- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Trump Trade Needs Healthcare

Thursday March 23: Five things the markets are talking about

This week’s global equities selloff has eased in the overnight session as the market steps back before today’s key U.S vote on Trump’s healthcare bill.

Market sentiment is being dictated to by this piece of legislation – the House votes this evening. The fact that the President is struggling to push his bill has raised raised doubts over whether he can win support for his pro-growth economic policy measures.

Press reports late Wednesday suggests that the White House is considering concessions to the right wing of the party to help the bill through the house.

This is the markets litmus test – if the healthcare bill does actually stall, the Trump ‘reflation’ trade will again come under threat – stocks, yields and dollar lower.

Note: The timing of this evening’s vote has not been set.

1. Global stocks see mixed results

This week’s equity selloff was the biggest for stocks since the November U.S election. To date, they have largely escaped the markets efforts this year to unwind the “Trump trade.”

Note: While the dollar has fallen -4.4% ytd, global stocks have climbed to new record highs.

In Japan, the Nikkei edged a tad higher overnight (+0.2%), up from its two-month low, as support from a weaker yen (yesterday’s ¥110.75 print was a four -month low) helped offset a political scandal centered on PM Abe’s wife. The broader Topix was little changed.

In Hong Kong, benchmark stock index struggled as strength in Chinese real estate developers was offset by weakness in some blue chips – earnings reports disappointed. The Hang Seng ended flat. The index is up +10% ytd and market is questioning valuations.

In China, stocks rebounded, but gains are being capped with more mainland money flowing into Hong Kong through trading links. The CSI 300 blue-chip index rose +0.4%, while the Shanghai Composite Index gained +0.3%.

In Europe, equity indices are trading mixed, as market participants remain nervous after the recent terror attack in London yesterday. Banking stocks are leaning on the Euro Stoxx 50, while energy, commodity and mining stocks trade in the FTSE 100.

U.S stocks are set to open in the black (+0.2%).

Indices: Stoxx50 -0.1% at 3,420, FTSE flat at 7,322, DAX +0.2% at 11,925, CAC 40 -0.1% at 4,989, IBEX-35 +0.1% at 10,235, FTSE MIB +0.2% at 19,999, SMI +0.2% at 8,581, S&P 500 Futures +0.2%

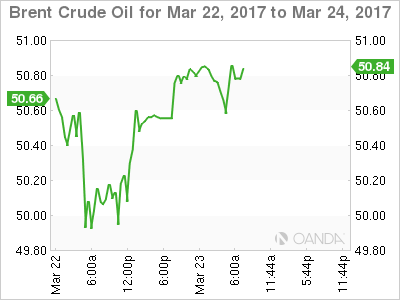

2. Oil bounces off lows, but bloated U.S stocks pressure market

Oil prices have recovered a tad, but the market remains under pressure as bloated U.S crude inventories and rising output continues to dampen OPEC-led efforts to curb global production.

Brent crude futures at +$50.82 per barrel is up +18c, or +0.4% from Wednesday’s close. Brent briefly dipped below the psychological +$50 intraday yesterday for the first time since November.

West Texas Intermediate (WTI) crude futures are up +19c, or +0.4% at +$48.23 a barrel, after testing support at +$47 overnight.

Note: The EIA said U.S inventories climbed almost +5m barrels to a record +533.1m last week, far outpacing estimates of a +2.8m barrel build. U.S production has risen over +8% since mid-2016.

There are signs that the Asian market is also bloated – China’s gas imports are slumping and its own domestic refiners are exporting huge volumes overseas.

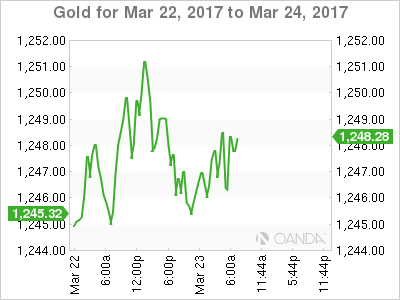

Gold prices slipped overnight, trading below its three-week high print yesterday, as the dollar recovers from its two-month low and markets wait to see if President Trump can push through his healthcare bill. The yellow metal is down -0.1% at +$1,247.30 per ounce – Wednesday, it touched its strongest since Feb. at +$1,251.26.

3. Global yields dependent on Trump stimulus expectations

With market risk sentiment being somewhat fragile given the uncertainty on whether Trump can deliver on stimulus expectations has been supporting U.S treasuries and bunds prices in particular

In the U.S., 10-Year yields rose above +2.6% earlier this month and reached a two-year high as investors anticipated the Fed would raise short-term interest rates. They did last week, but its signal of a “gradual” path of tightening policy has debt product better bid. U.S 10’s are trading at +2.41%. German bunds are trading just above +0.4%.

In the U.K, yields on 10-Year gilts have backed up +1 bps to +1.19% after domestic data showed that U.K retail sales rose beating expectations (see below).

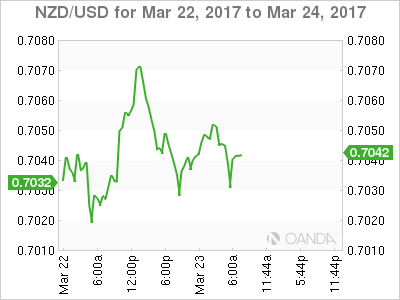

Elsewhere, the Reserve Bank of New Zealand (RBNZ) held rates steady overnight (+1.75%) as expected and maintains a neutral policy stance. In its policy statement, officials expressed more concern over housing inflation while reiterating that the exchange rate should depreciate more to achieve balanced growth.

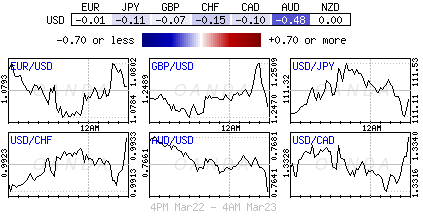

4. Dollar waits for U.S House vote

Some of yesterday’s risk aversion sentiment has eased overnight as the market awaits the U.S House vote on the repeal of Obamacare. A rejection of the bill could be interpreted that President Trump will have massive problems for his plans for tax cuts and spending increase and further undermine the Trump trade.

USD/JPY (¥111.00) has climbed away from its four-month low (¥110.75), but any further upside is facing resistance. Whispers of USD sell-stops below yesterday’s lows may provide further momentum to test below the psychological ¥110.00 handle.

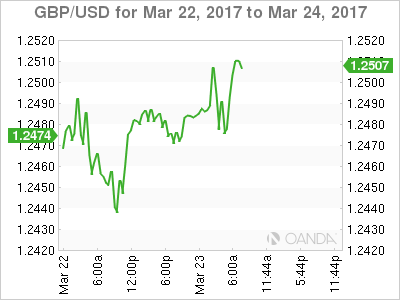

The Pound (£1.2520) has firmed on a better headline U.K retail sale for Feb. Sterling’s focus will now be on Brexit divorce proceedings, which PM May, is expected to trigger on March 29.

5. U.K Retail Sales rebound in Feb

Data released this morning showed that U.K retail sales rebounded strongly in February (+1.4% vs. +0.4% e) following three consecutive months of decline, but the underlying trend remained weak, suggesting the industry was unlikely to make a positive contribution to growth in the Q1.

There were strong sales across all categories, with household goods stores out performing. However, sales in the three-months through Feb. fell by -1.4%, the fastest pace of decline in seven-years.

The pound’s depreciation (£1.2520) since the Brexit vote is supporting price growth and with U.K wage growth struggles to keep up with inflation, the U.K consumer is expected to curb spending.

Related Articles

The combination of extremely rich equity valuations, high interest rates, and a new President taking bold actions will likely continue to whip stocks around for the foreseeable...

NFP take center stage amid DOGE layoffs ECB decides monetary policy after CPI data Canada jobs report and RBA minutes also on tap Will DOGE layoffs weigh on NFP? The US dollar...

US Dollar's Strength Triggers a Sell-Off in Gold The gold (XAU/USD) price plunged by more than 1.3% on Thursday as the US Dollar Index (DXY) moved sharply higher after a strong US...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.