- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

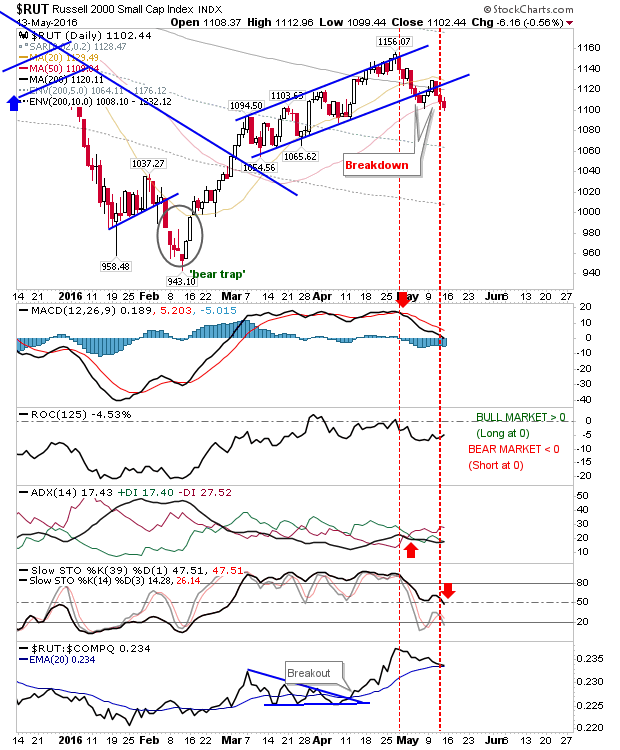

Fresh Losses Put Russell 2000 Under Pressure

The Russell 2000 experienced a third day of losses to push below the 50-day MA with technicals net bearish following the loss of stochastics [39,1] below the mid-line. Relative performance (against the NASDAQ) has also been in a downward trajectory since late April and is on the verge of a bear cross.

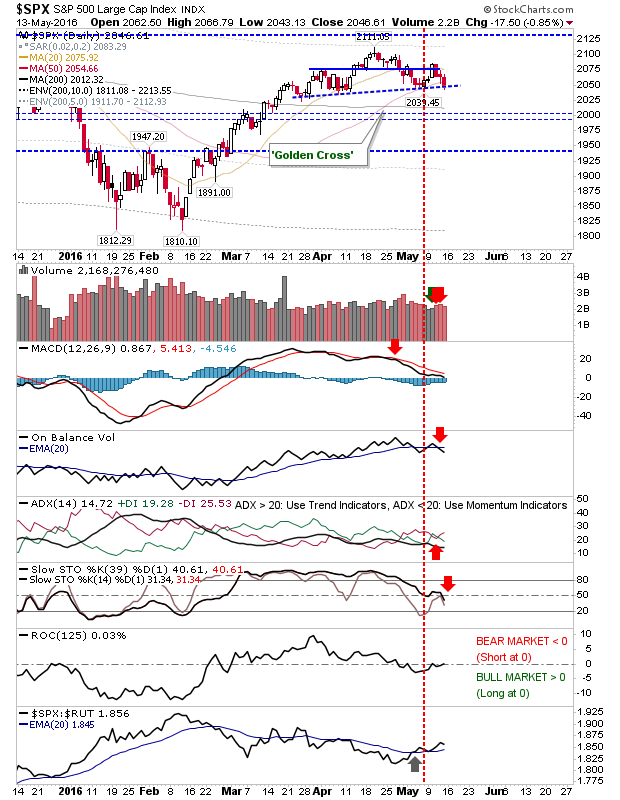

The S&P also saw its technicals turn net bearish. Rate-of-Change is holding to a possible swing low as the index finished Friday on the neckline of a potential head-and-shoulder reversal pattern. Buyers don't have a whole lot of room for maneuver if these factors are to play as support—look for a positive open.

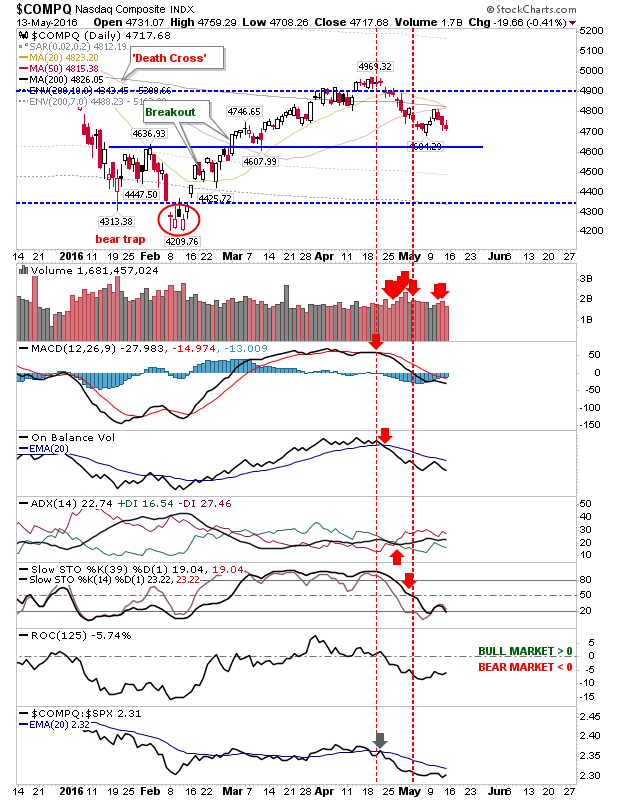

The NASDAQ finished Friday above the May swing low. Of the lead indices it has the most bearish technicals, but also the most oversold. While it isn't trading near price support, and has converged 20-day, 50-day and 200-day MAs overhead, it may be best placed to post a gain today, Monday.

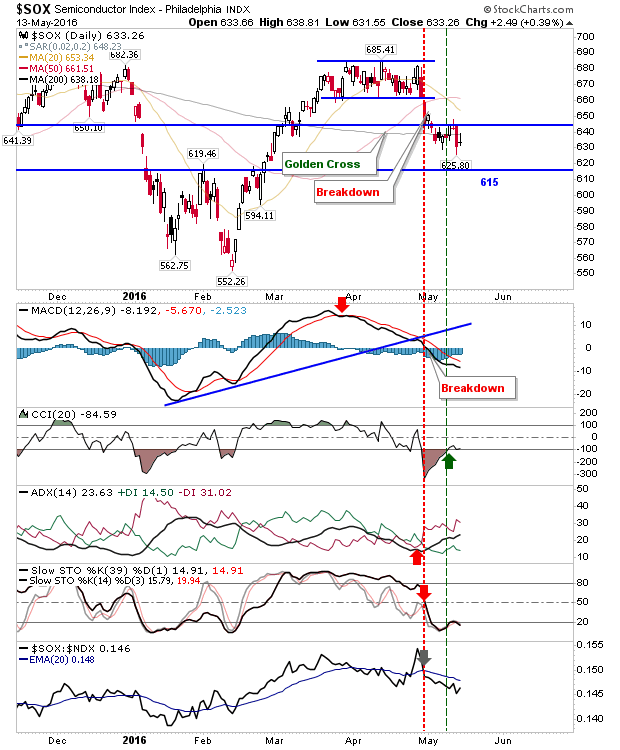

The Semiconductor Index finished last week with a bullish harami cross. Technicals remain mixed with the index trading below it 200-day MA. The NASDAQ shouldn't be too negatively influenced by Semiconductors today.

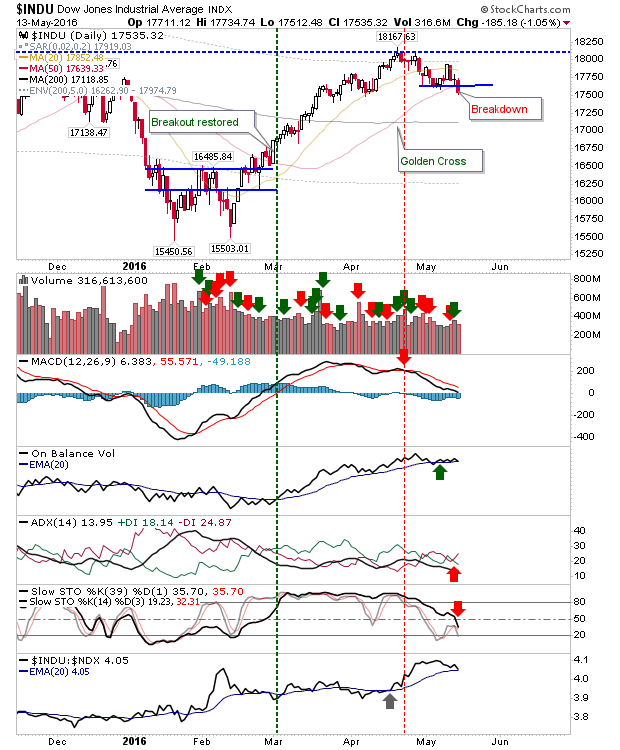

Bears can keep an eye on the Dow Jones Index. It suffered a clear loss of May support along with the 50-day MA. Technicals are a little mixed with stochastics [39,1] cutting below the mid-line into bearish territory, while On-Balance-Volume is net bullish.

In the near term, bulls can look to the S&P and NASDAQ. while bears have the Dow to track. Long term, markets are in neutral territory.

Related Articles

The gold market is experiencing a period of "Gold Mania," with record-breaking prices and significant volatility. This excitement is reflected in the precious metal reaching an...

Stocks are climbing a wall of worry, which is a hallmark of bull markets. Higher equity prices really do require fear! Today we’ll highlight the least-liked stocks on Wall Street....

Three mega-cap names recently announced billions in share repurchase authorizations. Mega-cap generally refers to stock with market capitalizations of $200 billion or more. Below,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.