with unemployment...

Forex Strategy is Bearish: USD/JPY is currently at 146.76 in a 5th fractal wave in a channel. We are looking for a continuation to the ATR target at the 146.10 area, with a...

The Canadian dollar is steady at the start of the week. USD/CAD is trading at 1.4385, up 0.06% on the day. The Canadian dollar declined 0.50% on Friday after Canada’s job report...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.