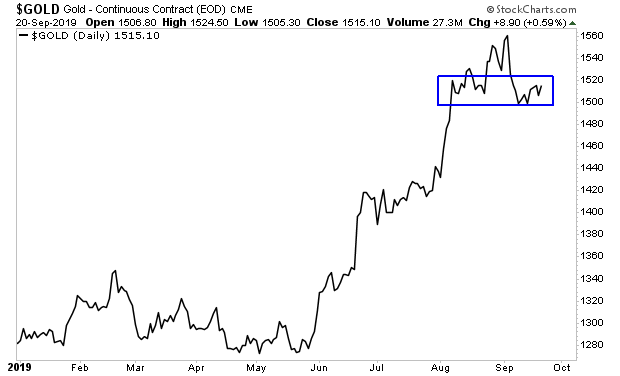

Gold continues to consolidate after one of its best runs in years. This is precisely what long-term bulls want to happen: a period of consolidation before the next major leg higher.

The precious metal has multiple reasons to be rallying.

- Inflation is beginning to get out of hand: all of the recent inflation data is coming in hotter than expected.

- Negative yielding bonds: compared to the $17 trillion in bonds with negative yields, gold, which has NO yield, is actually quite attractive.

- Central banks are easing again: every major central bank is starting to ease monetary policy again. Gold is a hedge against currency devaluation.

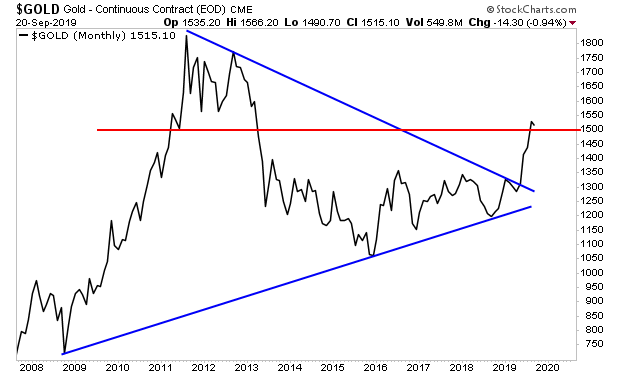

The big picture is similarly attractive. Provided Gold can remain above support (red line), the massive triangle formation is predicting a long-term run to $3,000 per ounce.

Does that mean Gold will hit that in the next few weeks? NO. That is simply the long-term prediction of where Gold will eventually trade.

The key for investors is to find the right plays for this, and then “buy and hold” for the maximum gains. Those who do this correctly, with carefully targeted picks, could stand to generate literal fortunes.