- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Helmerich & Payne (HP) Q1 Loss Narrows On Solid U.S. Land

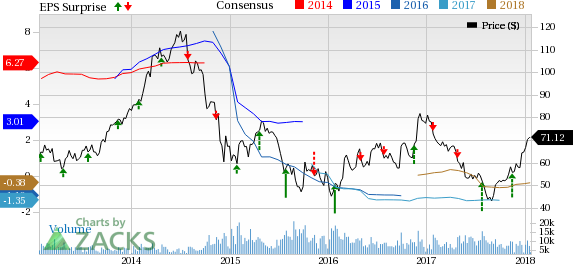

Helmerich & Payne Inc. (NYSE:HP) reported first-quarter fiscal 2018 adjusted operating loss of 2 cents per share, narrower than the Zacks Consensus Estimate of a loss of 14 cents.The outperformance was primarily driven by higher drilling activity at its biggest segment – U.S. Land. The bottom line also compared favorably with the year-ago adjusted loss of 41 cents.

Revenues of $564.1 million topped the Zacks Consensus Estimate of $538 million. Further the top line witnessed an increase of more than 53% from the year-ago number of $368.6 million.

Segment Performance

U.S. Land: During the quarter, operating revenues totaled $461.6 million (81.8% of total revenues), up 75.1% year over year. While average rig revenue per operating day was $22,400 — 10.7% below the year-ago period — average rig margin per day was down 7.6% to $8,854. However, utilization levels of 57% in the quarter under review (versus 31% in first-quarter fiscal 2017) resulted in an operating income of 24.7 million at the segment marking a turn around from the year-ago loss of $30.9 million.

Offshore: Helmerich & Payne’s Offshore revenues came in at $33.4 million compared with $33.8 million in the prior-year quarter. Daily average rig revenue rose 14.2% to $35,776 and average rig margin per day rose 18.1% to $12,375. Owing to this, the segment’s operating income increased 28.6% to $8.7 million. However, rig utilization came down from the year-ago level of 78% to 63%.

International Land: Helmerich & Payne’s International Land operations generated revenues of $63.2 million, down slightly from $68 million in the previous-year quarter. Average daily rig revenue was $38,039, down 32% from the corresponding period of last year and rig margin per day was $11,351, down from the year-ago figure of $12,969.

However, average rig expense per day decreased 38%, while activity levels increased to 45% from 33% a year ago. As a result, the segment’s operating income was $3.5 million as against the year-ago income of $0.8 million.

Capital Expenditure & Balance Sheet

During the quarter, Helmerich & Payne spent approximately $91.7 million on capital programs. As of Dec 31, 2017, the company had approximately $383.7 million in cash, while long-term debt stood at $493.2 million (debt-to-capitalization ratio of 9.7%).

Guidance

The Tulsa, OK-based company expects activity in the U.S. land segment to rise by 3-4% sequentially during the second fiscal quarter of 2018. While the average rig revenue per day is likely to be flat compared with the first fiscal quarter, daily average rig cost is expected to be roughly $13,900 during next quarter.

As for the offshore segment, Helmerich & Payne sees the average rig margin per day to be around $11,500 during second-quarter fiscal 2018 and revenue days to fall 2% sequentially.

The international land segment will likely suffer a 4% decrease in revenue days during the next quarter, while average rig margin per day is expected to average roughly $8,000.

For fiscal 2018, Helmerich & Payne projects a capital budget of $350 million.

Zacks Rank & Key Picks

Helmerich & Payne currently carries a Zacks Rank #4 (Sell).

Meanwhile, one can look at some better-ranked energy players like Cabot Oil & Gas Corporation (NYSE:COG) , Denbury Resources, Inc. (NYSE:DNR) and Pioneer Natural Resources Company (NYSE:PXD) . All the companies sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot is expected to witness a year-over-year increase of 94.4% in earnings in 2018.

Denbury Resources is expected to witness a year-over-year increase of 189.8% in 2018 earnings.

Pioneer Natural is expected to witness a year-over-year increase of 137.4% in earnings in 2018.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Helmerich & Payne, Inc. (HP): Free Stock Analysis Report

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

Cabot Oil & Gas Corporation (COG): Free Stock Analysis Report

Denbury Resources Inc. (DNR): Free Stock Analysis Report

Original post

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.