Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds, improving (geo)politics, reforms, and so-on.

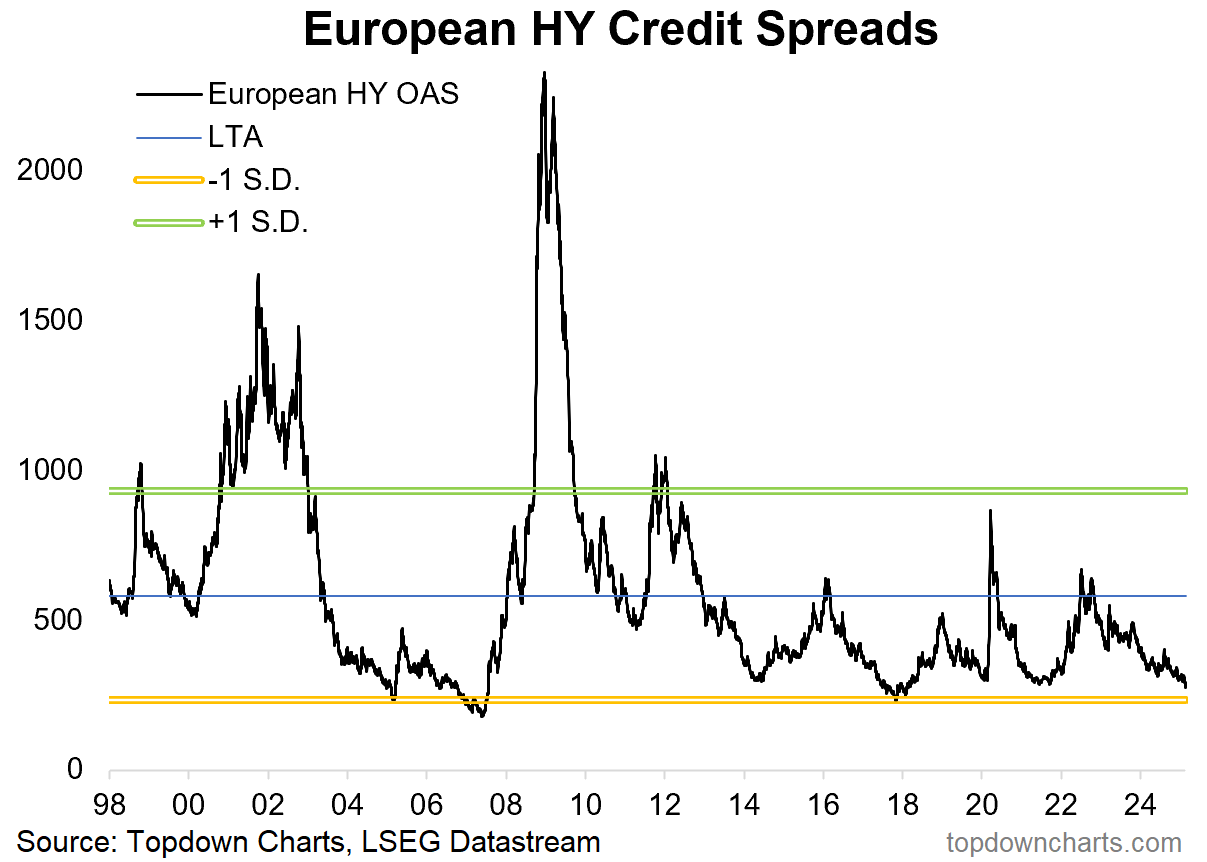

But not many have noted the similar bull market underway in European credit markets.

Much like what I observed with US credit spreads, European High Yield Credit Spreads have been steadily narrowing and making new lows. The point of contrast would be that Europe hasn’t quite revisited the pre-08 lows like the US has, but it sure is on a trajectory to get there — and is very clearly already at the bottom end of the range.

On face value this is a positive sign, it means credit investors are confident on the state of things, and are happy to take on credit risk. At the same time it indicates that the cost of debt capital for borrowers is low and that debt capital is likely flowing well.

This can have a reinforcing feedback loop to improving equity market sentiment and overall macro conditions —easier financial conditions boosts growth and sentiment, which lifts risk assets, which eases financial conditions, and so-on…

(but)

It can also indicate a degree of complacency and overconfidence.

Spreads rarely stay at these levels for long.

Add to that lingering questions on the macro outlook, elevated geopolitical uncertainty despite the peace-seeking overtures of the Trump admin, and even the other tail of resurgence risk rattling rates markets and it all adds up to one of those worried-smile faces, where yes things seem to be on an improving path, but to every upside there seems to be an equal and opposite downside.

One practical note I can say with certainty is that the risk premium is much better for equities than that of credit, and equities are likely going to be less impacted if we get an inflation resurgence and surge in rates.

So on balance, I would say definitely take note of this development (especially if spreads bottom out and turn up [not yet]), and stay bullish on European equities.

Key point: European credit spreads are making new lows (and equities new highs).

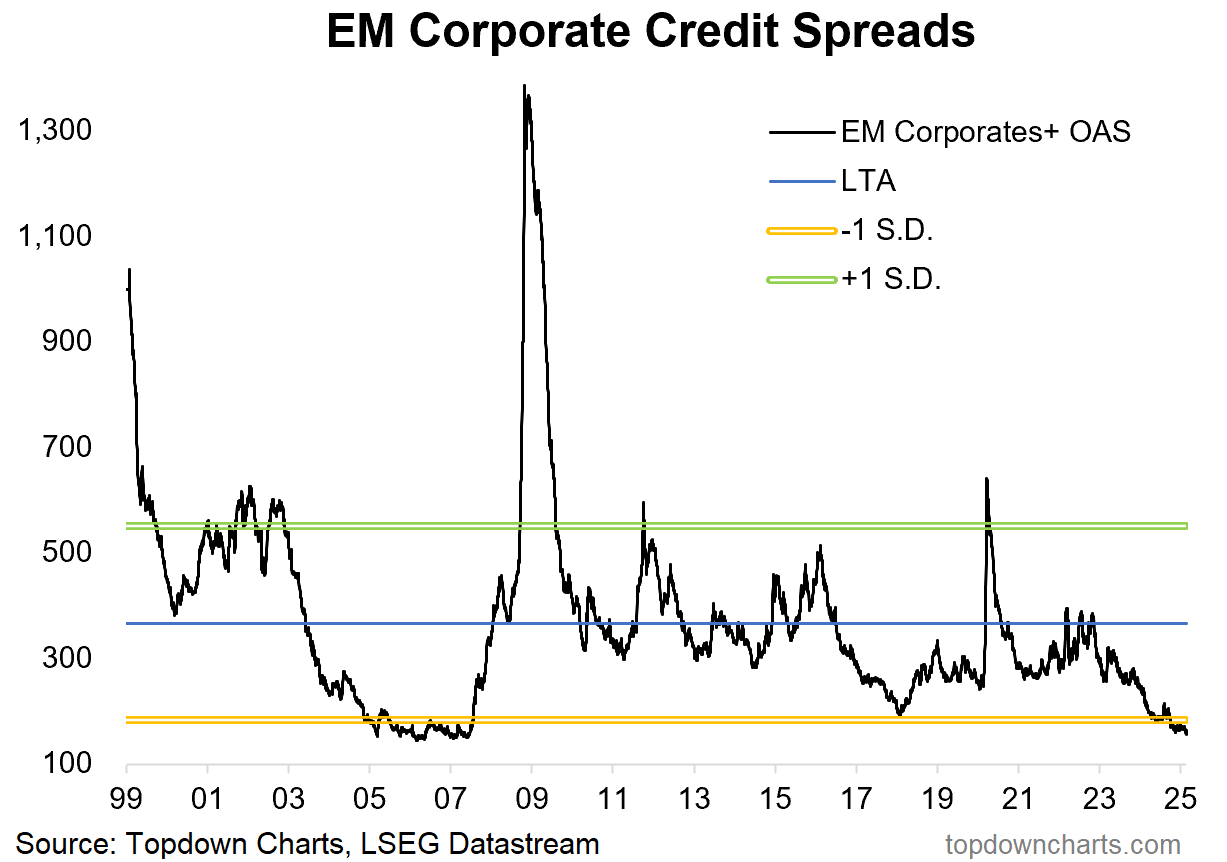

Bonus Chart: Emerging Market Credit Spreads

It’s not just the USA and Europe, EM corporate credit spreads are pushing lower as a warm blanket of complacency is wrapped around markets. The upside is that it likely does reflect an element of improved fundamentals given the relative calm in macro and markets and improving data out of China. Furthermore, again — this can become self-reinforcing in that it reflects easier financial conditions, supporting growth and risk-taking, which in turn imparts a cyclical improvement in fundamentals.

But the problem is it represents a very low-risk premium for investors should things deteriorate. On my analysis, I’d prefer EM sovereign bonds (ex-China), and EM equities where the risk premium is much larger and the upside potential asymmetric (but in the right direction whereas corporate bond returns are also potentially asymmetric, but in the wrong direction: i.e. limited upside, but large potential downside e.g. in the event of a credit default cycle or rates shock).

Overall though it’s a key development and one that’s probably slipped under the radar for most people..