- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

EU Unlikely To Approve Puma's Nerlynx In 2018, Stock Down

Shares of Puma Biotechnology, Inc. (NASDAQ:PBYI) tumbled almost 27% as the chances of its breast cancer treatment drug Nerlynx (neratinib) getting approval in Europe this year look dim.

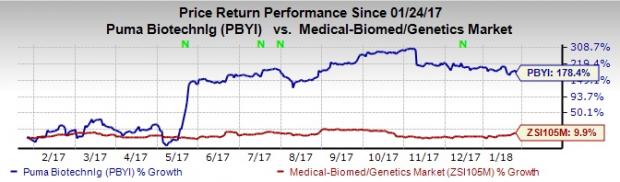

However, Puma’s shares have significantly outperformed the industry so over a year. The stock has rallied 178.4% compared with the industry’s 8.9% growth.

The Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency met with the company to convey that the former will most probably vote against the approval of neratinib at the formal CHMP decision vote scheduled next month. According to CHMP, the benefit risk assessment is unfavorable because the study results are based on evidence from a single pivotal trial.

The company might need to take additional steps in order to get approval in Europe.

The company filed a MAA for neratinib in Europe in June 2016. Neratinib is being evaluated for the extended adjuvant treatment of early stage HER2-positive breast cancer that has previously been treated with a trastuzumab containing regimen.

The CHMP’s opinion was based on the results from both the phase III ExteNET trial in extended adjuvant early stage HER2-positive breast cancer and the phase II CONTROL trial in extended adjuvant early stage HER2-positive breast cancer.

We remind investors that Nerlynx received an FDA approval in July 2017 for the extended adjuvant treatment of patients with early-stage HER2 over expressed/amplified breast cancer, who have been previously treated with Roche's (OTC:RHHBY) Herceptin-based adjuvant therapy. Notably, Nerlynx is the first anti-HER2 treatment to be approved by an extended adjuvant therapy for the indication. In the third quarter of 2017, the company generated net revenue from initial sales of NERLYNX of approximately $6.1 million.

In November 2017, Puma inked an exclusive licensing agreement with Specialised Therapeutics Asia, a Singapore-based biopharmaceutical company, to commercialize Nerlynx in Australia, New Zealand and South East Asia. The company expects a regulatory approval for Nerlynx in Australia by the second quarter of 2019.

Zacks Rank & Key Picks

Puma carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the health care space are Exelixis, Inc. (NASDAQ:EXEL) and XOMA Corporation (NASDAQ:XOMA) . While Exelixis sports a a Zacks Rank #1 (Strong Buy), XOMA carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

Exelixis’ earnings per share estimates have moved up from 72 cents to 73 cents for 2018 over the last 60 days. The company delivered a positive earnings surprise in the last four quarters, with an average beat of 572.92%. Share price of the company surged 64.1% over a year.

XOMA’s loss per share estimates have narrowed from 99 cents to 42 cents for 2018 in the last 60 days. The company delivered a positive earnings surprise in one of the last four quarters, with an average beat of 47.92%. Share price of the company skyrocketed 634.7% over a year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

XOMA Corporation (XOMA): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Puma Biotechnology Inc (PBYI): Free Stock Analysis Report

Original post

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.