Rockies CO2EOR consolidation

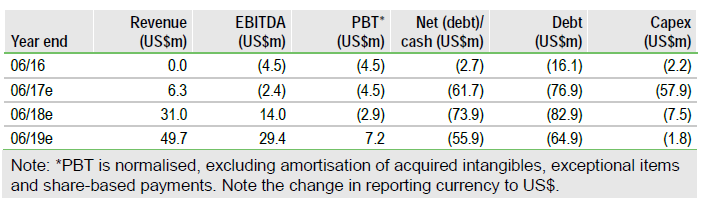

Elk Petroleum Ltd (AX:ELK) is an ASX-listed oil and gas producer and developer with a focus on enhanced oil recovery (EOR) from mature fields. The company’s current focus is on CO2 EOR projects in Wyoming, US, where it’s first EOR development project, Grieve, is due on stream in late 2017/ early 2018. Grieve, combined with the recent acquisition of a c 14% interest in the Madden gas field is due to turn ELK into a producer and material CO2 resource owner. We visited both Grieve and Madden in July 2017, which helped highlight a number of opportunities management is actively engaged in targeting. These include resource upside at both Grieve and Madden, numerous high IRR infrastructure optimisation opportunities and CO2 EOR opportunities in the vicinity of ELK’s operated assets. Our valuation of ELK reduces from A$0.11/share to A$0.09/share due to a reduction in Edison’s long term oil price assumption from $80/bbl (2022) to 70$/bbl.

Asset optimisation and inorganic growth

With ELK’s Grieve EOR project nearing completion and the acquisition of a 13.6% interest in the prolific Madden gas field, ELK is well placed to set its sights on asset optimisation opportunities and incremental inorganic growth. Low-hanging fruit includes unlocking resource upside at both Grieve and Madden through subsurface studies and facility optimisation. Inorganic growth is likely to include the acquisition of additional CO2 resource/midstream infrastructure as well as upstream EOR candidates. Previous transactions have demonstrated ELK’s ability to originate value-accretive transactions that offer synergies with current operations.

To read the entire report Please click on the pdf File Below: