- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Yellen Punches The Refresh Button

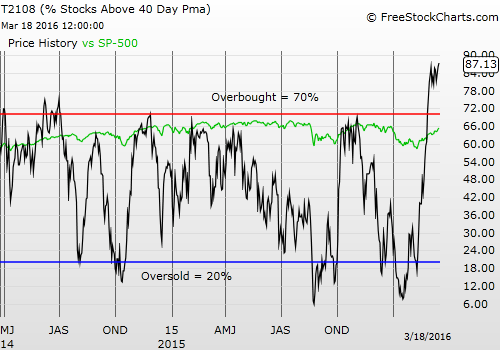

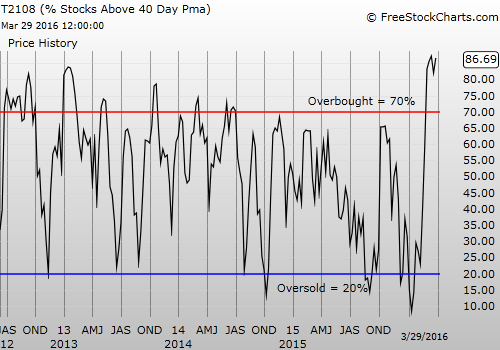

T2108 Status: 86.7%

T2107 Status: 43.9% (new 8-month high)

VIX Status: 13.8

General (Short-term) Trading Call: cautiously bullish

Active T2108 periods: Day #32 over 20%, Day #31 over 30%, Day #28 over 40%, Day #25 over 50%, Day #21 over 60%, Day #20 over 70%, Day #18 over 80% (overbought)

Commentary

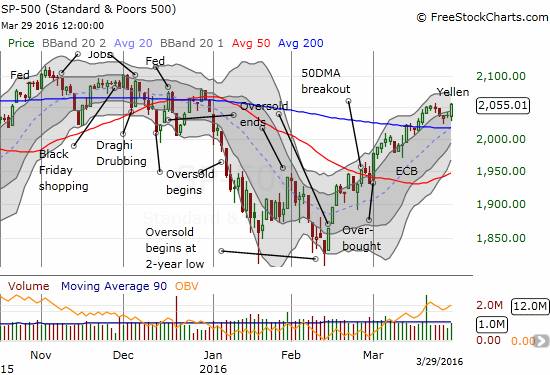

The “Pavlov circus” of Fed-speak and market-react continued today. Janet Yellen spoke at the Economic Club of New York on the topic “The Outlook, Uncertainty, and Monetary Policy” and delivered just the right punch to refresh the market’s spirits. Last week, I wrote about a sinking feeling in the market. Yellen swept that overhang right away. I cover my opinions on her speech at the end of this T2108 Update.

T2108, the percentage of stocks closing above their respective 40-day moving averages (DMAs), shifted upward to 86.7%…right to the top of a range that has stayed in place for almost the entire month of March. T2107, the percentage of stocks closing above their respective 200-day moving averages (DMAs), closed at a new (marginal) 8-month high at 43.9% and reaffirmed the underlying strength of the stock market. The S&P 500 (SPDR S&P 500 (NYSE:SPY)) cooperated by pulling away from its 200DMA support and closing at a new (marginal) 3-month high. The index is back into the green year-to-date.

The S&P 500 (SPY) gets a needed jolt from Janet Yellen and Fed-speak.

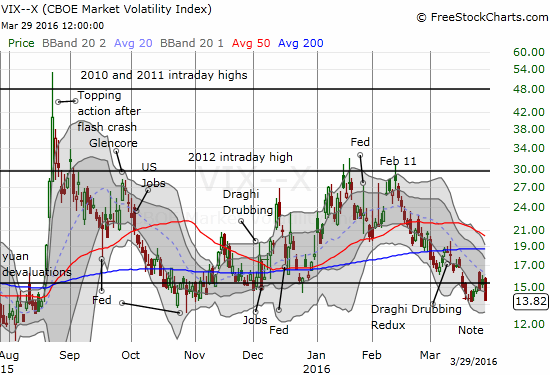

I never thought about putting on an anti-volatility trade ahead of Yellen’s speech. After all, the volatility index, the VIX, is already so low. Yet, Yellen managed to give the volatility index a shove similar in magnitude to the one following the March 16th policy meeting.

The VIX plunges off the 15.35 pivot to match recent lows.

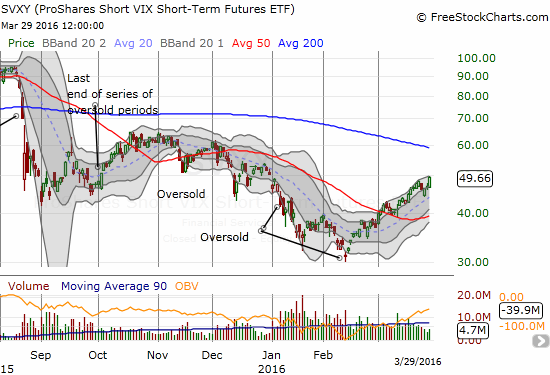

ProShares Short VIX Short-Term Futures (NYSE:SVXY) resumes its upward streak with an impressive 5.8% gain.

Of all the oversold trades I have closed out this year, I lament most the SVXY positions. I simply never envisioned such a smooth upward ride from the February low! SVXY is up an impressive 59.0% since then.

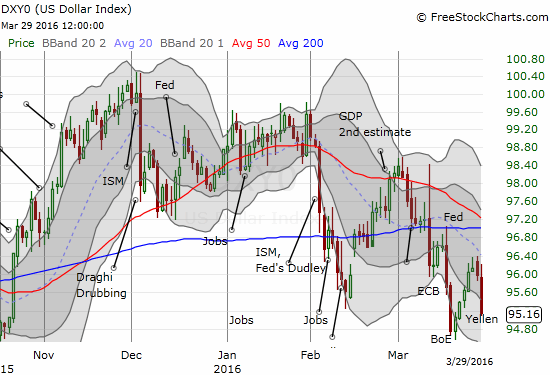

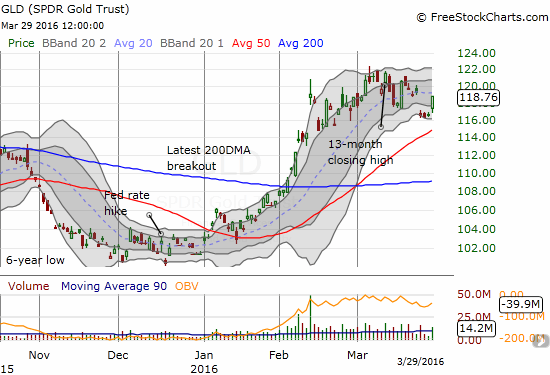

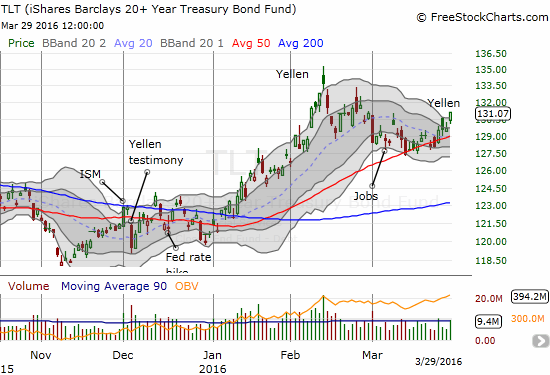

Yellen’s soothing words had other related impacts. In particular, Yellen seemed to go after the U.S. dollar, even if implicitly. She REALLY sent traders scrambling away from dollar. In unison, the U.S. dollar index (DXY0) tanked, SPDR Gold Shares (NYSE:GLD) sprang back to life, and iShares 20+ Year Treasury Bond (NYSE:TLT) continued its push off 50DMA support.

The U.S. dollar index confirms resistance at a now downtrending 20DMA

SPDR Gold Shares (GLD) jumps back to its 20DMA – is a trading range growing or is this the rest before the next leg higher?

iShares 20+ Year Treasury Bond (TLT) is building more and more upward momentum.

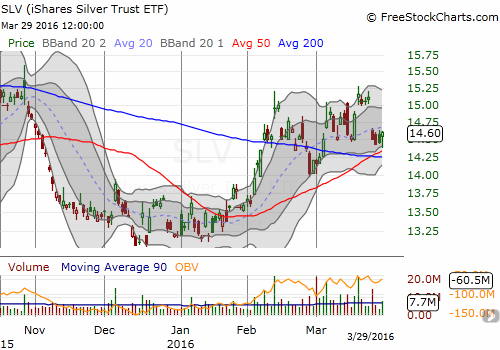

Surprisingly, iShares Silver Trust (NYSE:SLV) barely responded to the de facto easing party. SLV even traded lower at one point to challenge 50DMA support. I am looking to reload on call options on SLV as soon as possible. I am even thinking a breakout could be just over the horizon given the Fed has confirmed a major step up in dovishness.

The iShares Silver Trust (SLV) is churning just above 50DMA support. Did Yellen refresh the market enough to give SLV a fresh boost higher?

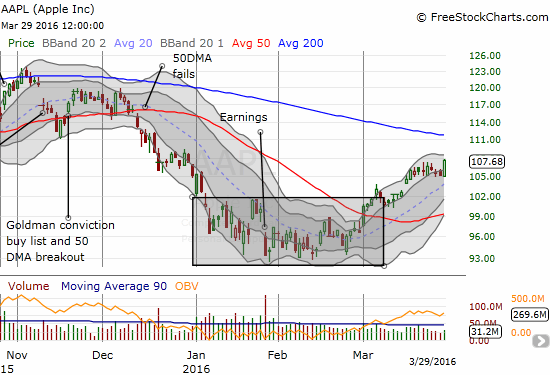

Apple (NASDAQ:AAPL) had a good day but I was VERY surprised to see a complete lack of volume on today’s 2.4% rally. I am still yet to make a play on AAPL for a rendezvous with 200DMA ressitance. It is looking like now or never on this minor breakout.

Trading volume has been weak for AAPL all month. Yet, it is managing to extend its breakout from the earlier doldrums.

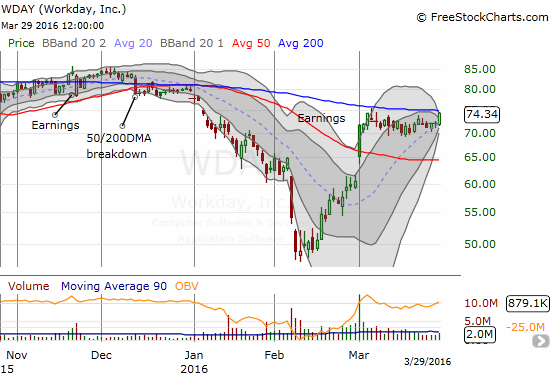

Workday Inc (NYSE:WDAY) is back on my radar as a potentially large Bollinger Band (BB) squeeze builds. A close above its 200DMA should be a VERY bullish sign for the stock.

Workday (WDAY) is on the edge of a major breakout above its 200DMA resistance AND out of a Bollinger Band (BB) squeeze.

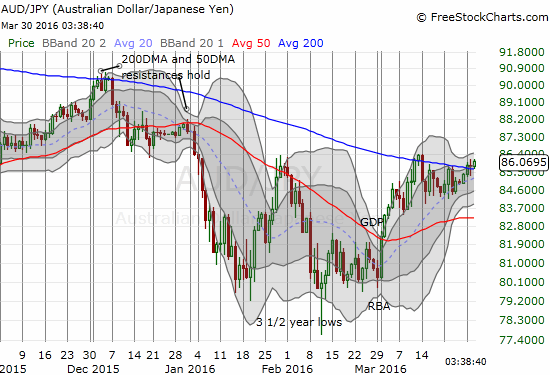

All things considered, I am once again leaving the trading call at “cautiously bullish.” A bullish call makes sense just from the S&P 500’s position above its 200DMA support. My cautiousness now turns toward T2107 which needs to get its previous momentum back. AUD/JPY is also just now breaking out above its 200DMA for its second try this month.

The Australian dollar versus the Japanese yen has been capped by 200DMA resistance all month.

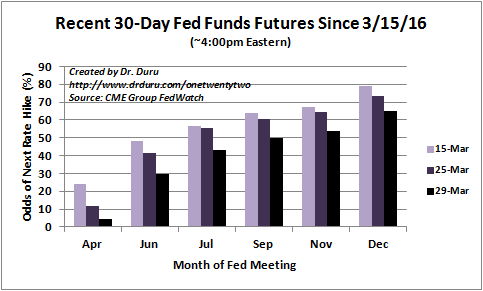

I am also cautious because I am getting increasingly uncomfortable (unsettled?) with the market’s celebrations any time the Fed admits that economic conditions are too weak to sustain even a snail’s pace of rate hikes. At this late stage in the bull market, I would have assumed unmitigated good news would provide the main fuel. Instead, news that drives expectations for rate hikes backwards gets loud applause. Yellen’s soothing words planted expectations for the next rate hike right back to September or even November. Another elimination of rate hikes for 2016 must be around the corner.

Expectations for the next rate hike are in retreat again.

I think Yellen’s speech was very deliberate in its attempt to push back on the market’s creeping expectations for rate hikes. I conclude by presenting key chunks of the speech followed by my 2-cents to point out how Yellen masterfully soothed the market (emphases mine)…

“The proviso that policy will evolve as needed is especially pertinent today in light of global economic and financial developments since December, which at times have included significant changes in oil prices, interest rates, and stock values. So far, these developments have not materially altered the Committee’s baseline–or most likely–outlook for economic activity and inflation over the medium term. Specifically, we continue to expect further labor market improvement and a return of inflation to our 2 percent objective over the next two or three years, consistent with data over recent months. But this is not to say that global developments since the turn of the year have been inconsequential. In part, the baseline outlook for real activity and inflation is little changed because investors responded to those developments by marking down their expectations for the future path of the federal funds rate, thereby putting downward pressure on longer-term interest rates and cushioning the adverse effects on economic activity. In addition, global developments have increased the risks associated with that outlook. In light of these considerations, the Committee decided to leave the stance of policy unchanged in both January and March.”

My read: The market did the heavy lifting for the Fed by pressuring long-term interest rates lower. Yellen clearly indicated the Fed is quite content with lower long-term rates and even sees this development as necessary to offset growing risks in financial markets. TLT looks like a good play to continue its rally off 50DMA support.

“On the other hand, manufacturing and net exports have continued to be hard hit by slow global growth and the significant appreciation of the dollar since 2014. These same global developments have also weighed on business investment by limiting firms’ expected sales, thereby reducing their demand for capital goods; partly as a result, recent indicators of capital spending and business sentiment have been lackluster.”

My read: The Fed is quite happy with a weaker U.S. dollar. Lower levels for the dollar will on net help U.S. economic activity.

“Although prices in these markets have since largely returned to where they stood at the start of the year, in other respects economic and financial conditions remain less favorable than they did back at the time of the December FOMC meeting. In particular, foreign economic growth now seems likely to be weaker this year than previously expected, and earnings expectations have declined. By themselves, these developments would tend to restrain U.S. economic activity. But those effects have been at least partially offset by downward revisions to market expectations for the federal funds rate that in turn have put downward pressure on longer-term interest rates, including mortgage rates, thereby helping to support spending. For these reasons, I anticipate that the overall fallout for the U.S. economy from global market developments since the start of the year will most likely be limited, although this assessment is subject to considerable uncertainty.”

My read: Here, Yellen reiterated her earlier point that the Fed is happy to have longer-term interest rates come down as a necessary tool for supporting economic activity. Most importantly, I am duly noting that the Fed observes a deterioration in economic conditions and is worried about heightened financial risks.

“All told, the Committee continues to expect moderate economic growth over the medium term accompanied by further labor market improvement. Consistent with this assessment, the medians of the individual projections for economic growth, unemployment, and inflation made by all of the FOMC participants for our March meeting are little changed from December.”

My read: Here, Yellen reminds the audience that the Fed’s baseline case remains unchanged. The Fed wants the market to remain hopeful on economic prospects even as risks have increased.

“Reflecting global economic and financial developments since December, however, the pace of rate increases is now expected to be somewhat slower. For example, the median of FOMC participants’ projections for the federal funds rate is now only 0.9 percent for the end of 2016 and 1.9 percent for the end of 2017, both 1/2 percentage point below the December medians.”

My read: These number confirm and quantify the cooling in expectations for rate hikes.

“There is a consensus that China’s economy will slow in the coming years as it transitions away from investment toward consumption and from exports toward domestic sources of growth. There is much uncertainty, however, about how smoothly this transition will proceed and about the policy framework in place to manage any financial disruptions that might accompany it. These uncertainties were heightened by market confusion earlier this year over China’s exchange rate policy.”

My read: China’s impact is very real. In particular, China’s economic transition is full of uncertainties which will continue to spook the market from time-to-time. Of all the major central banks I follow, the Fed’s assessment of China’s transition is the most sober…and I think the most realistic.

“..the decline in some indicators has heightened the risk that this judgment could be wrong. If so, the return to 2 percent inflation could take longer than expected and might require a more accommodative stance of monetary policy than would otherwise be appropriate.”

My read: after a lengthy discussion, the Fed seems biased toward concerns that inflation expectations are getting too low. The HUGE irony, to me anyway, is that dovish talk from the Fed fully justifies lowered expectations for inflation. This process is self-sealing, self-reinforcing, maybe even a Catch-22 of sorts!

“One must be careful, however, not to overstate the asymmetries affecting monetary policy at the moment. Even if the federal funds rate were to return to near zero, the FOMC would still have considerable scope to provide additional accommodation. In particular, we could use the approaches that we and other central banks successfully employed in the wake of the financial crisis to put additional downward pressure on long-term interest rates and so support the economy–specifically, forward guidance about the future path of the federal funds rate and increases in the size or duration of our holdings of long-term securities. While these tools may entail some risks and costs that do not apply to the federal funds rate, we used them effectively to strengthen the recovery from the Great Recession, and we would do so again if needed.”

My read: Yellen admonished markets yet again not to doubt the Fed’s ability to respond if needed with more monetary easing. I am guessing this reassurance alone substantially cheered a market which is still getting over increased concerns over the odds of recession.

“Financial market participants appear to recognize the FOMC’s data-dependent approach because incoming data surprises typically induce changes in market expectations about the likely future path of policy, resulting in movements in bond yields that act to buffer the economy from shocks. This mechanism serves as an important “automatic stabilizer” for the economy. As I have already noted, the decline in market expectations since December for the future path of the federal funds rate and accompanying downward pressure on long-term interest rates have helped to offset the contractionary effects of somewhat less favorable financial conditions and slower foreign growth. In addition, the public’s expectation that the Fed will respond to economic disturbances in a predictable manner to reduce or offset their potential harmful effects means that the public is apt to react less adversely to such shocks–a response which serves to stabilize the expectations underpinning hiring and spending decisions.”

My read: Clear data-dependency is the grease the allows the gears of market expectations to grind the way the Fed desires. When the market acts as expected to economic data, the Fed can focus on communications over action. This process preserves the Fed’s “bullets” for true emergencies. Yellen’s description of the way the Fed’s communications motivate proper market behavior is a KEY point to remember (see again my article titled “The Simple Calculus for the Timing of The Fed’s First Rate Hike“).

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: short AUD/JPY, closed out a bunch of anti-dollar currency bets, long GLD

Related Articles

If you can keep your emotions in check, the volatility in stocks sets up a long-term buying opportunity. However, investors with a lower risk tolerance may want to consider...

Let’s get right to it. First a quick comment on the weekly charts. The Russell 2000 (IWM) (Gramps) is at a key life support level on the 200-week moving average. Grandma...

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.