- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Tesla Set to Double From January Low on Turbocharged Tech Rally

(Bloomberg) -- Tesla (NASDAQ:TSLA) is poised to double in value from a January low, boosted by a breakneck rally for growth stocks and signs that big price cuts are working to spur a demand rebound for the electric-vehicle maker.

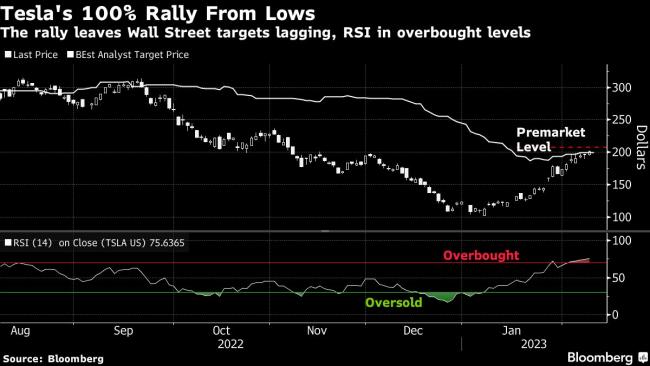

The shares jumped as much as 4.1% to $209.50 in US premarket trading, implying a 106% gain from their Jan. 6 intraday trough. The surge over the past month comes as investors pile back into so-called growth stocks, betting that the Federal Reserve’s aggressive rate-hike cycle is nearing its end.

The Elon Musk-led company has also gained after better-than-expected earnings and a spate of positive headlines on tax credits for electric vehicles boosted sentiment. At the same time, a big price cut in January appears to be working, prompting a surge in demand for Tesla cars.

“Tesla is rising so fast because of a market that believes the Fed is coming to the rescue,” said Eric Schiffer, chief executive officer of Los Angeles-based private equity firm Patriarch Organization. Good fourth-quarter results and “price cuts to turbocharge demand” also helped, he said.

A surge in speculative trading in recent weeks may also explain some of the gains, given the stock’s popularity among individual shareholders.

“Tesla has definitely been the main target of retail buying so far this year,” said Marco Iachini, senior vice president of research at Vanda Securities. While retail investors buying the stock is not unusual, given Tesla is “an ultimate retail favorite,” Iachini said the persistence and magnitude of the flows are surprising.

Even after doubling from lows, the shares are still only at the highest since early November, and have a long way to go to recover last year’s 65% plunge.

The rapid rally has left the shares trading just above the average analyst price target tracked by Bloomberg — suggesting Wall Street doesn’t see much more upside. Tesla’s relative strength index, a gauge that measures whether a stock is under or over bought — shows signs of excessive buying, typically seen by markets as an indication that a decline is imminent.

Related Articles

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.