- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Raytheon (RTN) Up 8% Since Earnings Report: Can It Continue?

A month has gone by since the last earnings report for Raytheon Company (NYSE:RTN) . Shares have added about 8% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to its next earnings release, or is RTN due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Raytheon Beats on Q4 Earnings, Issues '18 Outlook

Raytheon reported fourth-quarter 2017 adjusted earnings from continuing operations of $2.03 per share, beating the Zacks Consensus Estimate of $2.02 by 0.5%.

The company’s reported earnings of $1.35 per share came in below the prior-year quarter’s equivalent of $1.88, owing to the Tax Cuts and Job Acts of 2017, which had an unfavorable impact of 59 cents on earnings. Also, pre-tax discretionary pension plan contribution had an unfavorable tax-related impact of 9 cents on earnings.

Operational Performance

The company’s fourth-quarter revenues of $6,783 million witnessed 8% year-over-year growth. The reported number however missed the Zacks Consensus Estimate of $6,833.7 million by 0.7%.

Raytheon’s bookings in the fourth quarter were $8,541 million compared with $7,582 million in the year-ago quarter, reflecting a rise of 12.6%. Total backlog at the end of 2017 was $38.2 billion, compared to $36.7 billion at the end of 2016.

Total operating expenses increased 9.5% to $5,913 million in the fourth quarter. Operating income of $870 million dropped 1.1% from $880 million a year ago.

Segmental Performance

Integrated Defense Systems: The segment’s revenues grew 6% year over year to $1,553 million due to higher sales on an international early-warning radar program. Operating income increased to $247 million from $238 million.

Intelligence, Information and Services: The segment’s revenues of $1,572 million were higher than the year-ago level of $1,516 million by 4%. Operating income in the reported quarter dropped to $117 million from $120 million a year ago.

Missile Systems: Segment revenues grew 15% to $2,185 million from $1,897 million a year ago, driven by higher net sales on the Advanced Medium-Range Air-to-Air Missiles, Standard Missile-3 and Paveway programs. Operating income improved to $278 million from $261 million a year ago.

Space and Airborne Systems: Revenues in the quarter improved 4% to $1,670 million. Operating income rose 10% to $242 million.

Forcepoint: This commercial cyber-security segment generated net sales of $156 million in the fourth quarter, up from $143 million a year ago. The joint-venture entity registered operating loss of $8 million in the reported quarter, compared to the year-ago operating income figure of $21 million.

Financial Update

Raytheon ended 2017 with cash and cash equivalents of $3,103 million, down from $3,303 million as of Dec 31, 2016. Long-term debt was $4,750 million, down from an outstanding debt of $5,335 million as of Dec 31, 2016.

Operating cash flow from continuing operations was $2.7 billion at the end of 2017 compared with $2,852 billion at the end of 2016.

In 2017, Raytheon repurchased 4.9 million shares of common stock for $800 million.

Guidance

Raytheon expects to generate net sales in the range of $26.4-$26.9 billion in 2018 and earnings per share in the range of $9.55-$9.75. The company also issued its cash flow from operating activities guidance in the range of $3.6-$4 billion during 2018.

How Have Estimates Been Moving Since Then?

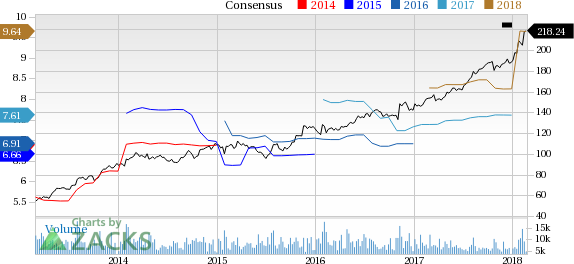

Fresh estimates followed an upward path over the past two months.

VGM Scores

At this time, RTN has a nice Growth Score of B, though it is lagging a bit on the momentum front with a D. The stock was also allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is solely suitable for growth investors.

Outlook

RTN has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.