- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GE Misses On Both Q4 Earnings & Revenues, Offers 2018 View

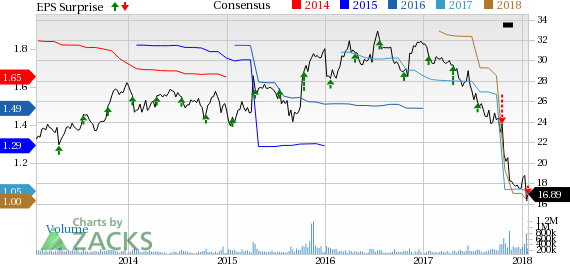

Industrial goods manufacturer General Electric Company (NYSE:GE) reported relatively modest fourth-quarter 2017 results on the back of some key initiatives. GAAP loss from continuing operations for the reported quarter were $9,863 million or loss of $1.15 a share compared with net earnings of $3,659 million or 39 cents a share in the year-ago quarter. The significant year-over-year decline in GAAP earnings was primarily attributable to charges related to legacy insurance businesses to the tune of $1.49 per share. Excluding these charges, industrial and other verticals operating earnings were 27 cents per share, which missed the Zacks Consensus Estimate of 28 cents.

For full year 2017, the company reported industrial and other verticals operating earnings (excluding fourth-quarter charges) of $1.05 per share compared with $1.49 in 2016.

Revenues

Total consolidated revenue for the reported quarter decreased 5% year over year to $31,402 million and missed the Zacks Consensus Estimate of $32,873 million. While the Industrial segment revenue improved 3% year over year to $32,214 million, GE Capital revenues declined 42% to $1,545 million. Organic revenues for the Industrial segment decreased 6% for the quarter to $28,712 million. For full year 2017, the company reported revenues of $122,092 million compared with $123,693 million in 2016.

Total orders for the quarter for the Industrial segment increased 3% year over year to $35 billion, with significant order improvements from the Oil & Gas segment (up 73%) and Transportation (up 56%), partially offset by decline in Power (down 25%). Total backlog of equipment and services at quarter-end was $341.3 billion, up 6% year over year.

Revenue by Segment

Revenues from Lighting decreased 7% to $546 million with lower revenues from the legacy lighting businesses, while Oil & Gas revenues were up 69% year over year to $5,756 million due to improved revenue contribution from Baker Hughes. Revenues from the Aviation segment remained flat at $7,222 million. Transportation revenues declined 20% year over year to $993 million on lower equipment volume.

Power segment revenue was down 15% year over year to $9,421 million with lower demand for turbines, while revenues from the Healthcare segment improved 6% to $5,402 million due to solid volume and cost productivity. Revenues from the Renewable Energy segment were up 15% year over year to $2,875 million largely due to higher services revenue. Revenues from the GE Capital segment decreased 42% year over year to $1,545 million.

Margins, Balance Sheet and Cash Flow

Despite stringent cost-cutting and simplification initiatives, General Electric recorded lower margins in the reported quarter due to headwinds in the Power and Transportation segments. Industrial segment operating profit decreased 39% year over year to $3,542 million, with a decline in profits in Power (down 88%) and Transportation (down 40%), partially offset by a significant rise in profits in Renewable Energy (up 25%) and Healthcare (up 13%).

GE Power is the largest business segment of the company in terms of corporate revenues. However, the business has been a drag on earnings in the last few quarters as global demand waned with increasing popularity of renewable energy sources, overcapacity, lower utilization and fewer outages. Industry experts opine that the acquisition of Alstom’s assets for $10 billion in 2015 further compounded the problems for General Electric, as it increased the employee count by approximately 65,000 with the addition of several field offices and manufacturing sites across the world. This led to higher operating costs and contracted margins.

General Electric recorded total segment loss of $3,028 million compared with profit of $6,057 million in the year-ago quarter. Non-GAAP operating margin for the Industrial segment declined to 11.2% from 16.8% in the prior-year period.

Cash generated from operating industrial activities for the quarter (excluding deal taxes and pension plan) totaled $7,757 million, down 6% year over year. Cash and marketable securities at year-end 2017 aggregated $82 billion compared with $92.4 billion in the year-ago period.

Outlook

General Electric offered its guidance for 2018. The company currently anticipates operating earnings to be within $1.00–$1.07, with growth momentum in Aviation and Healthcare and continued challenges in the Power segment. The company expects a gradual improvement in earnings with structural changes, simplification and cost-cutting initiatives.

General Electric currently has a Zacks Rank #5 (Strong Sell). Better-ranked stocks in the industry include Raven Industries, Inc. (NASDAQ:RAVN) , United Technologies Corporation (NYSE:UTX) and Leucadia National Corporation (NYSE:LUK) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Raven has a long-term earnings growth expectation of 10%. It surpassed estimates thrice in the trailing four quarters with an average positive surprise of 25.8%.

United Technologies has a long-term earnings growth expectation of 8.4%. It delivered earnings beat thrice in the trailing four quarters with an average positive surprise of 3.5%.

Leucadia has an expected long-term earnings growth rate of 18%. It exceeded estimates thrice in the last four quarters with an average beat of 21.2%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

United Technologies Corporation (UTX): Free Stock Analysis Report

Leucadia National Corporation (LUK): Free Stock Analysis Report

General Electric Company (GE): Free Stock Analysis Report

Raven Industries, Inc. (RAVN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.