- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Opening Bell: U.S. Futures Waver As European Stocks Recover After Asia Selloff

- Strong results from European financials outweigh US stimulus concerns

- Bitcoin lower despite positive sentiment

- Oil recovers

- Today US house prices and consumer confidence will be published.

- After the market closes Microsoft (NASDAQ:MSFT) reports Q2 2021 results.

- On Wednesday the Federal Open Market Committee monetary policy decision and briefing by Chairman Jerome Powell are scheduled.

- Facebook (NASDAQ:FB) and Apple (NASDAQ:AAPL) are among companies reporting results on Wednesday.

- Fourth-quarter GDP, initial jobless claims and new home sales are among US data releases on Thursday.

- Futures on the S&P 500 Index dipped 0.2%.

- The Stoxx Europe 600 Index gained 0.5%.

- The MSCI Asia Pacific Index declined 1.4%.

- The MSCI Emerging Markets Index declined 1.7%.

- The Dollar Index advanced less than 0.1% to 90.45.

- The euro was little changed at $1.2138.

- The British pound decreased 0.3% to $1.3639.

- The Japanese yen was little changed at 103.77 per dollar.

- The yield on 10-year Treasuries climbed one basis point to 1.04%.

- The yield on two-year Treasuries gained one basis point to 0.12%.

- Germany’s 10-year yield increased one basis point to -0.54%.

- Britain’s 10-year yield gained one basis point to 0.271%.

- West Texas Intermediate crude fell 0.3% to $52.75 a barrel.

- Gold weakened 0.1% to $1,854.94 an ounce.

Key Events

Futures on the Dow, S&P and Russell 2000 were marginally up ahead of the US session open on Tuesday after European stocks bucked the risk-off trend in Asia, after Swiss wealth manager UBS posted huge quarterly gains.

However, NASDAQ futures were slightly lower after the underlying index continued its meteoric rise on Monday as tech shares outperform.

The dollar continued its advance while yields fell.

Global Financial Affairs

US futures were wavering on Tuesday as concerns regarding the upcoming stimulus package were counterbalanced by strong results from European financials. There are some worries about the upcoming fiscal stimulus following Senate Majority Leader Chuck Schumer’s admission that funds won’t be released, possibly until mid-March.

President Joseph Biden also said he is open to negotiation on his $1.9 trillion fiscal aid package, weakening his position while signaling to traders that fiscal policy may not be as abundant as expected.

However, shares of UBS (SIX:UBSG) moved up 3.3% as increased trading activity pushed the world’s largest wealth manager to post a record-breaking 137% rise in net profit. Also, shares of Swedish buyout group EQT (ST:EQTAB) surged 9.7%, after it signed an agreement to buy global real estate investment manager Exeter Property Group for $1.87 billion. Both companies pushed the financial services index higher.

Earlier Tuesday, Asian shares fell amid worries about the new, more easily transmittable, and more dangerous, coronavirus variant. Another worry is whether existing vaccines will provide immunity to all the new strains being identified across the globe.

Hong Kong’s Hang Seng led regional stocks lower, slumping 2.5%, after the PBoC cut back liquidity amid a warning that assets are in a bubble. The financial hub took the brunt of the regional selloff with Chinese investors cashing out after investing $32 billion this year. The policy about-face coupled with the warning of a potential crash saw China’s Shanghai Composite close 1.5% lower.

US technology shares were in the lead in trading on Monday, ahead of earnings from some of the biggest names in the sector this week. The NASDAQ added value with gains for Apple (NASDAQ:AAPL), Tesla (NASDAQ:TSLA) and Microsoft (NASDAQ:MSFT).

The S&P 500 managed to eke out gains even after US health officials warned about vaccination delays.

The SPX found support by its bullish flag.

The VIX, volatility index, closed its rising gap, demonstrating that investors are calming down.

The “fear gauge” is now on track to potentially complete a H&S continuation pattern.

The same pattern is visible on the 10-year yield chart.

After the disappointment of the stimulus postponement, yields fell out of what was set to be a bullish pennant (dotted black lines), but the revived mood keeps a bullish flag in play (red lines).

The dollar is up for the third day, but has found resistance by the downtrend line (red) since Dec. 7, whose convergence with the (black) downtrend line since the March high raises the potential for a bottom.

The price-based MACD and momentum-based RSI are gunning for such a reversal.

Gold remains flat as it struggles between a rising, bearish flag, within a falling channel on one hand, and a potential H&S bottom, on the other. This range is a mirror image of the dollar.

The yellow metal’s indecision is projected by the convergence of the 50 and 100 DMA, as they await “further instructions” to provide a bullish pounce or a Death Cross.

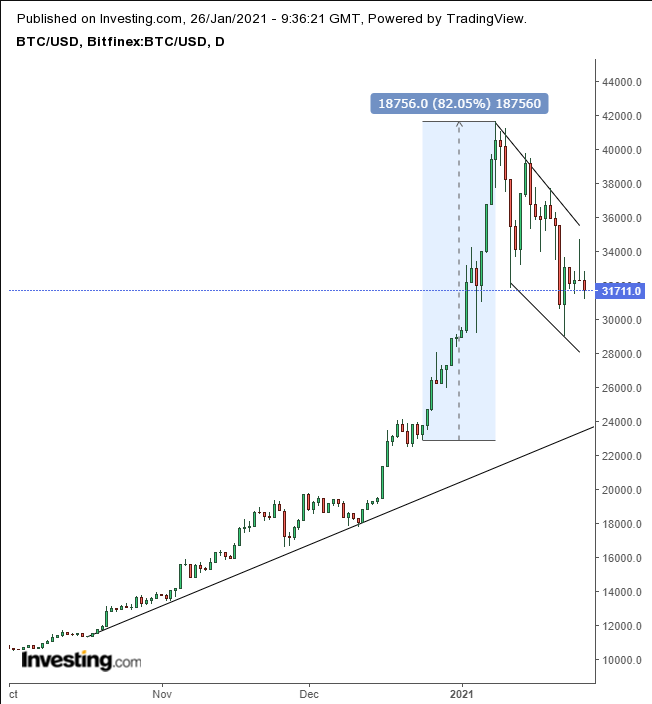

However, the precious metal is seen to be losing investments to Bitcoin, which is expected to top the psychological $50,000 level

The chart may easily support that view, if the falling flag completes with an upside breakout.

Like stocks and yields, oil rebounded to extend a rally for the second day, as it vies to complete the falling flag, whose upside breakout will send it toward $60. In the short term, the oil price may be supported by President Biden's stimulus, however longer-term the price may face supply pressures.

Up Ahead

Market Moves

Stocks

Currencies

Bonds

Commodities

Related Articles

We haven’t discussed global monetary inflation for a while, mainly because very little was happening and what was happening was having minimal effect on asset prices or economic...

Last week, we discussed the more extreme levels of bearishness that have gripped the markets as of late. “In other words, while the media scrambled to align reasons with the...

I’m sure this week will be interesting, given the CPI and PPI reports. I’m sure the administration will have plenty of on-again and off-again policy statements about something....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.