- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Crude Oil Support Break Here, Could Be Hard On Stocks

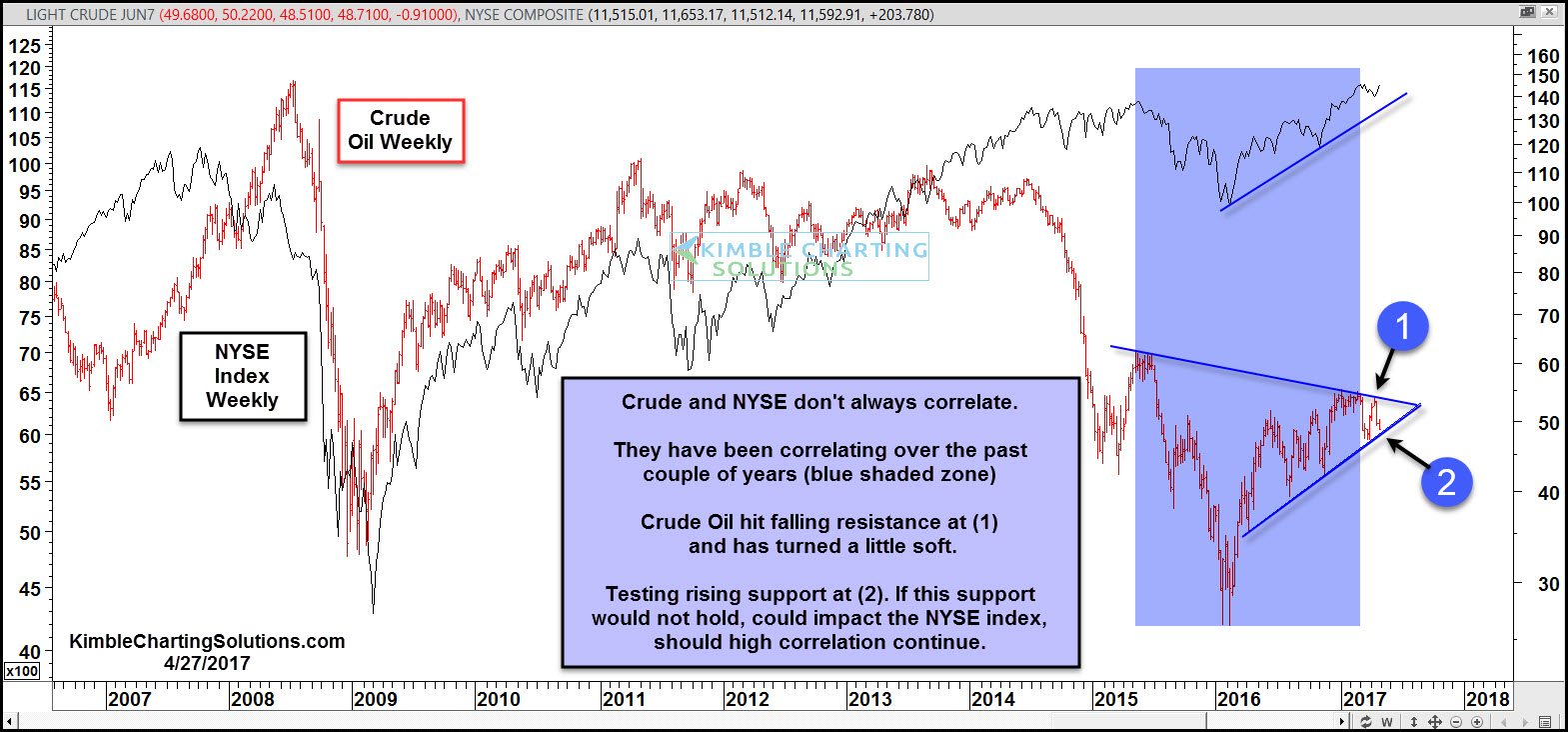

Below compares the price of Crude Oil and the NYSE Index over the past decade. Even though both of these assets don’t always correlate, sometimes they do, for good periods of time. Over the past couple of years, they have correlated and several lows and highs have taken place at the same time. If correlations are to continue, what crude does next, could be very important for the bull market in stocks.

Crude oil hit falling resistance at (1), which appears to be the top of a narrowing pennant pattern. Once it hit resistance at (1) a couple of weeks ago, crude has turned rather soft. The decline now has it testing rising support at (2), which appears to be support of the narrowing pennant pattern. If correlations are to remain high between the two, what crude does at (2), could become very important for the broad markets.

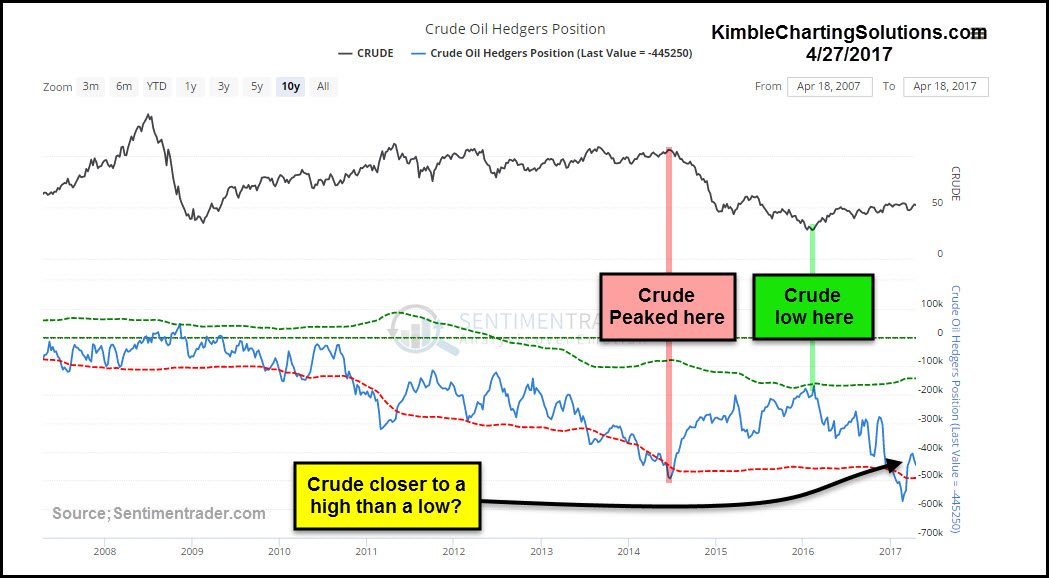

If traders and positions is any indicator of the future prices of crude oil, history would suggest that crude is closer to a high than a low, due to the chart above.

Bottom line with these two charts, crude and the NYSE remain highly correlated over the past couple of years and crude oil is testing rising support. If crude would happen to break below support and correlations remain high, a break could cause some selling pressure in stocks.

Related Articles

I recognize that there is a good case for gold at a time when the price level is rising steadily and there are upside risks to inflation and downside risks to the dollar. Let me...

Monday’s Daily talked about Biotechnology. I would continue to keep that on your list as today it made a move above price resistance. Yesterday I wrote about Adobe (NASDAQ:ADBE)...

Trumping Brent Oil Futures. Oil got Trumped and dumped. While many people feared that President Trump aggressive trade negotiations would raise the price of oil, so far oil has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.