- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar Slips On Yellen

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The U.S. dollar remains under pressure at the start of this new trading week. Janet Yellen’s speech in Philadelphia was the most anticipated event risk for the dollar and while it failed to ignite fireworks in the greenback, it gave investors very little reason to buy dollars. Going into her speech, many market participants expected the Fed Chair to say that rates would rise in the coming months. But unfortunately, she refrained from repeating that statement and instead recognized the deterioration in Friday’s jobs report. While Janet Yellen doesn’t want to read too much into one month’s report, she’s concerned by the extent of last month’s labor-market weakness. The overall tone of her speech in Philadelphia was less hawkish because aside from the jobs number, she’s also worried about China and Brexit risks. To be clear, Yellen still believes that economic positives outweigh the negatives and she believes that improvements in other labor-market releases indicate that wages are rising, thus eliminating labor slack. But she needs to see a significant recovery in job growth before raising rates again. The Fed is still on track to raise interest rates in 2016, but at this stage, a hike in June is definitely not happening and for rates to rise in July, we would need to see payrolls rise by more than 200K. The dollar only experienced modest losses following Yellen’s speech but her cautiousness along with the drop in the market’s expectations for a July rate hike according to the Fed fund futures points to further losses for the greenback.

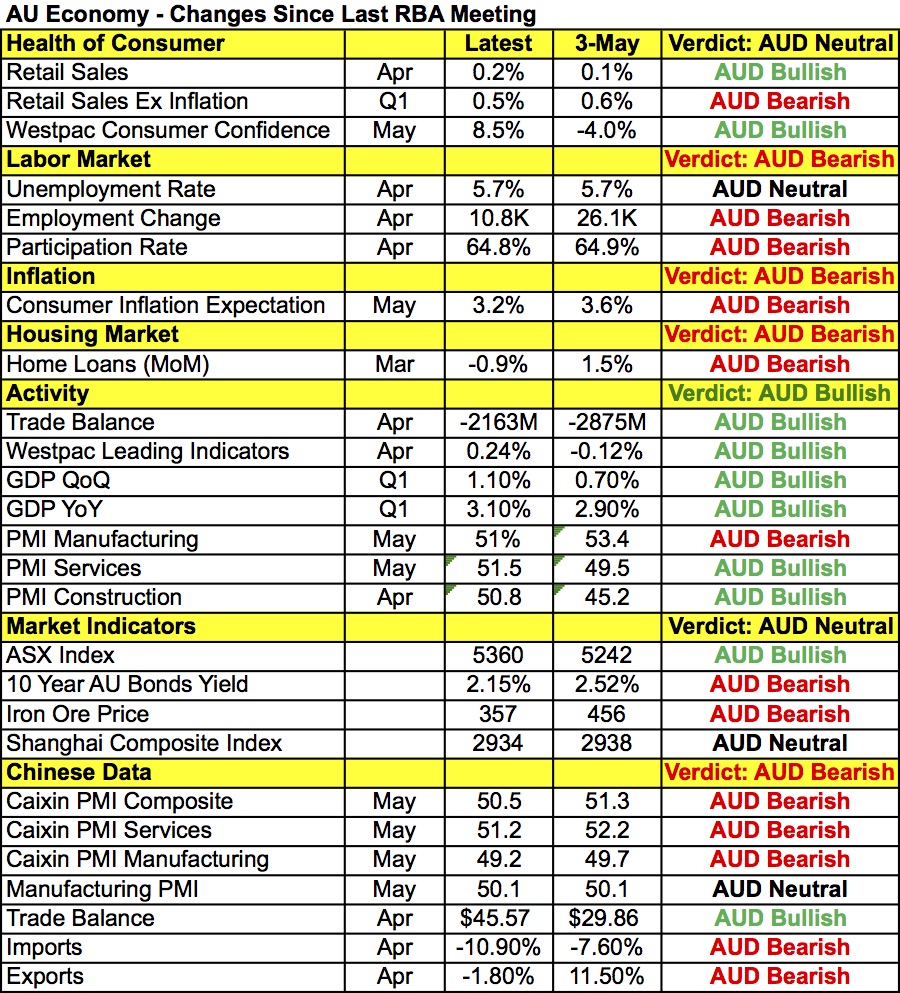

Speaking of central banks, the Reserve Bank of Australia was scheduled to meet Monday night and between the slowdown in China’s economy and the mixed readings in Australia, the RBA is expected to maintain a dovish bias. When it last met, the RBA surprised the market with a 25bp rate cut citing the Fed’s reluctance to normalize policy and signs of global economic slowdown. Since then, the Fed grew more hawkish but the global economy remained weak. Australia specifically saw slower job growth, lower price pressures and soft consumer spending. First-quarter GDP growth was very strong and service-sector activity accelerated while manufacturing activity slowed and commodity prices declined. While manufacturing activity expanded at a weaker pace, broad-based deterioration was seen in China’s economy. Considering that the decision to cut rates in May was a close call according to the minutes, the RBA won’t be easing again in June -- but the door to additional stimulus could remain wide open. The question for AUD/USD traders is whether the central bank emphasizes its current wait-and-see mode or the prospect of more easing down the line.

Australia’s Economy Since Last RBA Meeting:

With oil prices hovering near $50 a barrel, the Canadian dollar traded sharply higher against the greenback. CAD is in play this week with IVEY PMI scheduled for release Tuesday and Canadian employment numbers due on Friday. May is a seasonably weak month for manufacturing activity and the fires in Alberta may have negatively affected activity. According to RBC, manufacturing activity was slightly lower in May compared to April. Technically, USD/CAD has broken below the 50-day SMA and appears poised for a move below 1.2800. But for that to happen, we need to see a much stronger decline in the dollar and/or rise in oil.

Meanwhile, the Reserve Bank of New Zealand also meets this week and in contrast to Australia, there have been consistent improvements in New Zealand’s economy since the last monetary policy meeting. Unfortunately, NZD/USD traders don’t seem to recognize that as the New Zealand dollar ended Monday lower against the greenback.

The euro ended the day unchanged against the U.S. dollar despite the latest string of mixed Eurozone economic reports. Factory orders plunged 2% in April but consumer spending increased in Germany in May according to the Retail PMI index. German industrial production numbers are scheduled for release Tuesday along with revisions to first-quarter Eurozone GDP. None of these reports is expected to have a significant impact on the euro. The focus this week will be on the market’s appetite for the U.S. dollar and comments from ECB President Draghi.

The greatest volatility has and will continue to be in sterling as we head into the U.K. referendum. There is a handful of U.K. economic reports scheduled for release this week ranging from industrial production and the trade balance but the polls will drive the currency's performance. Sterlings latest decline was driven by the results of a survey from the Daily Telegraph that found 69% of subscribers polled favored leaving the European Union. According to our colleague Boris Schlossberg:

that’s still within the margin of error but close enough to worry the financial markets which generally remain convinced that UK will stay in the EU. Trading in cable will only grow more volatile as the vote approaches and many retail brokers have already started to raise their margin on the pair afraid of another SNB disaster on their hands. For now however, the general consensus from the markets as well as UK bookies is that the Stay vote will win, but with sentiment clearly fluid the risks to the downside in cable remain significant.

Related Articles

The German election results initially boosted optimism, but uncertainty over coalition talks is keeping pressure on EUR/USD. Trump's confirmation of tariffs on Mexico and Canada...

ECB and BOC Monetary Policy Divergence – EUR/CAD Exchange Rate Fluctuations. RBA and BOC Monetary Policy Divergence – AUD/CAD Exchange Rate Fluctuations. Canada and Australia...

The US Dollar’s recovery on tariff talk is causing the USD/CAD pair to bounce. The main events to watch out for this week are the US PCE data and Canadian GDP for Q4. A close...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.