- Bitcoin battles key technical levels as it consolidates between $92,000 and $98,000.

- Macroeconomic factors and a strong dollar shape Bitcoin's outlook heading into 2025.

- A break above $98,740 could signal a recovery, while failure to do so may bring deeper corrections.

- Kick off the new year with a portfolio built for volatility and undervalued gems - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

Bitcoin finds itself struggling to regain its momentum after peaking at $108,000 earlier in 2024. The cryptocurrency's price has since retraced, finding support around the $92,000 mark. A combination of waning trading volumes and profit-taking in the latter half of December has resulted in a bearish trend.

Despite this, Bitcoin’s recent consolidation between $92,000 and $98,000 suggests that demand for the digital asset is still alive. The market's hesitation to push past these levels highlights the lingering uncertainty, particularly as macroeconomic factors, such as the Federal Reserve's hawkish stance, continue to weigh on sentiment.

Chairman Powell's recent comments about tightening policies and his skepticism toward Bitcoin's role in U.S. re serves fueled a fresh wave of profit-taking. However, the lack of further selling pressure at $92,000 has prevented a deeper correction, hinting that buyers stepped in at this level and pushed the price back up.

Could Trump’s Stance and the Strong Dollar Alter Bitcoin’s Trajectory?

Looking ahead, market watchers are keeping an eye on the potential for a stronger dollar. While this poses a challenge for Bitcoin and other cryptocurrencies, the digital asset has proven its resilience in the face of global economic uncertainty. Last year, Bitcoin delivered impressive returns, rallying more than 120%, thanks in part to increased demand from institutional investors. As we enter 2025, the crypto sector’s volatility is expected to persist, driven by global geopolitical risks and economic factors.

A stronger dollar may prove beneficial for Bitcoin in certain regions, particularly in emerging markets where local currencies are under pressure. As a hedge against macroeconomic instability, Bitcoin could see increased demand in these areas, offsetting the impact of the dollar's strength.

In the U.S., however, continued Fed actions will remain a key factor in determining Bitcoin's path forward. Despite these challenges, Bitcoin's long-term appeal remains strong, particularly as it continues to attract institutional interest and benefits from positive regulatory developments.

Technical Outlook: Bitcoin’s Battle for $98,740

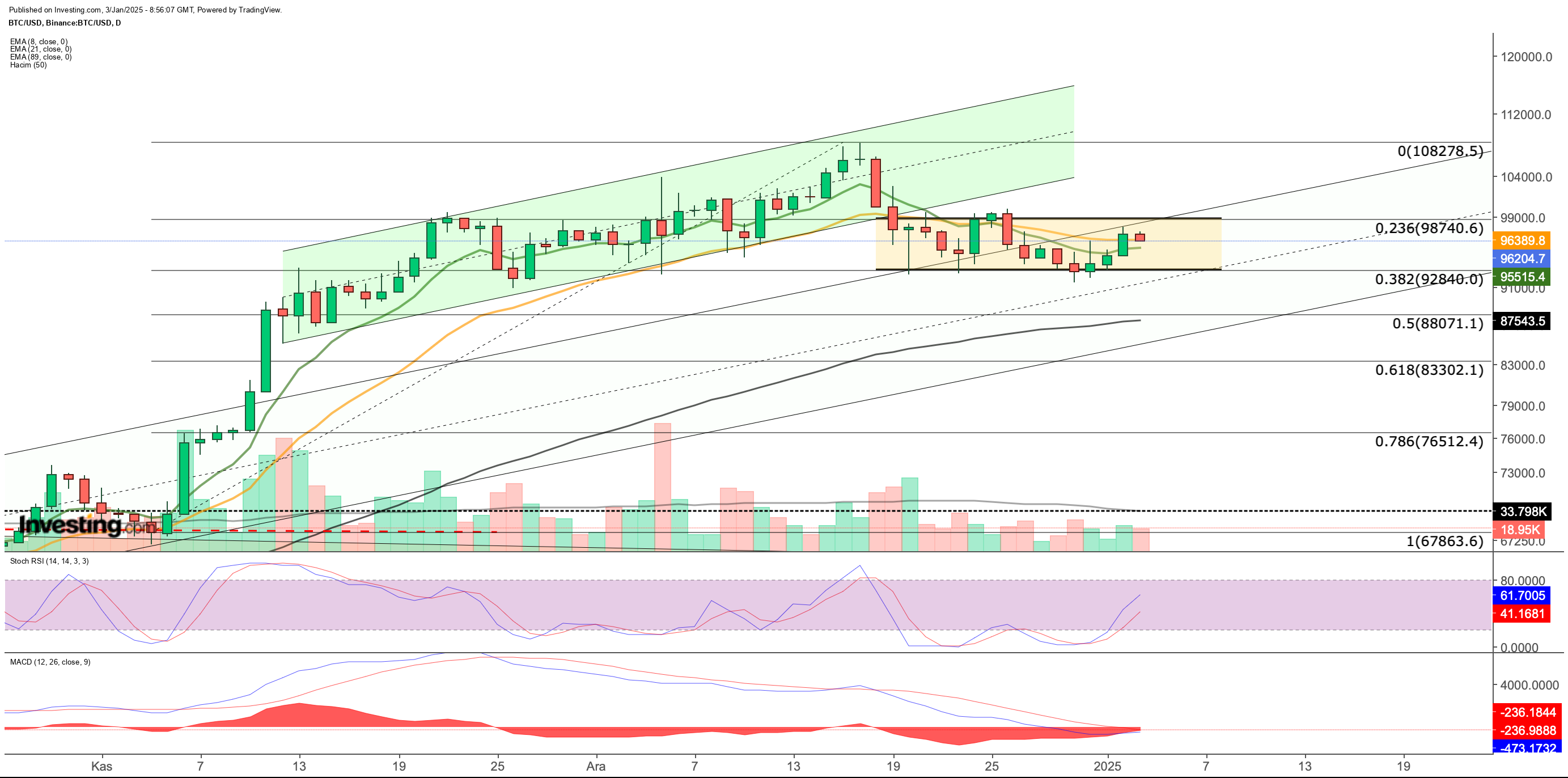

On the technical front, Bitcoin's price action between the $92,000 and $98,000 range will be critical in determining its next move. After recent pullbacks, Bitcoin has found support near the 38.2% Fibonacci retracement level, at $92,800, and is now pushing towards its short-term resistance at $98,740, the 23.6% Fibonacci level. The Stochastic RSI is showing upward momentum, while the MACD suggests that the selling pressure is beginning to ease.

A break above the $98,740 resistance could signal a continuation of the recent recovery, potentially pushing Bitcoin towards new highs in the $112,000–$117,000 range. On the other hand, if Bitcoin fails to break through this resistance, selling pressure may resume, bringing the $92,800 support level back into focus. A drop below this level could trigger a deeper pullback, potentially testing the $88,000 and $83,000 zones, which correspond to the 50% and 61.8% Fibonacci retracements.

In Conclusion

As Bitcoin consolidates in the $92,000–$98,000 range, all eyes will be on the technical levels that could dictate its next move. With increasing institutional interest and a potential shift in market sentiment, Bitcoin’s outlook remains uncertain, but its long-term potential as a hedge against inflation and global uncertainty keeps it firmly in the spotlight.

Curious how the world’s top investors are positioning their portfolios for next year?

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Ready to take your portfolio to the next level? Click here to discover more.

***

Disclaimer: This article is for informational purposes only. It does not constitute an investment recommendation or financial advice. All assets are evaluated from multiple perspectives and are highly risky, so any investment decision and associated risk are the investor's responsibility. We do not offer investment advisory services.