- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Intuitive Surgical (ISRG) Down 5% Since Earnings Report: Can It Rebound?

A month has gone by since the last earnings report for Intuitive Surgical, Inc. (NASDAQ:ISRG) . Shares have lost about 5% in the past month, underperforming the market.

Will the recent negative trend continue leading up to its next earnings release, or is ISRG due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

Intuitive Surgical posted adjusted earnings of $2.54 per share in the fourth quarter of 2017, which beat the Zacks Consensus Estimate of $2.27 and improved 25.1% year over year.

Revenues increased 17.9% year over year to $892.4 million, driven by growth in Instrument & Accessories, Services and Systems. Revenues also beat the Zacks Consensus Estimate of $864 million.

FY17 at a Glance

Intuitive Surgical reported revenues of $3.12 billion in full-year 2017. The company has three major revenue segments —Instruments and Accessories (52.3% of total revenues), Systems (29.1% of total revenues) and Services (18.6% of total revenues).

Business Highlights

Solid Procedure Trends

Intuitive Surgical posted solid numbers in the quarter, courtesy of rising customer adoption of procedures and growth in system placements. The company outperformed in the Mature and Growth procedures, especially in general and thoracic surgery.

Precisely, fourth-quarter procedures increased approximately 17% on a year-over-year basis. Procedure performance in Asia reflected persistent strength backed by solid growth in China, Japan and Korea. Added to this, growth in prostatectomy procedure volumes lent the company a competitive edge in the broader prostate surgery market in the fourth quarter.

Favorable Study Results

In November 2017, a team of investigators from the University of Southern California, the University of Michigan Ann Arbor, Penn State Health and Intuitive Surgical published a large-scale study titled ‘Robotic-Assisted, Video-Assisted Thoracic and Open Lobectomy: Propensity Matched Analysis of Recent Premiere Data in the Annals of Thoracic Surgery’.The results from this study demonstrated the increase in the number of robotic-assisted lobectomies. Lobectomy can be defined as surgical excision of a lobe or an organ.

In the quarter under review, Intuitive Surgical submitted the 510(k) applications to the U.S. FDA for its 60-millimeter stapler for da Vinci X and Xi platforms.

International Sales

The company has been gaining solid prominence globally. In fact, outside the United States, the company’s procedures improved approximately 21% on a year-over-year basis. Intuitive Surgical’s system placements included 47 in the Europe and 22 in Japan. Notably, 25 of the 47 systems placed in Europe, were da Vinci X systems. However, as the OUS markets are in early stages of adoption, sales might lag estimates in the region.

Revenue Segments

Instruments & Accessories

Revenues in the segment rose 18% to $457 million in the quarter, on the back of strong procedure growth and increased sales of stapling and vessel sealing products. Revenues realized per procedure were approximately $1,910, flat year over year.

Systems

Sales in the segment increased 20% to $283 million, buoyed by higher system placements and partially offset by lower average selling prices. Coming to the company’s flagship da Vinci surgical platform, Intuitive Surgical shipped 216 systems compared with 163 in the prior-year quarter.

Services

The company registered revenues of $153 million, up 13% on a year-over-year basis and backed by growth in the installed base of da Vinci systems.

Gross Margin

Intuitive Surgical’s adjusted gross margin in the reported quarter expanded 130 basis points (bps) to almost 71% of net revenues. The increase in margins indicates the company’s consistent efforts to lower manufacturing cost.

Notably, management expects margins to fluctuate based on the company’s mix of new products, reduction of product costs and the reinstatement of the medical device tax in 2018.

Financial Update

Intuitive Surgical ended the fourth quarter of 2017 with $3.8 billion in cash, cash equivalents, and investments, in line with the third-quarter figure. Per management, this was offset by a final payment of $274 million associated with the accelerated share repurchase agreement initiated by the company in first-quarter 2017.

Guidance

For 2018, Intuitive Surgical anticipates full year procedure growth within a range of 11% to 15%. Procedure growth is expected to be driven by U.S. general surgery and procedures outside the United States.

Management expects operating expenses to rise in the range of 16-18% in 2018, as the company continues to invest in emerging markets and new technology including computer-assisted surgery.

Gross margin is expected within the range of 70-71.5% of net revenues in 2018.

Incorporating projected impacts of the newly enacted U.S. tax law, Intuitive Surgical expects 2018 income tax rate between 2% and 20% of net pre-tax income.

How Have Estimates Been Moving Since Then?

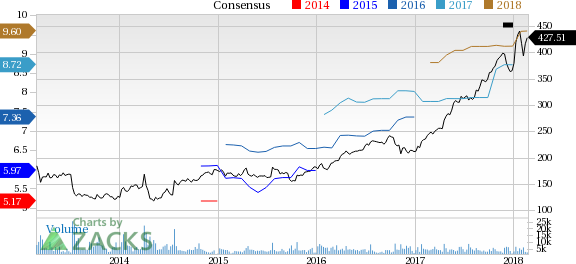

Fresh estimates followed an upward path over the past two months.

VGM Scores

At this time, ISRG has a nice Growth Score of B, though it is lagging a lot on the momentum front with a F. Following a similar course, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The stock is suitable solely for growth based on our styles scores.

Outlook

ISRG has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Original post

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.