- Political uncertainty and weak economic data weigh heavily on GBP/USD, as the pair tests critical support levels.

- Surging UK bond yields and expectations for BoE rate cuts add pressure to the pound's downtrend.

- Traders brace for pivotal GDP data that could sway monetary policy and drive the next GBP/USD move.

- Kick off the new year with a portfolio built for volatility and undervalued gems - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

The GBP/USD currency pair has been in steady decline this year, losing nearly 2.5% and extending the downtrend that began last October.

A perfect storm of factors is pressuring the pound: disappointing UK economic data, soaring bond yields, and mounting challenges for the ruling Labour Party.

These headwinds are fueling expectations for rate cuts, with some traders anticipating the Bank of England might make its move as early as February.

Meanwhile, the U.S. dollar remains resilient, buoyed by optimism around fiscal policies under the Biden administration.

If GBP/USD breaks below the critical 1.21 support level, the pair could slide further, potentially testing the 2023 lows near $1.19.

Politics Pushes GBP/USD Lower

Political instability is playing a key role in the pound’s struggles. The Labour Party, which won the last UK general election in a landslide, now faces growing criticism.

Chancellor Rachel Reeves’ policies of increased spending and higher taxes have sparked concerns, particularly as they drive up the supply of government bonds.

Meanwhile, Prime Minister Keir Starmer’s approval ratings are slipping, with poor business and consumer sentiment weighing heavily on market confidence.

This political uncertainty extends beyond the currency market, rippling through the bond market as well. Yields on United Kingdom 10-Year government bonds recently hit fresh 2023 highs, with more room for gains.

The surge in bond yields strengthens the case for a Bank of England rate cut. Markets have already priced in at least 60 basis points of cuts for this year, with speculation pointing to a February move.

However, the macroeconomic picture complicates the BoE’s decision-making.

Credit Growth Slows - A Double-Edged Sword

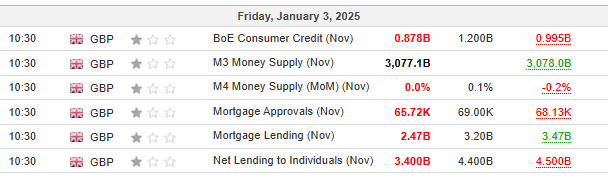

The latest data on UK credit growth paints a mixed picture. While a slowdown in consumer and mortgage lending supports the fight against inflation, it also dampens economic activity.

These dynamics, coupled with weak GDP growth, leave policymakers walking a tightrope.

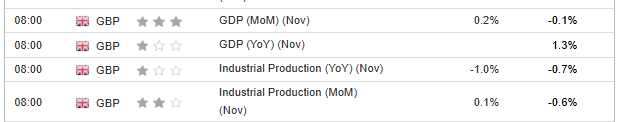

On Thursday, traders will closely watch the latest GDP figures, which could sway expectations for February’s rate decision. A weaker-than-expected reading would likely strengthen the case for easing monetary policy.

GBP/USD Tests 1.21 Support

Technically, GBP/USD is approaching a critical juncture. The recent selloff brought the pair to the key 1.21 support level, where buyers managed to fend off an initial test. However, if sellers mount another attack and succeed, the next stop could be the 2023 lows near 1.19.

For now, GBP/USD traders should keep an eye on political developments, macroeconomic data, and bond market trends. These factors will play a pivotal role in determining whether the pound can stabilize—or if further losses are on the horizon.

***

How are the world’s top investors positioning their portfolios for next year?

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Click here to discover more.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Read my articles at City Index

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI