Let’s get right to it.

First a quick comment on the weekly charts.

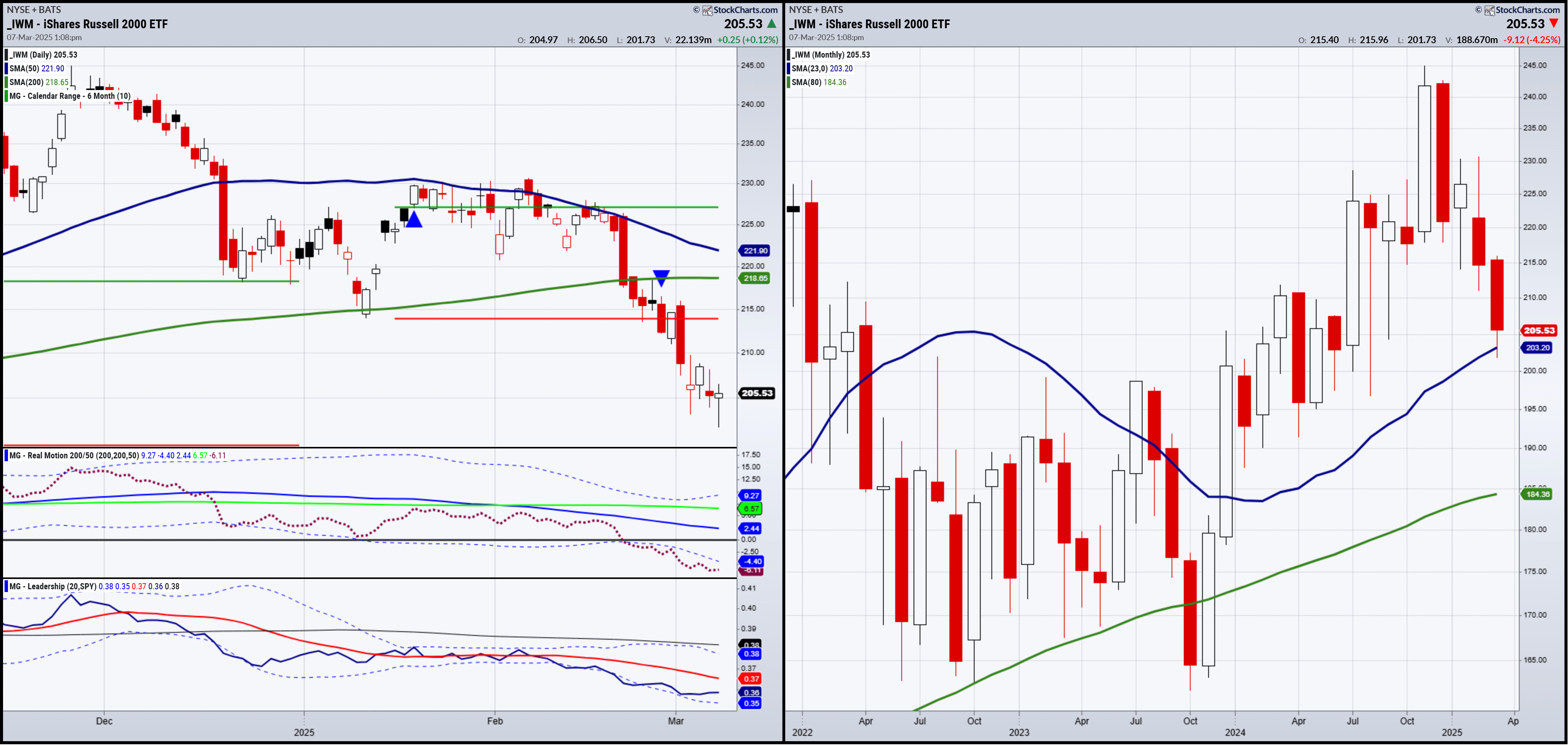

The Russell 2000 (IWM) (Gramps) is at a key life support level on the 200-week moving average.

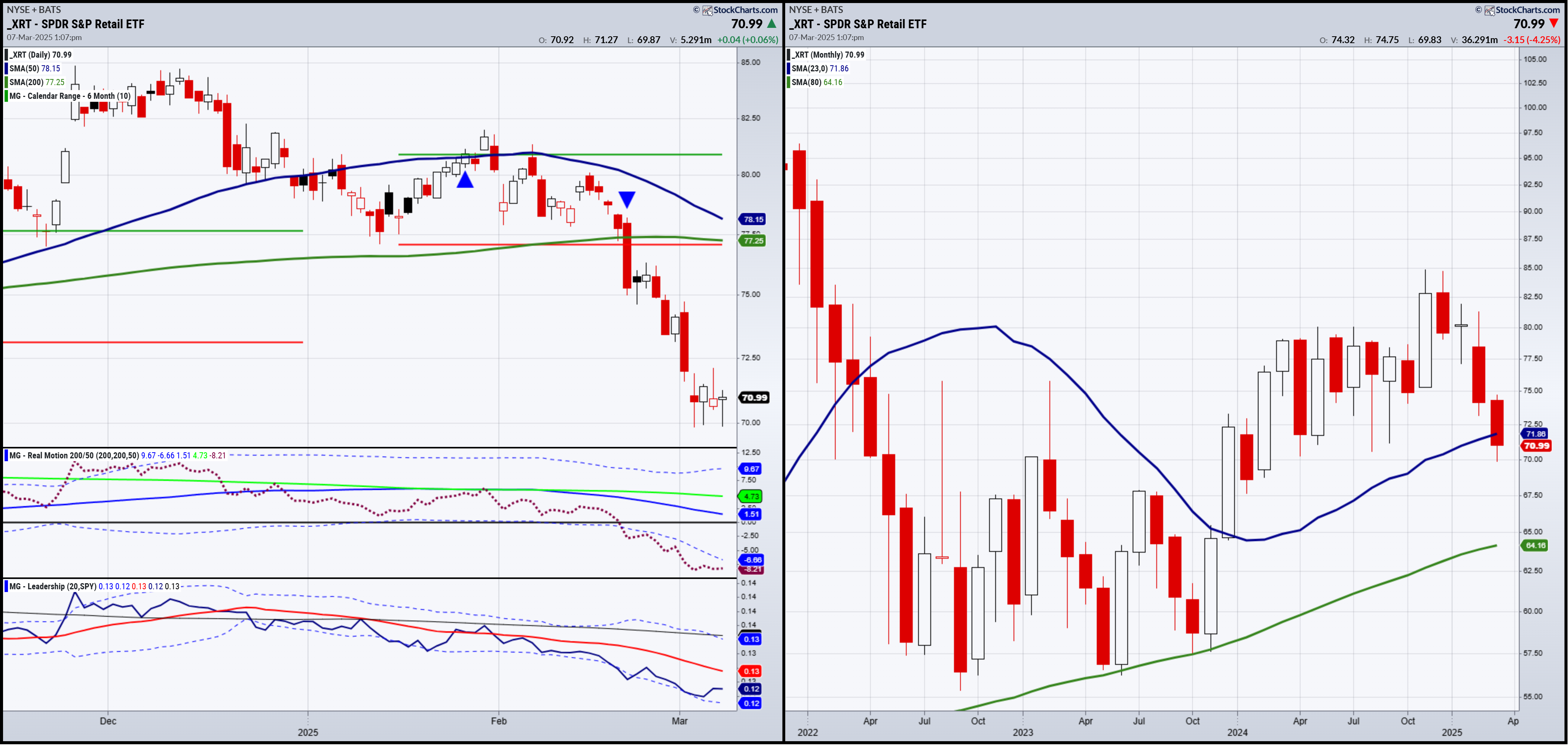

Grandma Retail XRT is intubated right now.

Biotechnology is still ok. In fact, I am keen on this sector.

Sister Semiconductors SMH might take a while to get her groove back.

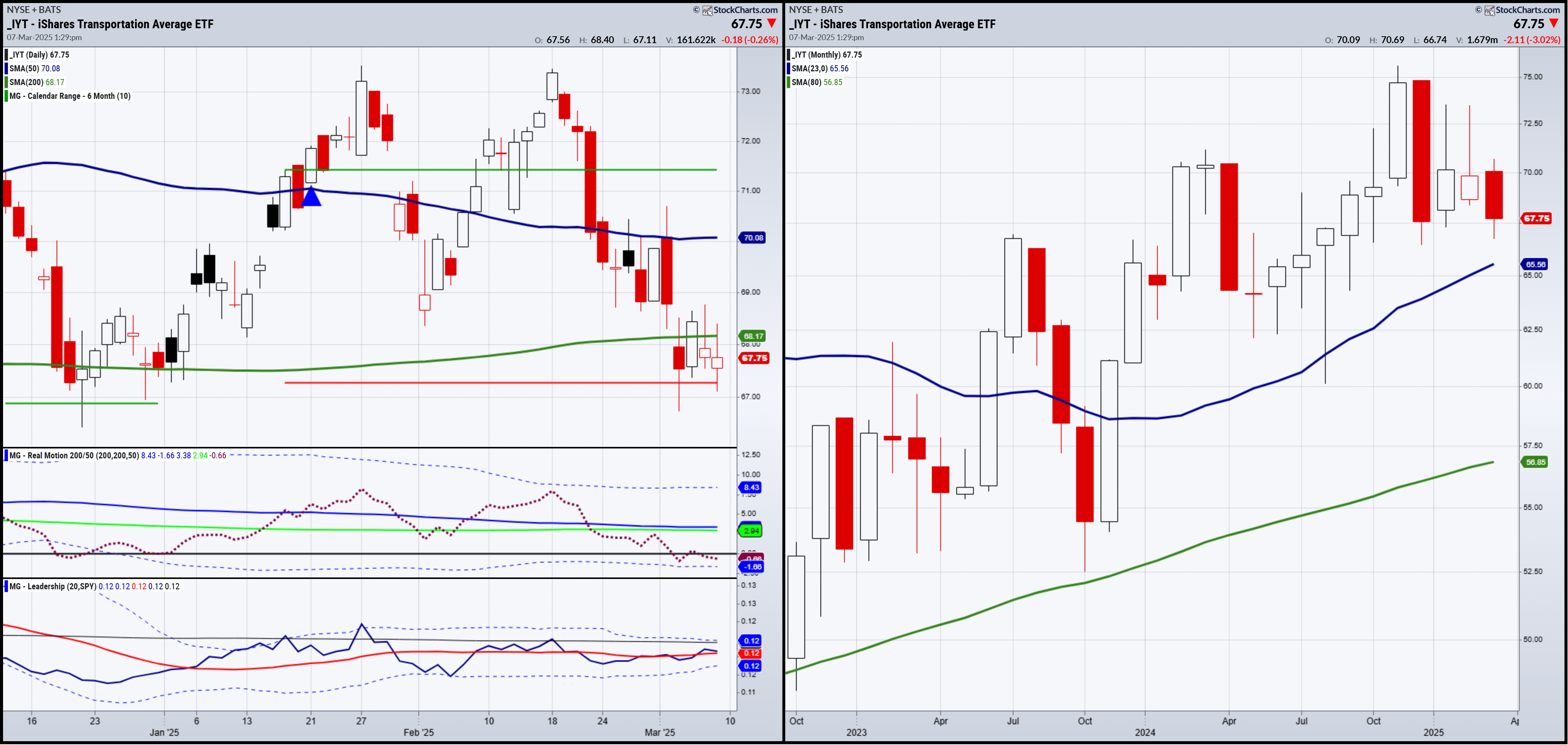

Transportation IYT, a move up this coming week will help.

Regional Banks, like Gramps, is on key life support.

Secondly, we will examine the 3 members of the Family and look at their Daily/Monthly timeframes for price consensus.

I choose the 3 areas that Stanley Druckenmiller called the “inside sectors” of the US economy.

Then, we will hopefully ascertain who is more accurate. Treasury Secretary Bessent telling us to prepare for detox. Or Jerome Powell telling us that the economy is solid.

Remember, price rules the narrative.

We see that on the weekly chart, IWM must hold the 200 level.

On the daily chart, it is possible that Friday was the flush, but we won’t know that until this week.

Plus, the momentum indicator is oversold, but no mean reversion yet.

One other potentially good sign is that the monthly moving average, the 2-year business cycle indicator, continues to hold economic expansion.

One thing is for sure: 200 is the level to hold.

Here is where it gets even more interesting.

XRT on the daily, after a huge breakdown on the weekly chart, could be showing support at 70.00.

Tuesday, Thursday and Friday last week, that level was tested and held.

But is that enough?

Looking at the monthly chart, XRT now sits back in economic contraction or below the 23-month moving average.

The month is not over, though.

Unless we see a close over that critical blue monthly moving average, we will continue to think this is a sell-rallies market.

What about Transportation? After all, the Dow theory is old but still applicable.

Notice that IYT is stuck between the January 6-month calendar range low (red horizontal line) and the 200-daily moving average.

Plus, IYT is outperforming the benchmark.

On the momentum indicator, IYT shows that perhaps the momentum of selling is slowing.

I would like to see IYT get back over 69.

On the monthly chart, IYT is in much better shape than IWM and XRT.

If you put this all together, it seems that transportation can drag us out of detox.

Granny can nail the coffin shut.

And Granddad can go either way.

Now you have the 3 key sectors and key numbers to watch this mid-week of March.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below.)

S&P 500 (SPY): Held the 200-DMA-key

Russell 2000 (IWM): Maybe a reversal-211 resistance

Dow (DIA): 432 pivotal

Nasdaq (QQQ): A move over 493 would look better

Regional banks (KRE): 57-58 support

Semiconductors (SMH): 220 support. 230 resistance

Transportation (IYT): 67-68 support

Biotechnology (IBB): Big one to watch as it cleared a calendar range and moving average

Retail (XRT): A move over 72 better

iShares 20+ Treasury Bonds (TLT): 90 support to hold