- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar And Equities Sentiment Upbeat; Market Awaits Brexit Meeting

Here are the latest developments in global markets:

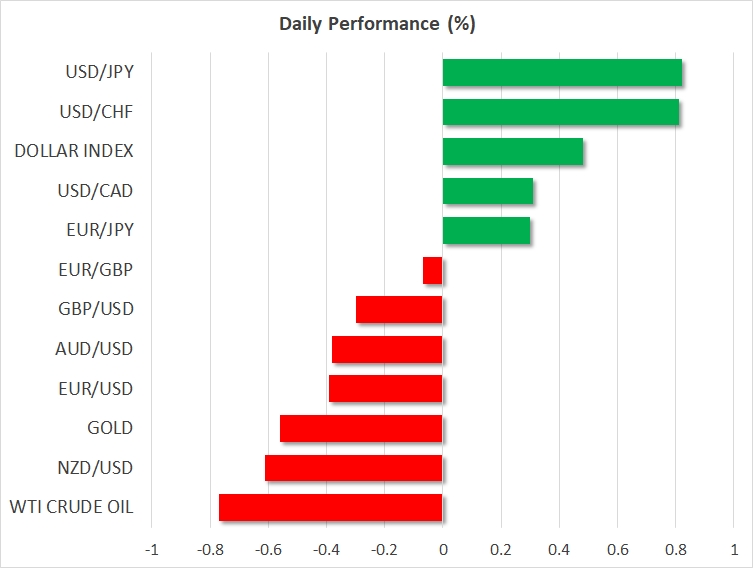

- FOREX: The dollar bounced to a 2-½ -week high against the yen during Asian trading following the approval of the tax overhaul bill by the Senate on Saturday despite persisting political noise in the country. Consequently, the dollar’s strength pushed other currencies lower, with the kiwi being the worst performer of the session.

- STOCKS: The Nikkei 225 finished 0.5% lower and the Hang Seng was up by 0.5% minutes before the day’s close; Euro Stoxx 50 futures traded 1.2% up at 0747 GMT; Dow, S&P 500 and Nasdaq 100 futures were up by 0.9%, 0.6% and 0.45%, gaining on positive sentiment after the Senate’s approval of the tax-cut bill.

- COMMODITIES: Oil prices opened weaker but close to two-year high levels. WTI crude was down 0.77%, trading at $57.91 per barrel and Brent retreated by 0.55% to $39.Gold fell back to three-week low levels, trading at $1,273.41 per ounce (-0.55%) as investors appeared to be in a risk-on mood

Major movers: Dollar drifts higher on tax relief; pound holds strong

- The Senate passage of the US tax legislation on Saturday brought Republicans closer to reach their goal of providing the biggest tax cut since the 1980s to both businesses and individuals. The news provided strong support to the dollar, erasing Friday’s sharp losses which emerged after the former US security advisor, Michael Flynn, admitted lying in relation to his discussions with the Russian Ambassador Sergey Kislyak during the 2016 presidential transition.

USD/JPY jumped by 0.75% to 112.94, dollar/swissie bounced by 0.66% to 0.9827, while EUR/USD declined by 0.26% to 1.1858. The pound posted moderate losses versus the greenback as positive sentiment on Brexit developments underpinned the currency. GBP/USD fell by 0.17% to 1.3439.

The aussie was moving sideways against the greenback as a rally in iron ore prices and better than expected data on Australian business inventories offset losses arising from a stronger dollar. AUD/USD was flat around $0.7601. Its New Zealand cousin pulled back by 0.40% to $0.6857.

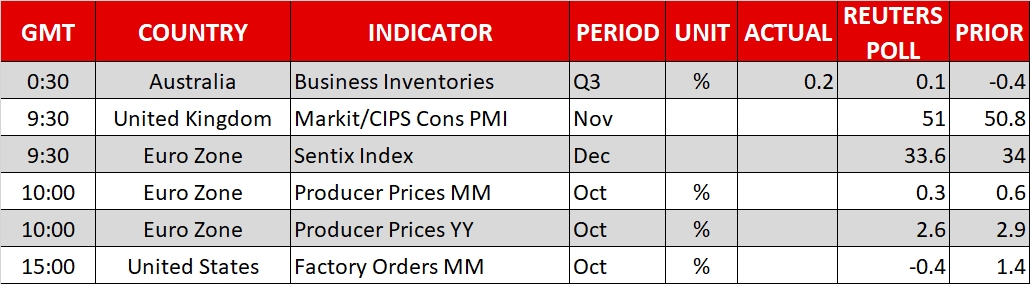

Day ahead: UK construction PMI, eurozone producer prices & investor confidence and US factory orders to gather attention – May’s Brexit meeting also eyed

At 0930 GMT, the UK will see the release of November construction PMI figures. The index is expected to rise to 51.0 from October’s 50.8. A reading of 50 indicates zero sectoral growth. Pound/dollar has been one of the major gainers during the preceding week on the back of positive Brexit developments and it would be interesting to see if the data provide further bullish momentum for the pair.

Out of the eurozone, December’s Sentix investor confidence index will be made public at 0930 GMT and data on producer prices for the month of October are due at 1000 GMT. Both readings are expected to reflect a slowdown relative to their previous releases.

The US will see the release of October factory orders at 1500 GMT. These are anticipated to decline by 0.4% m/m after growing by 1.4% in September.

In politics, after the US Senate’s approval of the tax-cut bill, the Senate and the House would have to work on reconciling their respective versions of the bill – discussions are expected to get underway this week. Beyond this, developments on the probe relating to Russian interference in last year’s presidential elections could also prove dollar-moving, while on the Brexit front, UK PM Theresa May will today be having a meeting with European Commission President Jean-Claude Juncker and the EU’s chief Brexit negotiator Michel Barnier.

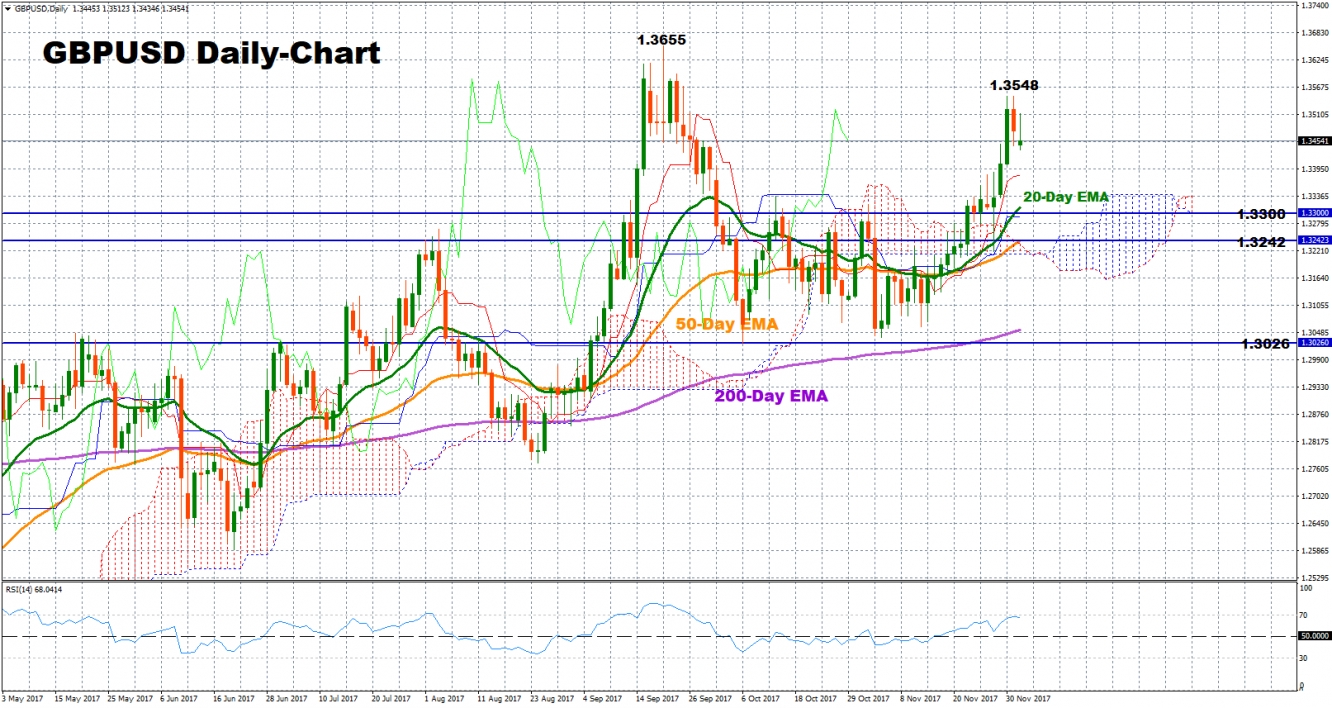

Technical Analysis: GBP/USD bullish bias still in place

GBP/USD remains bullish in the short-term, trading relatively close to two-month high levels as investors see positive Brexit developments on the horizon. Price action is taking place above the exponential moving average lines (EMA) as well as above the Ichimoku cloud, while the bullish cross between the 20-day and the 50-day EMA on November 16 also suggests positive movements in the near-term. The RSI has flattened out marginally below overbought levels, hinting that the pair might range for a while before a likely uptrend resumes.

Should the pair head up, immediate resistance is likely to occur at the two-month high of 1.3548. Further above, there is scope for a test of the one-year high of 1.3655. On the downside, strong support could be found at the 1.33 key-level which was recently an area of resistance. From here, corrective movement might target the 50-day EMA at 1.3242 before the focus shifts to a previous low of 1.3026.

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

U.S. economic growth fears mount as data disappoints, weighing on USD European data surprises fuel optimism, boosting EUR/USD Bond markets signal diverging growth outlooks for...

Today marks a further large step into Donald Trump's America First Agenda. Substantial tariffs are being imposed on Canada and Mexico. Additional tariffs have gone in on China....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.