- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

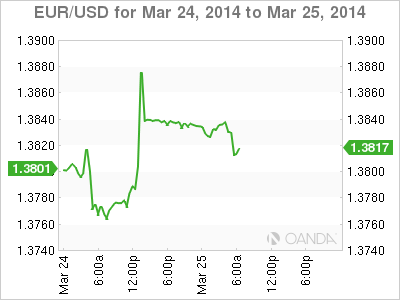

EUR/USD Slightly Lower As German Business Climate Dips

EUR/USD has edged downwards in Tuesday trading, but remains above the 1.38 level, as the euro's downward trend continues. In economic news, German Ifo Business Climate weakened in February but met expectations. Later today, ECB head Mario Draghi will speak at an event in Paris. There are two major releases out of the US, CB Consumer Confidence and New Home Sales.

The week started with a host of PMI releases out of the eurozone. French Manufacturing and Services PMIs both pushed above the 50 mark, which indicates expansion. The German numbers were a disappointment, as the Manufacturing and Services PMIs missed their estimates. If the fragile Eurozone recovery is to gain strength, the German locomotive will have to be in full gear.

German economic indicators have been one of the few bright lights in the Eurozone economy, but the German locomotive is suffering from persistently low inflation. Last week, the German Producer Price Index came in at a flat 0.0%, short of the estimate of +0.2%. As well, German Wholesale Price Index posted a decline of 0.1%, its fourth drop in five releases. Mario Draghi continues to insist that there is no inflation problem in the Eurozone, but the markets may not share his optimism, as Eurozone inflation indicators continue to look listless.

Last week's FOMC meeting, the first with Janet Yellen as Fed chair, was dramatic. The decision to trim QE by another $10 billion was widely expected, but her comments at the follow-up press conference gave the dollar a big boost against its major rivals. Yellen said that the Fed was on track to wind up QE in the fall, and could start to raise interest rates six months later. This is a more aggressive approach towards higher rates than the markets had expected, and the dollar responded by posting strong against the euro.

EUR/USD March 25 at 11:20 GMT

EUR/USD 1.3813 H: 1.3847 L: 1.3804

EUR/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3585 | 1.3649 | 1.3786 | 1.3893 | 1.4000 | 1.4149 |

- EUR/USD has edged lower in Tuesday trade. The pair touched a high of 1.3847 early in the European session but has since retracted.

- 1.3786 has reverted back to a support role. This is a weak line and could continue to face pressure during the day. There is stronger support at 1.3786.

- 1.3893 is providing resistance. This is followed by the key level of 1.4000.

- Current range: 1.3786 to 1.3893

Further levels in both directions:

- Below: 1.3786, 1.3649, 1.3585, 1.3410 and 1.3335

- Above: 1.3893, 1.4000, 1.4149 and 1.4307

OANDA's Open Positions Ratio

EUR/USD ratio has posted losses on Monday, reversing the trend we saw at the start of the week. This is consistent with the pair's current movement, as the euro has posted modest losses. Short positions retain a strong majority, indicative of trader bias towards the dollar continuing to move higher.

The euro is trading above the 1.38 line. We could see some movement in the North American session, as the US releases key housing and consumer confidence numbers.

EUR/USD Fundamentals

- 9:00 German Ifo Business Climate. Estimate 110.9 points. Actual 110.7 points.

- 13:00 US S&P/CS Composite-20 HPI. Estimate 13.3%.

- 13:00 US HPI. Estimate 0.7%.

- 14:00 US CB Consumer Confidence. Estimate 78.7 points.

- 14:00 US New Home Sales. Estimate 447K.

- 14:00 US Richmond Manufacturing Index. Estimate -1 point.

- 16:00 ECB President Mario Draghi Speaks.

- 16:30 Deutsche Bundesbank President Jens Weidmann Speaks.

- 23:00 US FOMC Member Charles Plosser Speaks.

Related Articles

The GBP/USD has stabilized on Friday, after declining more than 1% a day earlier. In the European session, GBP/USD is currently trading at 1.2406, up 0.16% on the day. The US...

USD/CAD holds short-term range ahead of ISM manufacturing PMI. Bulls lose power but not the battle, uptrend intact above 1.4260. USD/CAD is in a wait and see mode. USD/CAD is...

The first trading day of the year brought fresh pressure on European currencies. There is now a considerable risk premium being built into EUR/USD, and we suspect that both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.