- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

FX Markets Quiet Ahead Of FOMC Minutes

Market Brief

Judging by the latest data from China, it seems that the world’s second biggest economy is stabilizing and that the effects of several rounds of easing undertaken by the PBoC, together with the government’s fiscal stimulus, did in fact help the economy to adjust to the new environment of weak global demand. After last week’s encouraging signs from the manufacturing sector, both the Caixin Services and Composite PMIs increased in March, printing above the 50 mark that separates growth from contraction.

Services PMI came in at 52.2 after printing at 51.2 in February, while Composite PMI rose to 51.3 from 49.4. However, one should interpret this good news cautiously, as the report also showed that composite employment fell at the fastest pace since January 2009. Overall, the report confirmed that China’s economic activity rebounded after the Chinese New Year, but failed to clear the clouds on the horizon, suggesting that further stimulus is required to soften the impact.

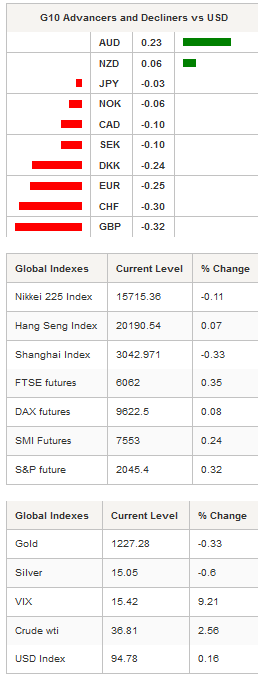

In the absence of a clear driver, Asian regional equity markets were trading trendless, taking a breather from yesterday’s sell-off. In mainland China, the Shanghai Composite edged down 0.33%, while the tech-heavy Shenzhen Composite was “up” 0.07%. In Japan, equities were trading in negative territory with the Nikkei and Topix indices edging lower by 0.11% and 0.05% respectively.

Elsewhere, shares were trading higher, boosted by a recovery in crude oil prices. The S&P/ASX rose 0.44% and the S&P/NZX surged 0.27% as West Texas Intermediate jumped 2.56%, while the Brent crude rose 1.69% to $38.50 a barrel.

The Australian dollar got some color back during the Asian session, taking a breather from the sell-off, which brought the AUD/USD to 0.7510 from 0.7720, down 2.75%. Overnight the pair edged higher, hitting 0.7560. We maintain our downside bias on the pair, as the weakness in commodity prices and a looming rate cut by the RBA should prevent investors from supporting the Aussie.

EUR/USD was treading water between 1.1340 and 1.14, as investors were left wondering whether the pair would be able to break the strong resistance lying between 1.1375-1.1495 (high from February 11th and October 15th) to the upside. On the downside, the nearest support can be found at 1.1335 (low from April 1st), then 1.1310 (low from March 31st).

USD/JPY was unable to break the strong 110 support to the downside and stabilized at around 110.40. Overall, with the exception of commodity currencies, the FX market was globally driven by the US dollar. The dollar index consolidated slightly below the 95 threshold, at around 94.80. The bias remains on the downside as the monetary policy divergence story loses traction, while the market awaits the FOMC minutes. The next support lies at 93.80 (low from October 15th).

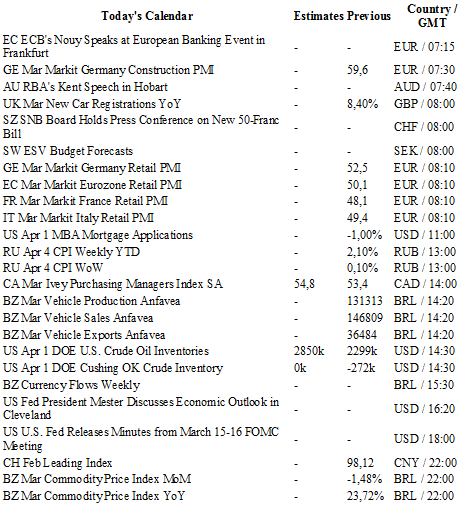

Today, traders will be watching Markit Retail PMIs from Germany, France, Italy and the eurozone; MBA mortgage applications, crude oil inventories and FOMC minutes from the US.

Currency Technicals

EUR/USD

R 2: 1.1714

R 1: 1.1495

CURRENT: 1.1367

S 1: 1.1144

S 2: 1.1058

GBP/USD

R 2: 1.4591

R 1: 1.4459

CURRENT: 1.4144

S 1: 1.4033

S 2: 1.3836

USD/JPY

R 2: 113.80

R 1: 112.68

CURRENT: 110.30

S 1: 107.61

S 2: 105.23

USD/CHF

R 2: 0.9913

R 1: 0.9788

CURRENT: 0.9579

S 1: 0.9476

S 2: 0.9259

Related Articles

Back in late December, I showed gold stock investors some key cycle and oscillator charts for XAU/USD and the miners, suggested that the GDX (NYSE:GDX) ETF and its component...

The central bank’s job is never easier, but in the current climate, it’s unusually tricky. In addition to the usual challenges that complicate real-time monetary policy decisions,...

At age 94, Warren Buffett can still formulate a shareholder letter like no other. His humility, candor, and wisdom is special. I always make it a point to read these because you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.