- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will E-Retail Boom Mar Simon Property's (SPG) Q4 Earnings?

Simon Property Group (NYSE:SPG) is scheduled to report fourth-quarter 2017 results on Jan 31, 2018 before the market opens. Both its funds from operations (FFO) per share and revenues are anticipated to improve year over year.

In the last reported quarter, this Indianapolis, IN-based retail real estate investment trust (REIT) witnessed a positive surprise of 0.35% in terms of funds from operations (FFO) per share. Results highlighted improved property performance and growth in revenues.

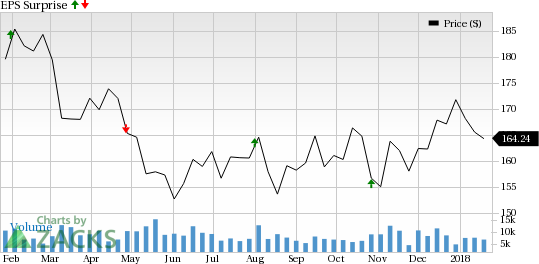

Nonetheless, over the trailing four quarters, the company exceeded the Zacks Consensus Estimate in three occasions and missed in the other, the average beat being 4.10%. This is depicted in the graph below:

Simon Property Group, Inc. Price and EPS Surprise

Let’s see how things are shaping up for this announcement.

Factors to Influence Q4 Results

Simon Property has been undertaking various initiatives, of late, to strengthen its relationship with customers. In addition, it is focusing on omni-channel strategies to gain popularity among retailers. Further, in the fourth quarter, the company initiated various programs and events to steer mall traffic.

Simon Property has also resorted to micro-retail modeling that offers store units ranging from 20-200 square feet of space. Such moves make its shopping malls more appealing and will be conducive to revenue growth in the to-be-reported quarter.

In addition, the Zacks Consensus Estimate for the fourth-quarter revenues is currently pegged at $1.4 billion — indicating projected growth of around 0.5% year over year.

Nevertheless, with more and more consumers shifting to online purchases, mall traffic continues to remain considerably depressed. This has resulted in an increasing number of retailers joining the dot-com bandwagon. Retailers are also reconsidering their footprint and opting for store closures.

Furthermore, retailers unable to keep up with the intense competition in the industry have been filing bankruptcies. This is a pressing concern for retail REITs, as the trend has been significantly dragging down demand for the retail real estate space. This choppy retail real estate market situation is also said to have led to tenants demanding substantial lease concessions, though the mall landlords find it unjustified.

While Simon Property is making efforts to beat these retail blues through various initiatives, implementation of such measures requires a decent upfront cost. Consequently, this might impede any robust growth in the company’s profit margins in the quarter under review.

In addition, during the third-quarter earnings release, Simon Property had revised its full-year 2017 FFO per share to the range of $11.17-$11.22 compared with the prior guidance of $11.14-$11.22. The company had incorporated an expected 3 cents per share negative impact in the fourth quarter as a result of the ongoing repair and restoration work at the company’s two centers in Puerto Rico. The Zacks Consensus Estimate for the same is currently pegged at $11.21.

Moreover, prior to the fourth-quarter earnings release, there is lack of any solid catalyst. As such, the Zacks Consensus Estimate of FFO per share for the quarter remained unchanged at $3.11 over the past month.

Finally, shares of Simon Property have climbed 3.9%, versus the industry’s gain of 14.7%, in six months’ time.

Earnings Whispers

Our proven model does not conclusively show that Simon Property will likely beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. But that is not the case here, as you will see below.

(You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.)

Zacks ESP: The Earnings ESP for Simon Property is 0.00%.

Zacks Rank: Simon Property currently has a Zacks Rank #4 (Sell), which actually reduces the predictive power of ESP.

Stocks That Warrant a Look

Here are a few stocks in the REIT space that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this time around:

EPR Properties (NYSE:EPR) , slated to release fourth-quarter results on Feb 28, has an Earnings ESP of +0.69% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ramco-Gershenson Properties Trust (NYSE:RPT) , scheduled to release earnings on Feb 20, has an Earnings ESP of +1.24% and a Zacks Rank of 3.

Weingarten Realty Investors (NYSE:WRI) , slated to release quarterly numbers on Feb 21, has an Earnings ESP of +0.07% and a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Simon Property Group, Inc. (SPG): Free Stock Analysis Report

Ramco-Gershenson Properties Trust (RPT): Free Stock Analysis Report

Weingarten Realty Investors (WRI): Free Stock Analysis Report

EPR Properties (EPR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.