Monday’s Daily talked about Biotechnology. I would continue to keep that on your list as today it made a move above price resistance.

Yesterday I wrote about Adobe (NASDAQ:ADBE) which made a good move both on turnaround Tuesday and today.

I also wrote about Advanced Micro Devices (NASDAQ:AMD), which I would continue to watch as today’s trading range was inside yesterday’s trading day, or a pattern called an inside day.

What has made this market so fun is that we get to teach you about technical patterns to watch for as we know,

Price Rules the Narrative.

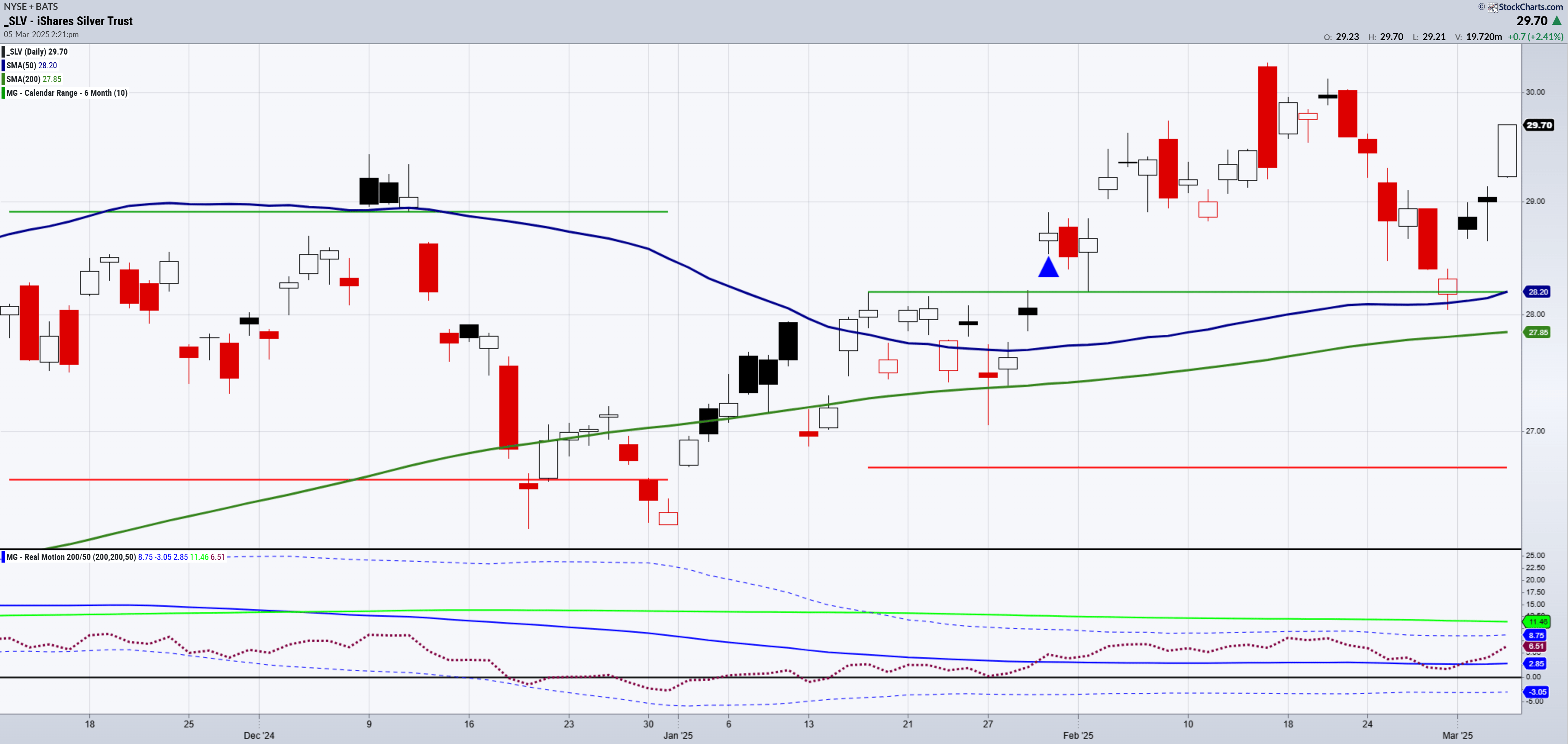

Today, I want to show you silver through its ETF rather than its futures prices.

Regardless of the sell-off in oil prices, the metals are telling their own story.

And while the dollar sank, yields rose today.

The silver futures chart is a technical beauty. The price fell right to the major moving averages.

The bears came out to play.

But silver has had a run of selling rallies and buying dips since 2020.

Mistaking corrections as the end of the rally has been costly.

Not only are we patiently waiting to see if silver outperforms versus gold, but we are also patiently waiting for the trend to flip where strength in silver gets bought, hence the metal goes parabolic.

Note the chart shows iShares Silver Trust (NYSE:SLV), the ETF clearing both the 50-DMA (blue) and January 6-month calendar range high (horizontal green) just 4 days ago.

The momentum, though, still shows a bearish divergence as the 50-DMA is below the 200-DMA and price shows the opposite.

Once and should the momentum change, that could be the day we see $35 an ounce and much higher.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) Bounce off of support-but can SPY retake 590?

- Russell 2000 (IWM) It would be healthy to see this pop over 214 and hold

- Dow (DIA) 432 pivotal

- Nasdaq (QQQ) Has to hold over 500

- Regional banks (KRE) Weakness here as it now heads to test 57-58 support

- Semiconductors (SMH) 220 support. 240 resistance

- Transportation (IYT) 67-68 support

- Biotechnology (IBB) 135 needs to hold 137 to clear

- Retail (XRT) A move over 72 better

- iShares 20+ Treasury Bonds (TLT) 90 support to hold