- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Infosys (INFY) To Aid A.S. Watson In Digital Transformation

Infosys Limited (NYSE:INFY) recently announced that A.S. Watson Group (ASW), the largest international health and beauty retailer in the world, has selected Infosys to accelerate its digital transformation initiatives. The collaboration aligns with ASW’s Technology Partnership Program, which focuses on developing strategic partnerships to augment the long-term goals.

A.S. Watson Group selected Infosys as an Official Technology Partner to offer technology services across Data Science and Artificial Intelligence. The collaboration supports ASW’s customer strategy, DARE — to be Different, Anywhere, build Relationships and offer unique Experiences. Infosys’ services and technologies will help ASW accelerate its next-generation digital marketing platform, optimize operational efficiencies, build robust AI and Machine Learning frameworks as well as improve scalability & reusability across business units.

Our Take

Infosys has been strengthening its core competencies by pursuing strategic collaborations and acquisitions that allow it to leverage emerging technologies in a mutually beneficial and cost-competitive manner. In past few quarters, the company has entered into several strategic collaborations with other technology biggies to boost digital, cloud, legacy modernization and automation business. Further, innovative actions like ‘Zero Bench’ program devised by the company to eliminate the notion of “bench” in the IT service industry are bolstering its internal strength.

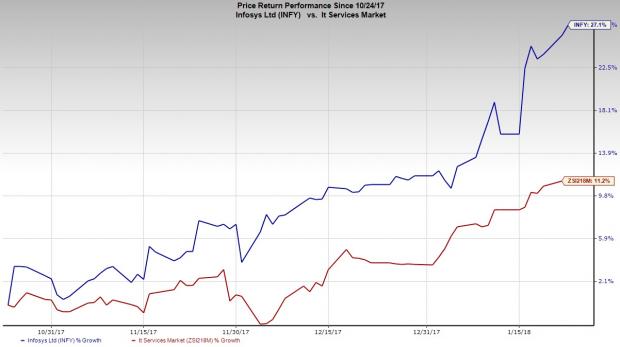

Moreover, the company’s “Renew New” program, which includes restructuring of customer-centric functions, streamlining of sales function and unification of delivery systems, is proving to be highly beneficial. These initiatives are allowing the company to counter major challenges. Moreover, its services and software are proving conducive to top-line growth. Strong demand for these relatively new services is helping the company to achieve higher growth as well as margin expansion. Notably, the Zacks Rank #3 (Hold) company’s stock has appreciated 27.1% in the past three months, outperforming the industry’s growth of 11.2%.

Despite these positives, President Trump’s anti-immigration stance and escalating costs are likely to affect performance. The company’s growth momentum may be thwarted due to unfavorable political climate in the United States. In the past few months, the company has been struggling to adapt itself to the changing political climate in the region. This is a direct threat to the company’s economical cost structure, which focuses on using its workforce on sites located abroad.

Stocks to Consider

Some better-ranked stocks from the same space are Micron Technology, Inc. (NASDAQ:MU) , Arista Networks, Inc. (NYSE:ANET) and AMTEK, Inc. (NYSE:AME) . While Micron Technology sports a Zacks Rank #1 (Strong Buy), Arista Networks and AMTEK carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Micron Technology has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 10.2%.

Arista Networks has outpaced estimates in the preceding four quarters, with an average earnings surprise of 27.5%.

AMTEK has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 4.1%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Infosys Limited (INFY): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

AMTEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.