- ECB and BOC Monetary Policy Divergence – EUR/CAD Exchange Rate Fluctuations.

- RBA and BOC Monetary Policy Divergence – AUD/CAD Exchange Rate Fluctuations.

- Canada and Australia Inflation Data and Interest Rate Expectations.

- AUD/CAD Technical Analysis: Trend Break and Support.

Following the inflation peak of 2022 and as central banks globally began raising interest rates, the global disinflation process has progressed at different paces for each economy. This divergence has created arbitrage opportunities for their respective currency exchange rates.

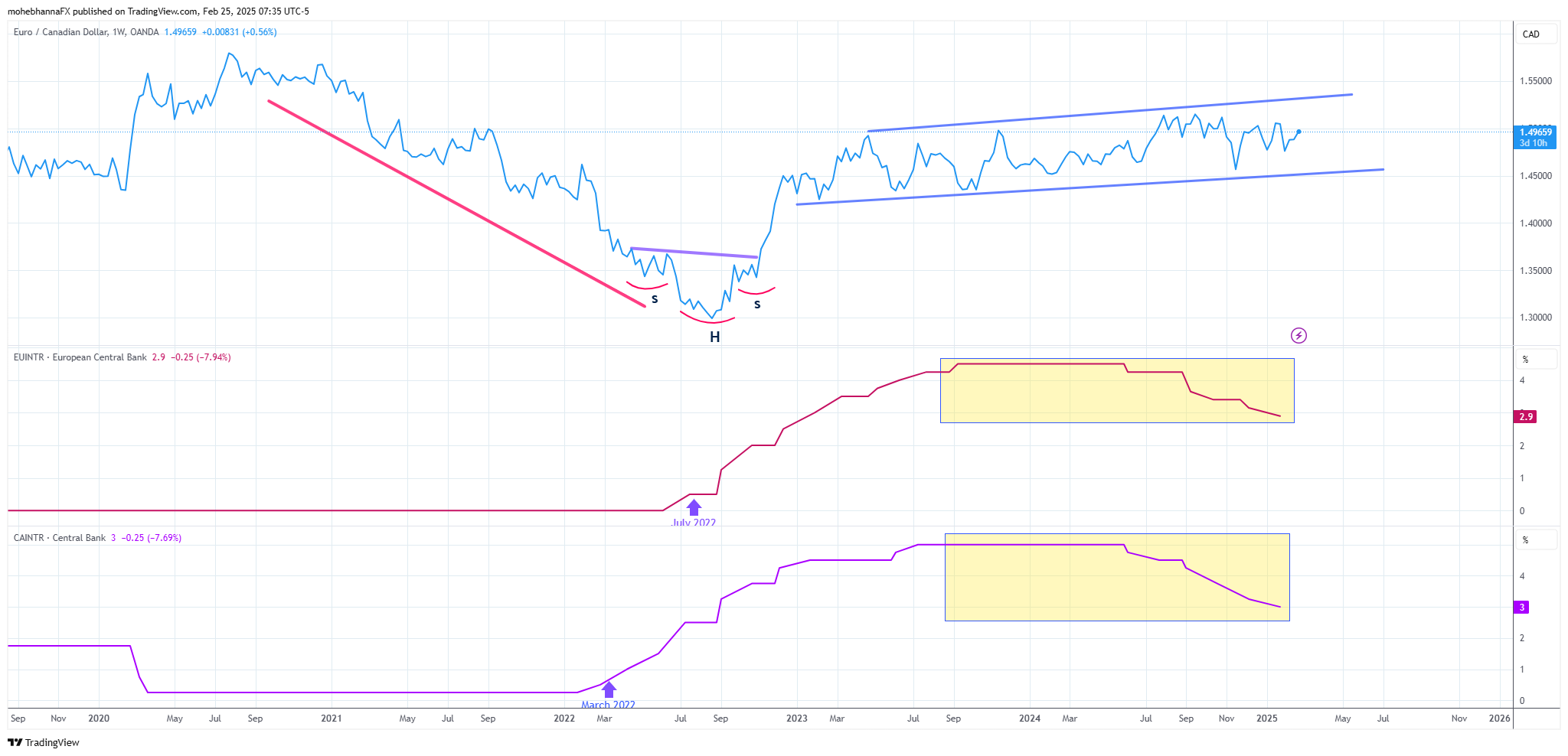

ECB and BOC Monetary Policy Divergence – EUR/CAD Exchange Rate Fluctuations

For example, in early 2022, the Bank of Canada (BOC) was the first to raise interest rates in March, and the European Central Bank (ECB) followed suit in July.

The monetary policy divergence between the respective central banks caused fluctuations in FX exchange rates, impacting multiple major, minor, and cross-FX pairs due to changes in the supply and demand balance.

Source: https://www.tradingview.com

The chart shows the EUR/CAD exchange rate’s reaction to the rate hikes by both banks. The pair was initially trading in a downtrend. However, as the BOC began its rate hikes in March 2022, the trend weakened, followed by a reversal pattern: an inverted complex head and shoulders.

By August 2023, the two central bank monetary policies aligned, and the uptrend began to lose momentum. Price began to trade within a confined range, as marked on the chart. The sideways price action continued as the central banks’ monetary policies converged, as they held and began cutting rates in mid-2024 (highlighted rectangles).

RBA and BOC Monetary Policy Divergence – AUD/CAD Exchange Rate Fluctuations

Inflation and interest rates remain a hot topic, especially given that global inflation indicators moved slightly higher in the second half of 2024, and concerns about trade wars persist.

This section will examine the monetary policies of the Bank of Canada and the Reserve Bank of Australia’s monetary policy divergence. The Canadian and Australian dollars are considered commodity currencies because both are impacted by commodity prices. Therefore, they may have more exposure to tariff risks. However, these risks are not equal, and the pace at which the BOC and RBA manage their monetary policies may differ, thus creating FX exchange rate arbitrage opportunities.

Source: https://www.tradingview.com

In June 2024, as global central banks began cutting interest rates, the BOC cut its rates by 25 basis points, while the RBA preferred to wait until February 2025 for its first 25 bps rate cut. The BOC’s earlier move resulted in a stronger Australian dollar against its Canadian counterpart. The AUD/CAD exchange rate rose by approximately 3.7% between June and September 2024, as shown on the chart.

By October 2024, ahead of the RBA’s first actual cut, market participants began to anticipate the move, and the trend reversed. The Australian dollar fell against its Canadian counterpart back to the same price level from which it had initially risen in June 2024, when the BOC first cut rates

Canada and Australia Inflation Data and Interest Rate Expectations

Canada’s inflation data, released on February 18, 2025, was higher than forecast, with both Median CPI and Trimmed (Core) CPI at 2.7%. This, along with an upward revision to last month’s Median CPI, has led traders to reduce bets on the BOC’s interest rate cut path. According to Bloomberg’s analyst survey, 42.8% of participants expect a 25 basis point rate cut for the upcoming March 12th BOC interest rate decision, down from 100% earlier that month.

Markets are looking forward today to inflation data from Australia, according to the Bloomberg analyst surveys, the CPI Y/Y is forecasted at 2.6%, compared to 2.5% for last month. The analysts’ survey shows that 16.8% of participants expect the RBA to cut rates by 25 basis points at their upcoming April 1st 2025 meeting.

AUD/CAD Technical Analysis: Trend Break and Support

Source: https://www.tradingview.com

- Price action was trading in a downward trend which was broken in January 2025, marked by a circle on the chart, multiple throwbacks followed through which were able to find support above the trendline extension, marked by purple arrows.

- A confluence of support lies below price action represented by the intersection of EMA9, SMA9, SMA20 and the weekly PP of 0.9039.

- RSI is in line with the price action and near its neutral level.

In conclusion, the divergence in monetary policies between central banks, exemplified by the BOC, RBA, and ECB, has created significant fluctuations in currency exchange rates. As inflation rates change and central banks adjust their interest rate stances, arbitrage opportunities arise for traders. Analyzing these divergences, coupled with technical analysis of price action and support levels, provides valuable insights into potential future movements in the FX market. The shifting expectations surrounding interest rate hikes/cuts, driven by evolving inflation data, will likely continue to influence currency valuations, making it crucial for market participants to stay informed and adapt their strategies accordingly.