- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Soft Dollar And Stock Market Supported By Dovish Fed And US Economy

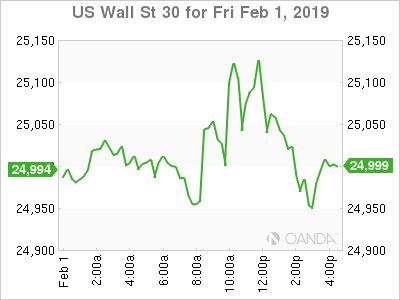

Commodity currencies outperformed against the US dollar after the Fed clearly signaled that rates are going nowhere anytime soon, also shrugging off a very strong nonfarm payroll number. Strong corporate earnings and no major hiccups with trade talks also helped drive equities higher on the week.

Rate decisions will be a key theme for the week. The Bank of England policy meeting, inflation report and Governor Carney press conference on Thursday will closely be watched as growth and inflation forecasts could be cut. Key decisions will also come from the Mexico Banxico and the Philippines central bank, economists also expect no change with their respective policy rates.

- RBA, BOE, Banxico, and Philippines central bank all expected to keep rates steady

- Fed’s Mester, Quarles, Powell, Kaplan, Clarida and Bullard all expected to speak

- Should get an update on the release dates for major US data including Advance Q4 GDP and personal income and spending (delayed due to shutdown)

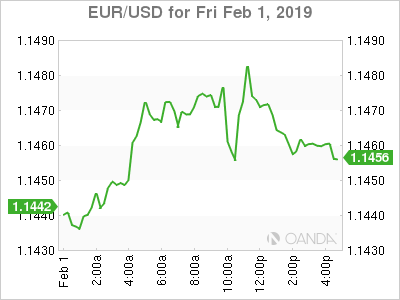

Dollar continues to fall as rate hike expectations evaporate

EUR/USD had another positive week, but still remains trapped in a very stubborn 1.1200 to 1.1550 range. The prospects of tightening have faded for both the ECB and Fed, making next week’s wrath of European services PMIs, factory orders and industrial production data an important gauge if the slowdown is easing in Europe. Fed speak this week is also expected to confirm the Fed’s dovish pivot.

Global stock markets will see uneven flows as most of Asia will be closed for some or all of next week as the Lunar New Year holiday begins. Corporate earnings will remain busy next week and look to build on the recent gains. The stock market rally has so far been supported by the backdrop of no rate hikes priced in for 2019 from both the Fed and ECB, progress in trade talks between China and the US and mostly better than expected earnings. Key earnings for the week include Google (NASDAQ:GOOGL) on Monday, Disney on Tuesday, and both AIG (NYSE:AIG) and Boston Scientific (NYSE:BSX) on Wednesday.

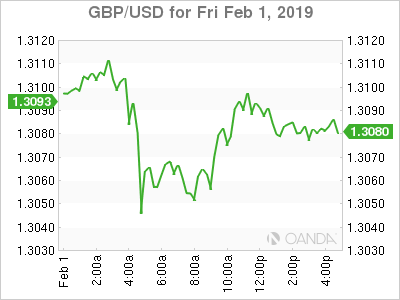

Cable remains in wait-and-see mode on Brexit negotiations

The British had a very choppy move lower this week as lawmakers voted on amendments that gave PM May a new mandate to negotiate a new deal with the EU. The EU is set on taking their time with negotiations and have even suggested they could wait till the scheduled summit on March 21-22nd, just seven days before they are scheduled to leave the bloc.

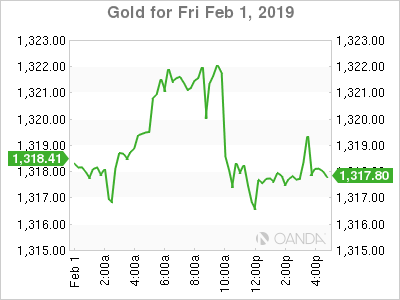

Gold continues to shine on dovish Fed

The precious metal’s breakout was supported on a dovish Fed and slower global growth concerns. The precious metal however pared gains at the end of the week on mostly stronger economic data from the US. Friday delivered several positive signs on the economy as the NFP headline came in better than the top forecast, an impressive ISM manufacturing reading and a rebound with the Michigan sentiment survey.

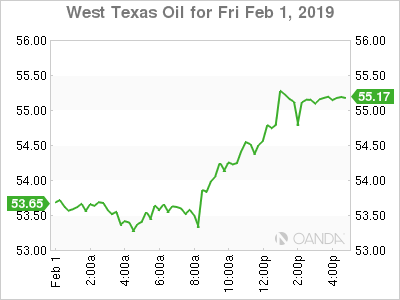

Crude rallies on Venezuela sanctions and strong US data

West Texas Intermediate crude prices remained bid this week as the US unleashed sanctions on Venezuela, and refiners struggled to get crude before the polar vortex crippled the mid-west.

If we do see Venezuelan opposition leader Juan Guaido become successful in win over the backing from Russia and China, we could see President Maduro run out of support. If we do see a peaceful transition of power, oil could see prices fall towards the $50 level. A continued standoff could see prices attempt to capture the $60 handle.

Monday, February 4

10:00am USD Factory Orders and Durable Goods

7:30pm AUD Retail Sales m/m

10:30pm AUD RBA Interest Rate Decision

Tuesday, January 5

Major European Services PMI data

9:45am USD Markit Services PMI

7:00pm USD State of the Union Address

7:30pm AUD CPI q/q

Wednesday, February 6

2:00am EUR German Factory Orders

8:30am USD Trade Balance

9:00am MXN Mexico Consumer Confidence

4:45pm NZD Employment Change

7:00pm USD Fed Chair Powell to host town hall

Thursday, February 7

2:00am EUR Germany Industrial Production

3:00am PHP Philippines Rate Decision

7:00am GBP BOE Rate Decision and Inflation Report

2:00pm MXN Mexico Rate Decision

Friday, February 8

2:45am EUR France Industrial Production m/m

4:00am EUR Italy Industrial Production m/m

8:30am CAD Net Change in Employment

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.