- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

USD Weaker On Lower Yields

Market Brief

FX markets were subdued in the Asian session as USD lost some ground on further profit taking. Regional equity indices were in the red as the Nikkei fell -0.48%, the Hang Seng dropped -0.28% and Shanghai was slightly lower at -0.5% (at the time of writing). In FX, USDJPY continued to fall, slipping to 103.68 weakness in US treasury yields while EURUSD rose to 1.3218 on a Reuters report stating the ECB was doubtful to ease at next weeks policy meeting, unless Friday’s inflation data was meaningfully softer then consensus. EURUSD traders are eyeing the gap open from Friday-Monday (1.3242 close), which could get filled should inflation data come better than expected (lower should data come in lower then forecasts). AUDUSD climbed to 0.9372 from 0.9332 as stronger CAPEX data cleared stops above 0.9350 resistance. Most Asia EM traded higher verse the USD. USDKRW was sold to 1013.30 were official support was rumored to have stepped in. USDINR fell to 60.3600 as yields rose 2bp. Yet the broader trend of EM bonds and currecnies being in demand looks to continue. We are highly constructive on EM Asia currecneis in particular.

Asian Session

In the Asian session, report showed that China’s industrial profits grew 13.5% y/y in July, decelerating from its prior increase of 17.9% in June. Australia’s private capital expenditure jumped 1.1% q/q in Q2 2014 significantly better than expectations of a 0.9% fall. The CAPEX underlying spending results illustrates a more balanced investment approached then just heavy allocation toward mining. South Korea’s Balance of Payment current account surplus slipped marginally to $7908.8mn in July from $7919.7mn in June.

On the docket

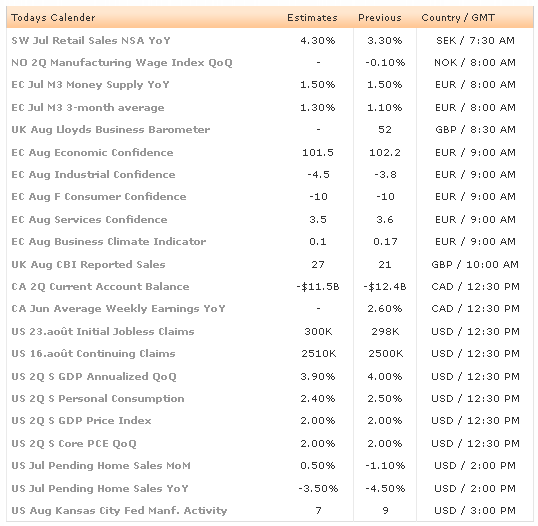

In the European session, Spanish GDP Q2 final came in as expected at 0.5% q/q and 1.2% y/y. While German CPI fell to 0.0% from 0.4%. The weaker inflation reads will support the pro-QE team demand to launch aggressive easing next week. We still suspect that weak European data will increase debate for ECB action and keep EUR soft. However, we are still in the camp that doesn’t anticipate the ECB will pull the trigger at next week’s meeting. In the UK, CBI reported sales for August expect to come in at 27, stronger then the July print of 21. And in Sweden, retail sales growth is expected at 4.3% y/y in July verse 3.3% y/y in June.

Currency Tech

EURUSD

R 2: 1.3290

R 1: 1.3250

CURRENT: 1.3213

S 1: 1.3152

S 2: 1.3136

GBPUSD

R 2: 1.6656

R 1: 1.6610

CURRENT: 1.6594

S 1: 1.6531

S 2: 1.6506

USDJPY

R 2: 104.41

R 1: 104.17

CURRENT: 103.79

S 1: 103.69

S 2: 103.50

USDCHF

R 2: 0.9196

R 1: 0.9186

CURRENT: 0.9132

S 1: 0.9104

S 2: 0.9060

Related Articles

The US dollar fell last week due to Trump's inconsistent trade policies and signs of a slowing economy. February's non-farm payroll data disappointed, with unemployment...

Forex Strategy is Bearish: USD/JPY is currently at 146.76 in a 5th fractal wave in a channel. We are looking for a continuation to the ATR target at the 146.10 area, with a...

The Canadian dollar is steady at the start of the week. USD/CAD is trading at 1.4385, up 0.06% on the day. The Canadian dollar declined 0.50% on Friday after Canada’s job report...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.