- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

TE Connectivity (TEL) Q1 Earnings & Sales Top, View Buoyant

TE Connectivity Ltd. (NYSE:TEL) scored its ninth consecutive earnings beat as the company reported first-quarter fiscal 2018 adjusted earnings of $1.40 per share, beating the Zacks Consensus Estimate of $1.25 by 12%. The figure also steered past the projected range of $1.23-$1.27.

The impressive earnings were driven by the continued solid execution and impressive top-line growth. Encouraged by the successful execution and all-round growth, the company released upbeat earnings and revenue guidance for second-quarter fiscal 2018.

On a GAAP basis, the company reported loss from continuing operations of 11 cents per share compared with earnings of $1.14 recorded in first-quarter 2016. The company’s GAAP profitability was adversely affected by a huge, one-time charge associated with the latest U.S. tax regulations.

Inside the Headlines

Net sales in the quarter were up 14% year over year at $3,480 million and also topped the Zacks Consensus Estimate of $3,367 million. Solid performance in two of the three segments drove the quarterly top-line growth. Excellent traction in the company’s harsh environment businesses, which has been a staple profit churner over the past quarters, contributed significantly to the top line.

Segmental Performance

Transportation Solutions revenues came in at $2,032 million in the reported quarter, up 21.3% on a year-over-year basis. Orders in the transportation segment came in at $2,129 million, up 20% on a year-over-year basis. Organic growth in automotive, commercial transportation, and sensors across all regions boosted the top line. In fact, the company’s sales in automotive and commercial transportation were considerably above market trends.

Industrial Solutions revenues witnessed another strong quarter, rising 10.9% year over year to $882 million. Orders in this quarter rose 13% to $942 million. The impressive growth was driven by strength in industrial equipment. Industrial Equipment business contributed to the segment revenues, which was slightly offset by decline in the Aerospace, Defense and Marine business. Also, organic decline in the Energy business, which stemmed from weakness in the European power market, dragged down segment revenues to some extent.

Communications Solutions revenues contracted 4.6% year over year to $566 million. However, orders were up 9% year over year to $454 million, led by strength across all regions and businesses. The segment’s sales were boosted, somewhat, by strength in Asia in Data and Devices, and double-digit growth in appliances.

The company’s adjusted operating margin for the quarter expanded 10 basis points from the year-ago quarter to 17.9%.

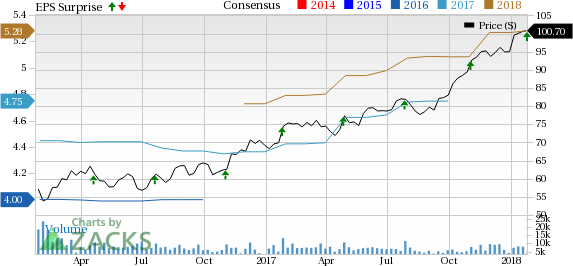

TE Connectivity Ltd. Price, Consensus and EPS Surprise

Liquidity & Cash Flow

TE Connectivity exited the quarter with cash and cash equivalents of $704 million, higher than $665 million reported a year back.

The company generated free cash flow of $127 million in the quarter, down from $218 million in the prior-year quarter.

Acquisition

The company recently enhanced its harsh environment portfolio with bolt-on acquisitions in the Automotive and Medical business.

In addition, it also acquired Hirschmann Car Communication, which focuses on vehicle connectivity technology used in antenna and infotainment systems. TE Connectivity also acquired MicroGroup, which makes specialized shafts for medical applications. These acquisitions will unlock expansion opportunities, and advance content growth in key applications for the automotive and medical markets.

Guidance

The company issued encouraging earnings and revenue guidance for the fiscal second quarter. It expects net sales in the range of $3.55-$3.65 billion, reflecting growth of 12% at the mid-point. Adjusted earnings per share are projected in the band of $1.33-$1.37, reflecting growth of 13% year over year at the mid-point.

Additionally, for fiscal 2018, the company expects net sales of $14.1-$14.3 billion, reflecting growth of 8% year over year at the midpoint. The company expects adjusted EPS to be $5.40-$5.50, reflecting 13% year-over-year growth at the mid-point.

To Conclude

TE Connectivity delivered yet another impressive quarter with strong top- and bottom-line beats. The company’s fiscal 2018 earnings guidance and robust sales forecast are likely to go very well with investors, as it carries its growth momentum forward into fiscal 2018.

Most of the company’s operating margin expansion in the past few years have been driven by the transportation segment. Encouragingly, in recent times we observed that both, the Communications and Industrial segments, are contributing significantly to the operating margin expansion as well, thus adding to the company’s strength.

We believe the previously-completed Creganna and Intercontec acquisitions will continue to unlock significant opportunities in the transportation and industrial segments. Overall, we believe strong demand in end markets, along with an overarching business model, will continue to drive TE Connectivity’s future growth.

Zacks Rank & Stocks to Consider

TE Connectivity carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader space include ZAGG Inc (NASDAQ:ZAGG) , Universal Display Corporation (NASDAQ:OLED) and IntriCon Corporation (NASDAQ:IIN) , each carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ZAGG has beaten earnings estimates each time in the trailing four quarters. Last quarter, it beat estimates by 6.3%.

Universal Display also has a striking earnings surprise history, with an outstanding average beat of 599.4% over the preceding four quarters, driven by massive, consecutive beats.

IntriCon has beaten earnings estimates each time during the same time frame, for an impressive average surprise of 59.5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

ZAGG Inc (ZAGG): Free Stock Analysis Report

TE Connectivity Ltd. (TEL): Free Stock Analysis Report

IntriCon Corporation (IIN): Free Stock Analysis Report

Universal Display Corporation (OLED): Free Stock Analysis Report

Original post

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.