- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

HollyFrontier (HFC) Q4 Earnings Lag, Sales & Profit Up Y/Y

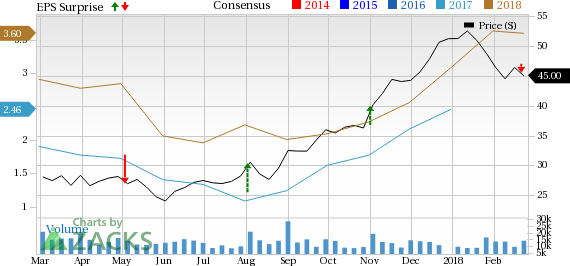

HollyFrontier Corporation (NYSE:HFC) reported fourth-quarter 2017 net income per share (excluding special items) of 70 cents, below the Zacks Consensus Estimate of 82 cents. The weaker than anticipated results can be attributed to lower-than-expected refining margins. Notably, the refining margins in the quarter stood at $12.54 a barrel against the Zacks Consensus Estimate of $13.15 a barrel.

However, the bottom line turned around from the year-ago period’s loss of 6 cents.Robust year-over-year results were driven by higher sales volume and stronger contribution across all segments.

Revenues of $3,992.7 million missed the Zacks Consensus Estimate of $4,310 million. However, the top line surged 35.1% from the fourth-quarter 2016 sales of $2,955.1 million.

Segmental Information

Refining: Net income from the Refining segment, which is the main contributor to HollyFrontier’s earnings, was $282.3 million, surging a whopping 475.5% from the year-ago income of $49 million. The improvement reflects wider gross margins, which jumped 85.2% to $12.54 per barrel.

Total refined product sales volume averaged 482,860 barrels per day (bpd), up 3.5% from 464,160 bpd in the year-ago quarter. Moreover, throughput increased from 497,450 bpd in the prior-year quarter to 466,640 bpd. Capacity utilization was 100.9%, up from 94.5% in fourth-quarter 2016.

Lubricants and Specialty Products: Income from the segment, totaled $29.3 million, up from $20.6 million reported in the year-ago quarter. Product sales averaged 29,670 bpd, significantly above the prior-year level of 11,230 bpd. Throughput came in at 20,990 bpd in the reported quarter.

HEP: This unit includes HollyFrontier’s 36% interest in Holly Energy Partners L.P. (NYSE:HEP) , a publicly-traded master limited partnership that owns, operates, develops and acquires pipelines and other midstream assets.

Segment profitability was $67.6 million, up from $54.9 million in fourth-quarter 2016. Earnings were buoyed by higher segment sales.

Balance Sheet

As of Dec 31, 2017, HollyFrontier had approximately $630.8 million in cash and cash equivalents, and $2,498.9 million in net long-term debt, representing a debt-to-capitalization ratio of 29.8%.

Zacks Rank & Other Key Picks

Headquartered in Texas, HollyFrontier carries a Zacks Rank #2 (Buy).

Meanwhile, investors interested in the same sector may also consider Marathon Petroleum Corp. (NYSE:MPC) and Murphy USA Inc. (NYSE:MUSA) . While Marathon Petroleum sports a Zacks Rank #1 (Strong Buy), Murphy USA carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Marathon Petroleum delivered an average positive earnings surprise of 182.62% in the trailing four quarters.

Murphy USA delivered an average positive earnings surprise of 20.65% in the trailing four quarters.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Murphy USA Inc. (MUSA): Free Stock Analysis Report

HollyFrontier Corporation (HFC): Free Stock Analysis Report

Marathon Petroleum Corporation (MPC): Free Stock Analysis Report

Holly Energy Partners, L.P. (HEP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.