- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

General Mills Forays Into Pet Food With Blue Buffalo Buyout

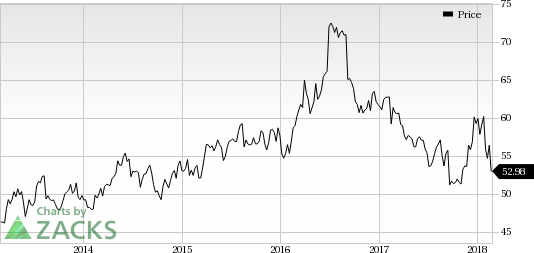

General Mills Inc. (NYSE:GIS) is foraying outside of food for human consumption, as it intends to buy Blue Buffalo Pet Products Inc. (NASDAQ:BUFF) . Notably, this buyout is the latest by the food giant, seeking to expand in the $30 billion U.S. pet food market and reshape its portfolio as it struggles with weak demand amid changing consumer preferences.

The Deal

General Mills will pay Blue Buffalo shareholders $40 per share or $8 billion in cash to acquire the company, which will operate as a new pet operating segment. This represents a premium of 17.2% to Blue Buffalo’s closing price as of Feb 22. General Mills’ other four segments are North American retail, convenience stores and foodservice, Europe & Australia and Asia & Latin America.

Will General Mills Be Able to Boost Sales With Blue Buffalo Buyout?

The U.S. pet food market is a $30 billion industry, growing in the 3-4% range each year. Founded in 2002, Blue Buffalo is the leader in the fastest-growing Wholesome Natural category with double-digit growth in each of the last three years. The Wholesome Natural market represents approximately 10% of the pet food market in volume and 20% in value. Blue Buffalo generates more than $1 billion in yearly sales, profiting from robust demand for its BLUE brand of dog and cat food made with whole meats, fruits and vegetables. Blue Buffalo’s revenues have advanced at an annual compound rate of 12% over the past three years. This reflects significant demand from consumers of upmarket pet food brands.

General Mills expects the addition of Blue Buffalo to help the company boost its top as well as bottom line. The company expects Blue Buffalo to be immediately accretive to the company’s top-line and operating margin profile, with bottom-line growth expected in fiscal 2020. Meanwhile, the addition is expected to be neutral to cash EPS in fiscal 2019.

Major Food Biggies Diversifying to Combat Fading Demand

The packaged-food industry is suffering from waning consumer demand due to the shift in consumer preferences to healthier options. As a result of this, food companies, namely General Mills and Kellogg Company (NYSE:K) , have been witnessing weak sales over the past few quarters.

Big food giants are gradually re-shuffling their shelves and are making niche acquisitions, given tepid demand. For example, in a bid to go beyond chocolate and gain a solid footing in the fast-growing market for healthy snacks, Hershey Co. (NYSE:HSY) inked a deal last December to acquire Amplify Snack Brands Inc. — the maker of SkinnyPop and Tyrrell’s potato chips.

Kellogg acquired protein-bar maker, Chicago Bar Company in 2017. Chicago Bar Company makes RXBAR, which is considered to be the fastest growing nutrition bar brand in the United States. The addition of “clean-label, high-protein” RXBAR can be expected to revive Kellogg’s wholesome snacks business, which has been weak over the past few quarters.

Meanwhile, Conagra Brands Inc (NYSE:CAG) took over Boomchickapop popcorn maker, Angie's Artisan Treats, in September 2017.

General Mills, a Zacks Rank #2 (Buy) company, has been focusing on various strategies for fiscal 2018 to combat weak sales trajectory. The latest addition is expected to place General Mills as the leader in the U.S. Wholesome Natural pet food category, which is the fastest growing section of the overall pet food market, and accelerates its portfolio reshaping strategy.

"In pet food, as in human food, consumers are seeking more natural and premium products," said General Mills CEO Jeff Harmening.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Blue Buffalo Pet Products, Inc. (BUFF): Free Stock Analysis Report

Hershey Company (The) (HSY): Free Stock Analysis Report

General Mills, Inc. (GIS): Free Stock Analysis Report

Conagra Brands Inc. (CAG): Free Stock Analysis Report

Kellogg Company (K): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.