- U.S. economic growth fears mount as data disappoints, weighing on USD

- European data surprises fuel optimism, boosting EUR/USD

- Bond markets signal diverging growth outlooks for the U.S. and Germany

- EUR/USD struggling above 1.0500, providing hurdle for bulls

- U.S. tariffs on Europe remain a significant bearish risk

Summary

Economic growth expectations between the United States and Europe have flipped, with sentiment towards the former deteriorating while optimism towards the latter has improved, partly due to increased military spending aimed at resolving the Ukraine war. While this has EUR/USD on the cusp of a bullish breakout, the threat of U.S. tariffs on European imports looms. The greater that perceived threat grows, the harder it will be to maintain a bullish stance on Europe’s growth trajectory.

Divergent Growth Expectations Upend EUR/USD Bearish Trend

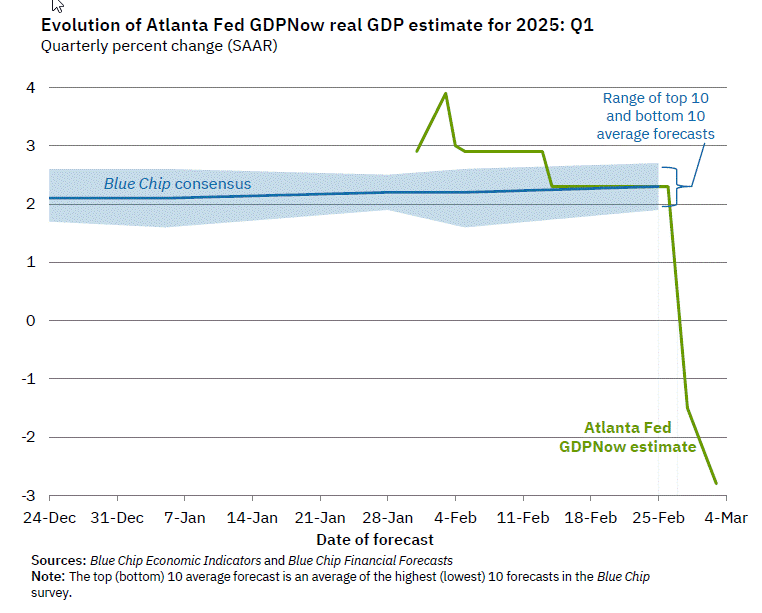

The long-held market narrative of U.S. economic exceptionalism is under serious threat. Not only is data missing expectations at rates not seen since the Federal Reserve started cutting rates in September last year, but the Atlanta Fed’s GDPNowcast model has Q1 U.S. economic growth tracking at -2.8% on a seasonally adjusted annual basis.

Source: Atlanta Fed

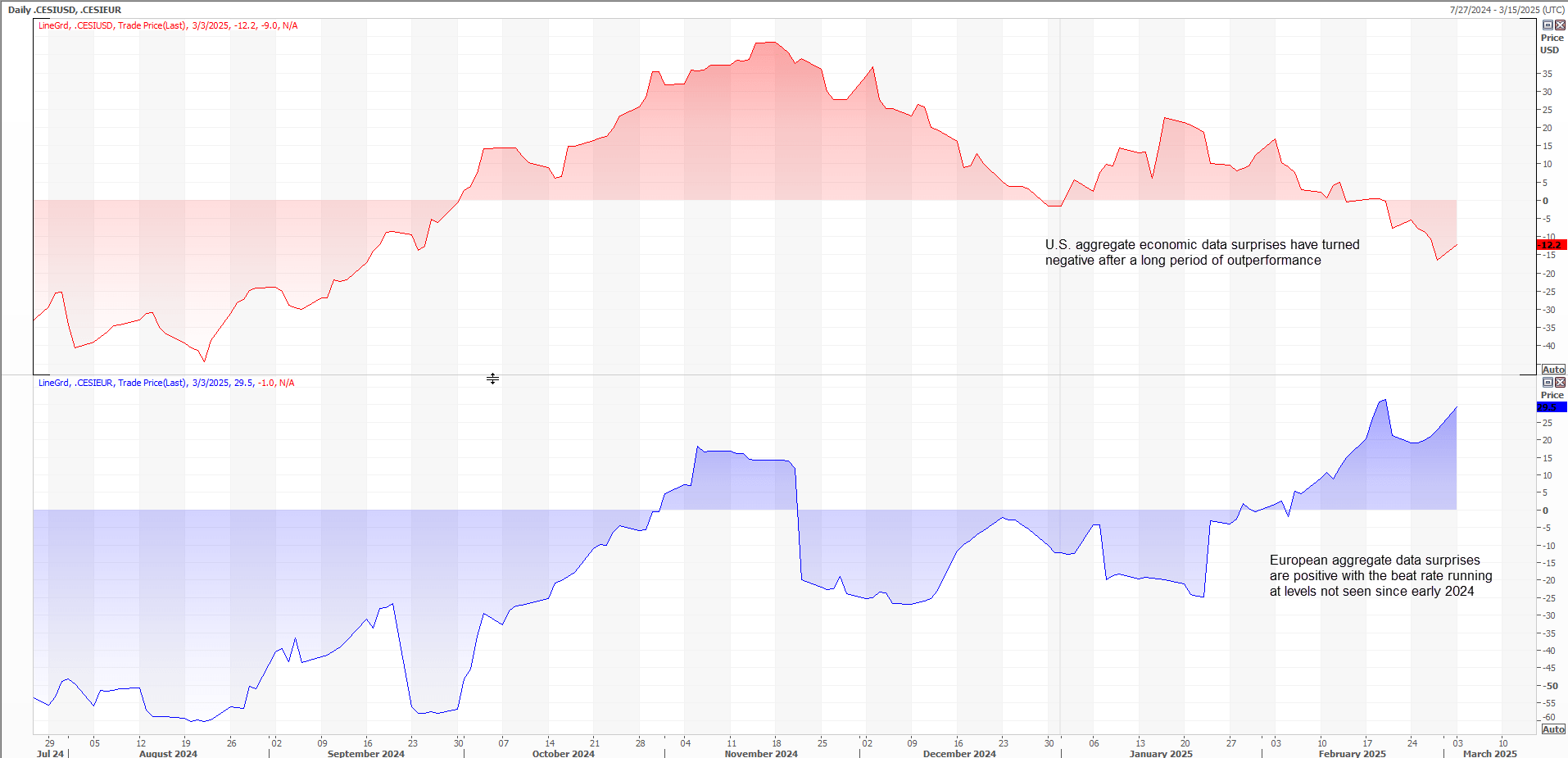

In contrast, European economic data surprises are at their highest levels in nearly a year, largely reflecting significantly lower expectations for Europe relative to the U.S.

Source: Refintiv

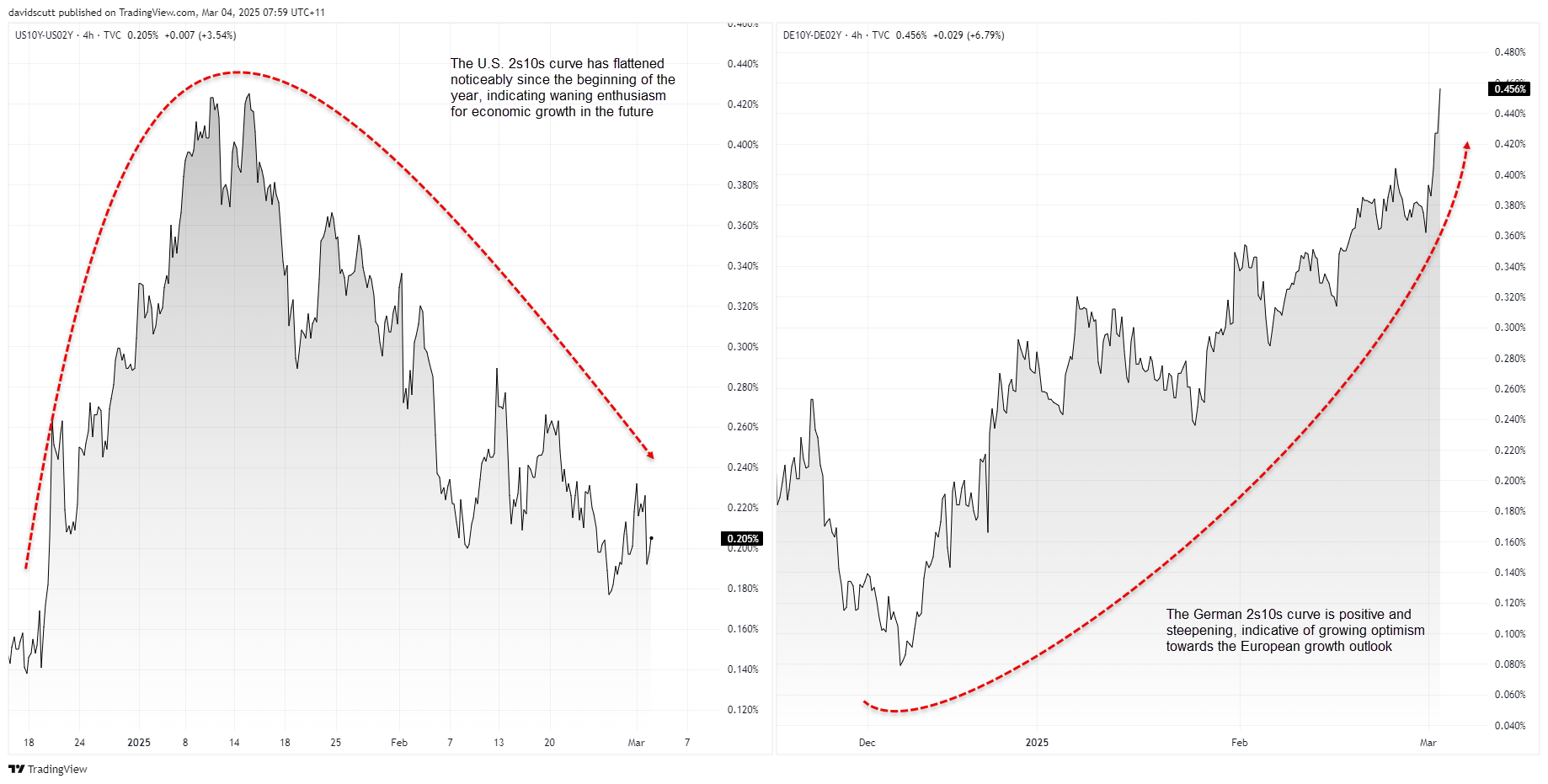

Bond Markets Send Strong Signal

While uncertainty remains, bond markets are sending a strong signal on where they see growth and inflationary pressures evolving through the shape of the 2s10s yield curve in the U.S. and Germany, the latter being Europe’s largest economy. The 2s10s curve simply measures the difference between 10-year and 2-year bond yields.

Source: TradingView

Although both curves remain positive—indicating longer-dated yields are higher than shorter-dated ones—what’s notable is how much the U.S. curve has flattened in 2025, reflecting tempered growth expectations. In contrast, the German curve has steepened rapidly, helped by plans for increased military spending and the prospect of lower energy prices, which should boost European growth.

EUR/USD Bulls Eying 1.05 Break

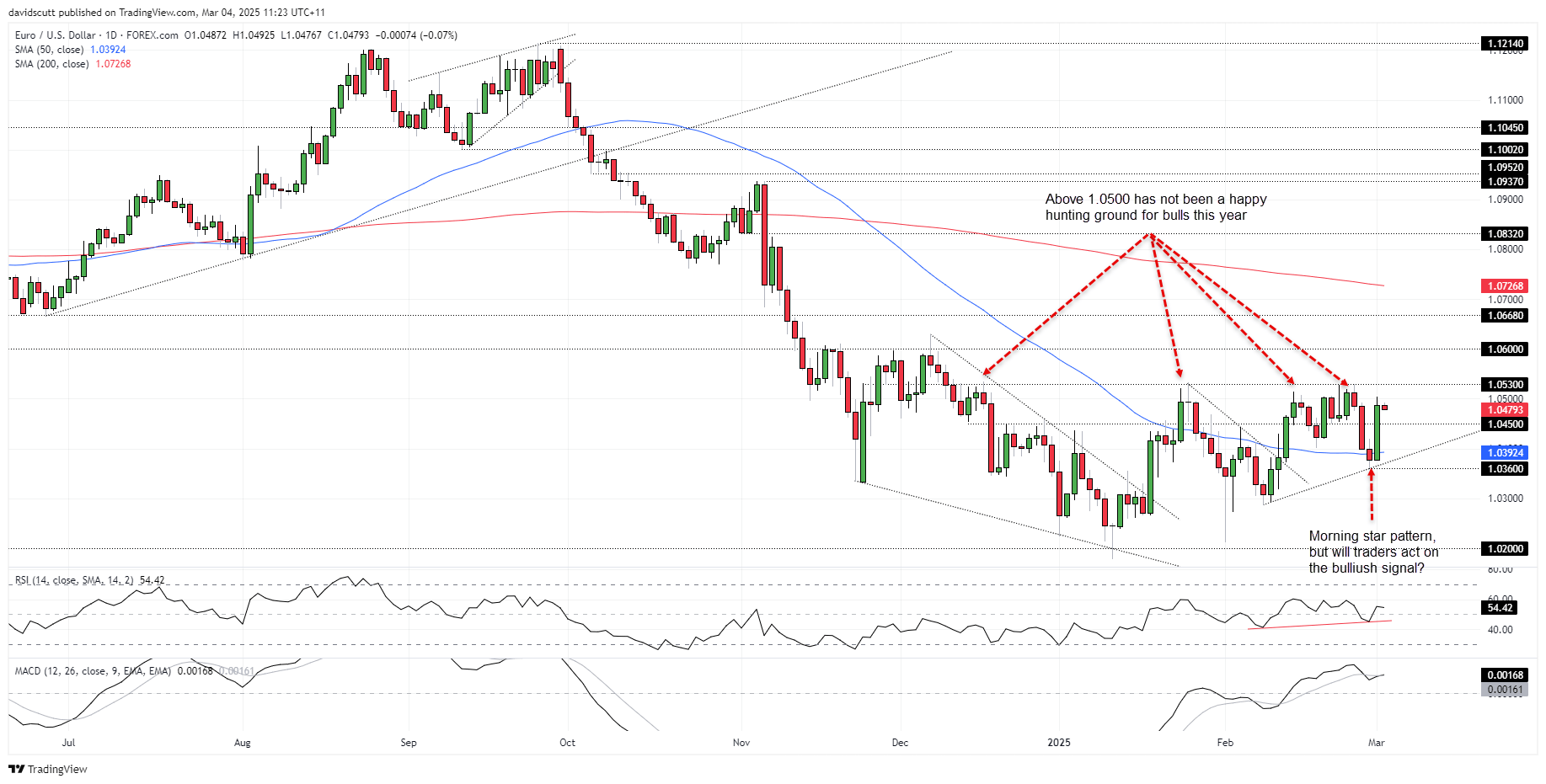

This divergent growth outlook has played a major role in driving EUR/USD this year, overshadowing concerns about an escalating global trade war. U.S. economic exceptionalism is on shaky ground, and with falling U.S. Treasury yields reducing their appeal relative to other developed markets, EUR/USD weakness has started to reverse.

Source: TradingView

The latest probe below the 50DMA didn’t last long this week, with EUR/USD surging higher on Monday as narrowing interest rate differentials between the U.S. and Europe provided support.

While the three-candle morning star pattern suggests potential for further gains—reinforced by momentum indicators such as RSI (14) and MACD which are trending higher—EUR/USD’s performance above 1.0500 this year doesn’t inspire confidence. Repeated failures up to 1.0530 make it a key level bulls must overcome to build momentum.

Above 1.0600 saw heavy two-way action late last year. A break of that level could see a retest of 1.0668—the June 2025 low—along with the 200DMA at 1.07268.

Below 1.0530, 1.0450 has seen plenty of two-way price action recently, with the 50DMA the next downside marker. A clean break of 1.0360 would invalidate the cautious bullish bias.

Managing Ample Event Risk

Source: TradingView

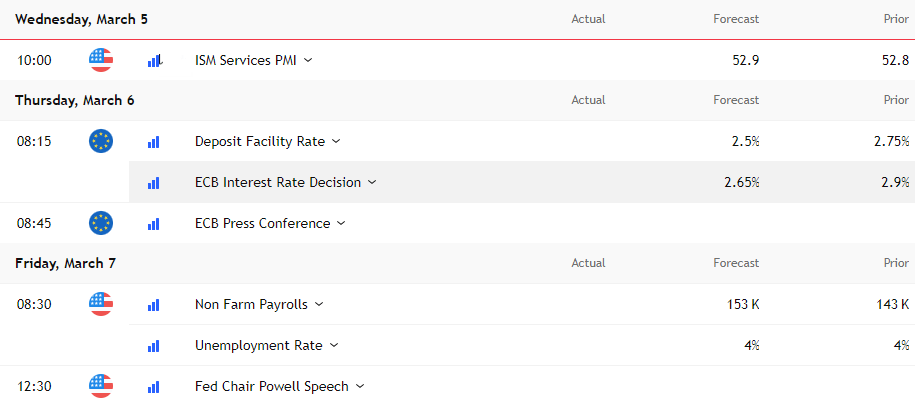

As for near-term risks for EUR/USD traders, this week’s key data releases are in the U.S.

Friday’s payrolls report is the standout event—especially with consumer concerns growing. Despite the name, the unemployment rate is what matters most, given its importance to Fed policy. If payrolls and unemployment send conflicting signals, markets will likely follow the latter.

Before that, ISM services PMI is worth watching. The manufacturing PMI hinted at stagflation, so similar signs in the far larger services sector could amplify fears of a sharp U.S. growth slowdown.

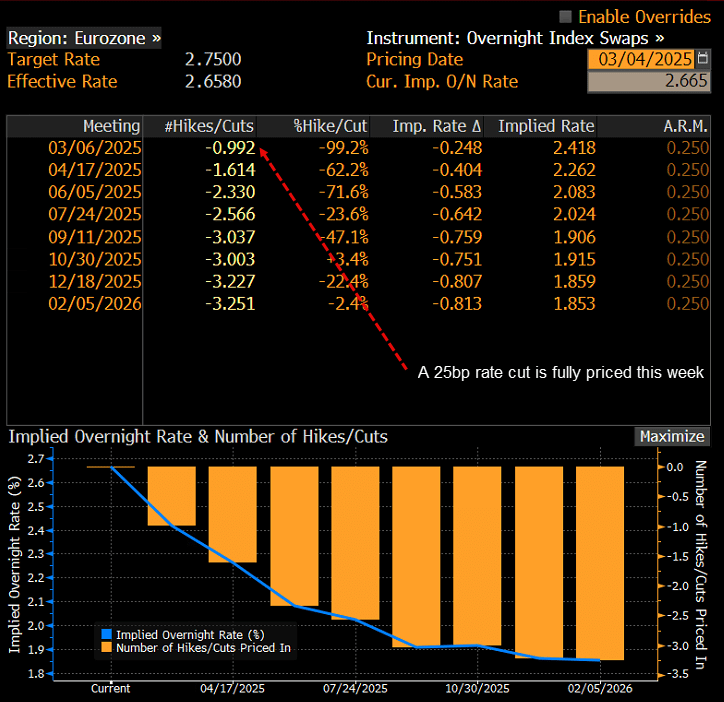

ECB Guidance, Forecasts Key

While Europe has several second-tier releases, the main event will be the ECB’s interest rate decision on Thursday. A 25bp cut is fully priced in, so the market’s focus will be on the bank’s guidance and updated economic forecasts. With at least three additional cuts priced in—plus the risk of a fourth—recent developments suggest that if there’s to be a surprise from the ECB, it may be a less dovish stance than markets expect.

Source: Bloomberg