- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GBP/JPY Near Fresh Multi-Year Highs

On Monday of this week, GBP/JPY traded at its highest levels since August of 2009. During the New York trading session it is trading modestly higher, close to price levels unseen in over four years.

Japanese Yen Remains Under Pressure

Last week the Japanese Yen softened after Finance Minister Taro Aso emphasized the importance of keeping foreign exchange intervention as a policy option.

Aso stated before parliament that "Japan must have tools to counter speculative moves in the currency market."

The prospect of intervention caused selling in the yen and fueled a rally in Japanese stocks. A weaker yen helps Japanese exporters, making their products more competitive abroad.

Related: Euro Up on ZEW Data

The recent positive economic news out of the US, notably the last employment report, raised the prospect of the tapering of stimulus, also adding pressure to the Japanese currency.

British Pound Buoyed by Positive Data

Last week, the U.K. Office for National Statistics reported that Britain's unemployment rate fell to 7.6 percent in the three months to September, its lowest level in more than three years. The unemployment rate falling from 7.8 percent to 7.6 percent in the three months to the end of September marked a move closer to the seven percent level that will prompt the Bank of England to consider raising interest rates.

Earlier in the month the Bank of England maintained its asset-purchase target at 375 billion pounds and held its benchmark interest rate at 0.5 percent.

However, on Wednesday, the minutes of the Bank of England’s November meeting showed that policymakers are not in a hurry to raise interest rates.

Related: Brent Sinks As Negotiations Over Iran's Nuclear Program Resume

The minutes had a dovish tone, stating "With the proviso that medium-term inflation expectations remain sufficiently well-anchored, the projections for growth and inflation under constant bank rate underlined that there could be a case for not raising bank rate immediately when the seven percent unemployment threshold was reached."

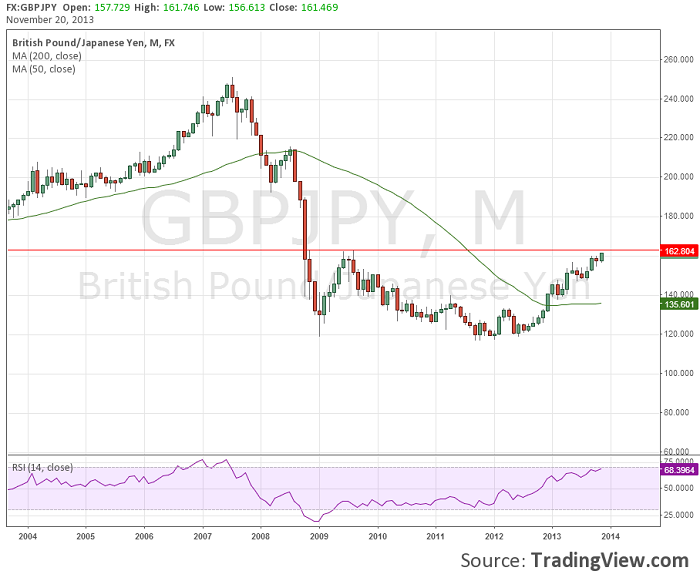

GBP/JPY Monthly Chart

Looking at the GBP/JPY monthly chart we can see that price has almost retraced to the prior highs of mid 2009, where a double top had formed.

BY Dan Blystone

Related Articles

The GBP/USD has stabilized on Friday, after declining more than 1% a day earlier. In the European session, GBP/USD is currently trading at 1.2406, up 0.16% on the day. The US...

USD/CAD holds short-term range ahead of ISM manufacturing PMI. Bulls lose power but not the battle, uptrend intact above 1.4260. USD/CAD is in a wait and see mode. USD/CAD is...

The first trading day of the year brought fresh pressure on European currencies. There is now a considerable risk premium being built into EUR/USD, and we suspect that both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.