- Despite a generally bullish 2024, several S&P 500 stocks posted sharp declines in 2024.

- Are any of these laggards good investments for 2025?

- In this piece, we will analyze the stocks' turnaround potential in the new year.

- Kick off the new year with a portfolio built for volatility and undervalued gems - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

2024 wrapped up with solid gains for the S&P 500, which rose 23.3%, despite a rough finish to the year. But that growth wasn’t spread evenly across the board.

While communication services (NYSE:XLC) surged by over 40%, making it the standout sector, The materials (NYSE:XLB) lagged, posting a nearly 2% decline.

In terms of individual stocks, Palantir Technologies (NASDAQ:PLTR), Vistra Energy Corp (NYSE:VST) and Nvidia (NASDAQ:NVDA) gained the most last year, surging 340.5%, 257.9% and 171.2% respectively.

Conversely, Walgreens Boots Alliance (NASDAQ:WBA), Intel (NASDAQ:INTC) and Moderna (BMV:MRNA) (NASDAQ:MRNA) posted the biggest falls: -64.5%, -60.6% and -60.4%.

As we move into 2025, many investors are wondering if the top-performing stocks from last year still have room to run. Analysts are increasingly concerned about the inflated valuations of major tech stocks, with some even predicting a correction in the near future.

This might open the door for stocks that underperformed last year to step into the spotlight. Could these beaten-down names be the next big opportunity?

To find out, we searched for S&P 500 stocks with a specific set of characteristics:

- A price decline of more than 25% over the past 12 months

- A potential upside of more than 25% according to InvestingPro’s Fair Value

- A similar upside of more than 25% according to analysts’ average target

- A financial health score above 2.5/5 from InvestingPro

Fair Value is an intelligent valuation model that helps us assess whether a stock is over- or undervalued. Meanwhile, the Health Score takes key financial metrics into account to gauge a company’s overall financial strength.

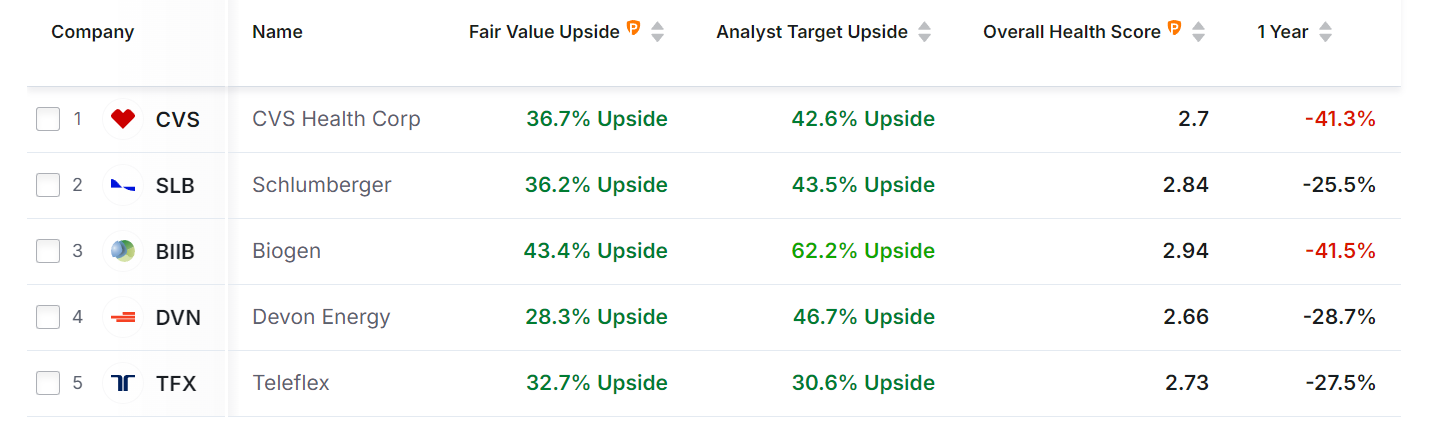

Our research has turned up five stocks that meet these criteria:

Source: InvestingPro

Note that the stock with the greatest upside potential according to Fair Value AND analysts' objectives is biotech Biogen (NASDAQ:BIIB). Fair Value assigns it an upside potential of 43.4%, while analysts forecast an increase of 62.2%.

What's more, Biogen is also the stock on the list with the highest financial health score (2.94/5).

However, the other stocks on this list also merit the interest of investors looking for shares ripe for a rebound after a difficult period.

Even so, betting on stocks that are currently on a downward trend remains a risky strategy that is not suitable for all investor profiles.

What are the best S&P 500 stocks to consider for 2025?

If you're looking for the best S&P 500 stocks to buy for 2025, there are probably other complementary approaches worth considering.

On the other hand, it's risky to try and predict stock market trends over too long a timescale, given the unpredictability of modern markets and the diversity of their influences.

Today, investors must regularly re-evaluate their portfolios to keep up with the constant changes and current events, which requires almost constant analysis.

Of course, not everyone can do this, which is why many investors can barely match the performance of benchmark indices, while some may even post losses when markets rise, due to poor choices or timing errors.

For those who don't have the time or inclination to devote their heart and soul to managing their portfolio, InvestingPro's AI-managed ProPicks strategies could prove an ideal solution.

ProPicks offers 6 thematic portfolios managed by our proprietary AI and re-evaluated monthly.

For investors primarily interested in S&P 500 stocks, ProPicks offers the "Beat the S&P 500" strategy, which has proven its ability to outperform its benchmark over time, with solid long-term performance:

Source: InvestingPro

Today marks the rebalancing of the above-mentioned strategy, along with all other ProPicks strategies. It’s the perfect moment to jump in and take advantage, especially with InvestingPro now available at a 50% discount to ring in the New Year.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.