The closely watched Santa Claus Rally period officially wraps up today. This historically strong seven-day stretch for stocks was first discovered by Yale Hirsch back in 1972. Hirsch, creator of the Stock Trader’s Almanac, officially defined the period as the last five trading days of the year plus the first two trading days of the new year.

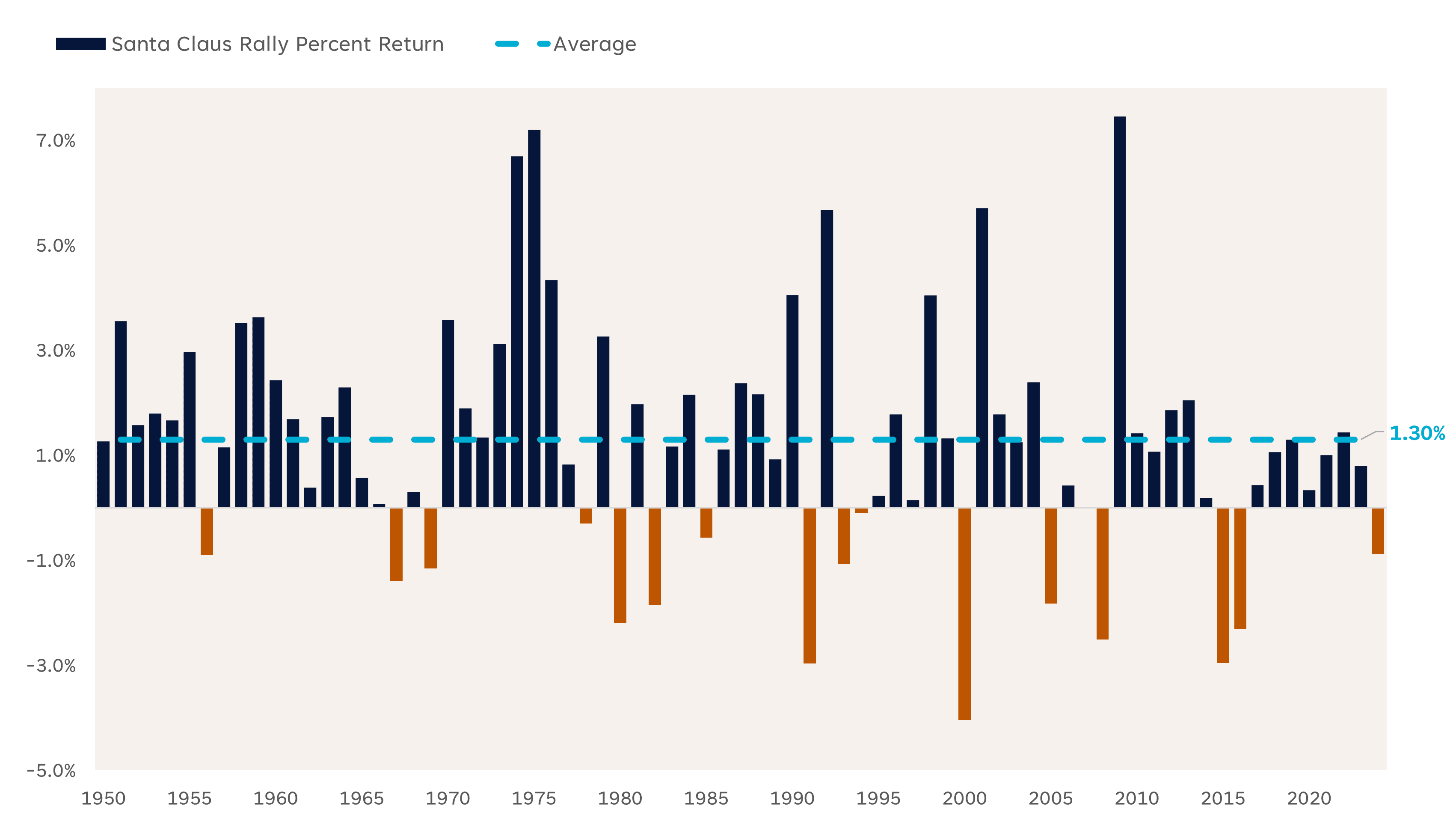

The Santa Claus Rally usually generates a lot of headlines due to the market’s tendency to post strong returns over this short period — or perhaps it receives more attention because it occurs during a usually slow financial news cycle. Regardless, since 1950, the S&P 500 has generated an average return of 1.3% during the Santa Claus Rally period, with positive returns occurring 79% of the time. This compares to the market’s average seven-day return and positivity rate of 0.3% and 58%, respectively. Finally, back-to-back years of negative Santa Claus Rally periods are rare, occurring only in 1993–1994 and 2015–2016.

Santa Claus Rally Returns by Year (1950-2023)

Source: LPL Research, Bloomberg 01/02/25

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

The Naughty or Nice List

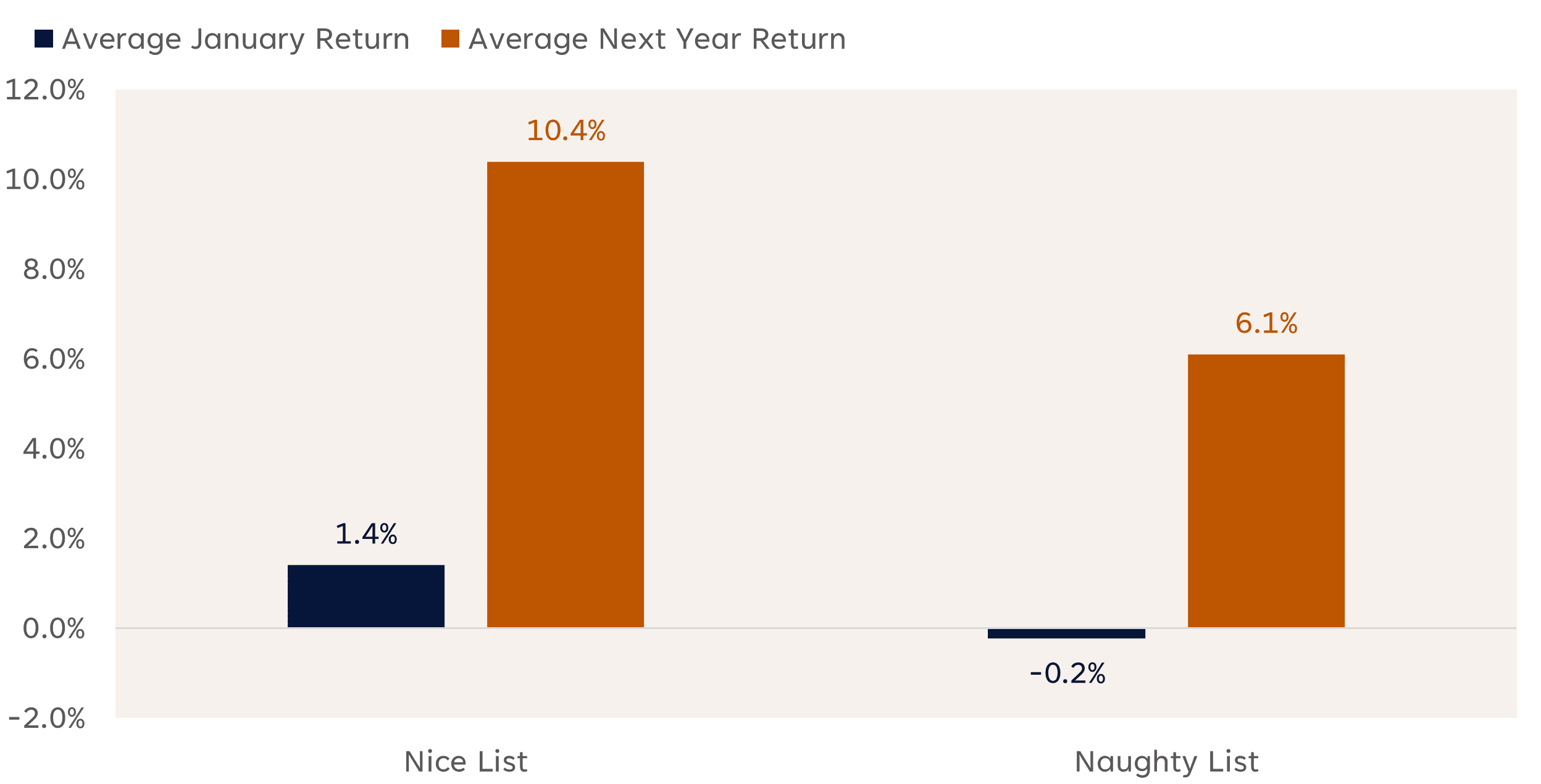

Another important aspect of the Santa Claus Rally period is its linkage to January and the following year’s returns. As Yale Hirsch put it, “If Santa Claus should fail to call, bears may come to Broad and Wall.” As highlighted below, historical data supports this adage.

When investors are on the “nice” list and Santa delivers a positive rally, the S&P 500 has generated an average January return of 1.4% and an average following-year return of 10.4%. This compares to the respective average January and following returns of -0.2% and 6.1% when investors are on the “naughty” list and receive a negative Santa Claus Rally return.

Santa Claus Rallies and S&P 500 Returns (1950-2024)

Source: LPL Research, Bloomberg 01/02/25

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

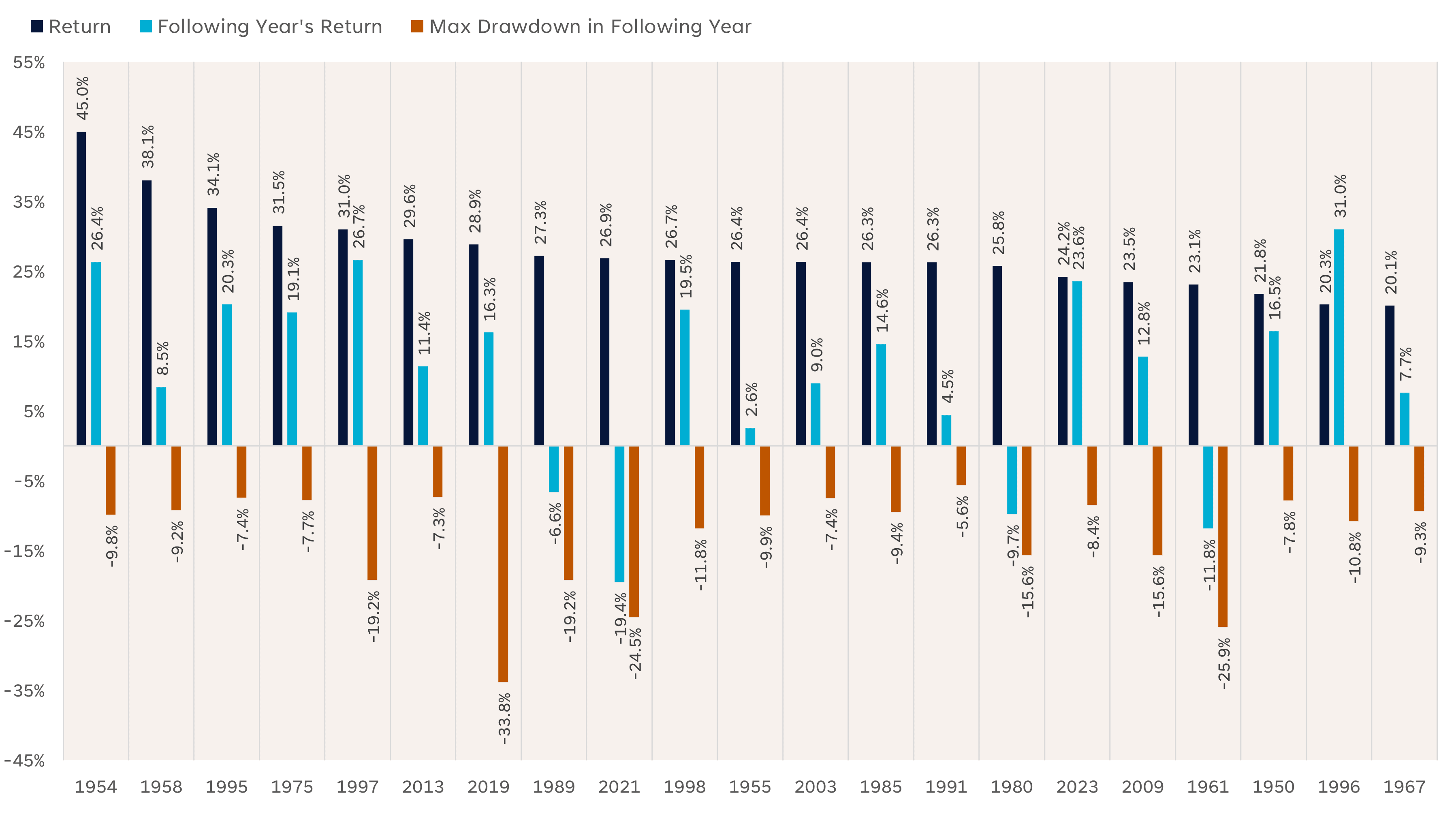

While a four-day losing streak into year-end has jeopardized the Santa Claus Rally, longer-term momentum remains strong. The S&P 500 wrapped up 2024 with an impressive 23.3% price return. This ranks as the 18th-best year for the index since 1950. The table below highlights all years when the S&P 500 posted at least a 20% return going back to 1950. Over the following year, the index posted average returns of 10.6% and finished positive 81% of the time. The maximum drawdown over the following year averaged -13.1%, roughly in line with the historical average maximum drawdown across all years (-13.7%).

What Historically Happens After a +20% Year

Source: LPL Research, Bloomberg 01/02/25

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Summary

December did not live up to its reputation of being a strong month for stocks, an important reminder that seasonality trends may represent the climate, but they do not always reflect the weather. The Federal Reserve has been the scapegoat for the selling pressure after policymakers delivered a hawkish rate cut earlier this month.

However, we don’t believe they should take all the blame for the recent dip. Rates were rising well before the Federal Open Market Committee Meeting on December 18, while market breadth and momentum indicators were deviating from price action. Technical damage has been most acute on a short-term basis. The S&P 500 has dipped below its 50-day moving average but remains above its longer-term uptrend. However, we believe near-term downside risk remains elevated given the recent deterioration in market breadth and momentum, stretched bullish sentiment, and macro headwinds from higher rates and a stronger dollar.