- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

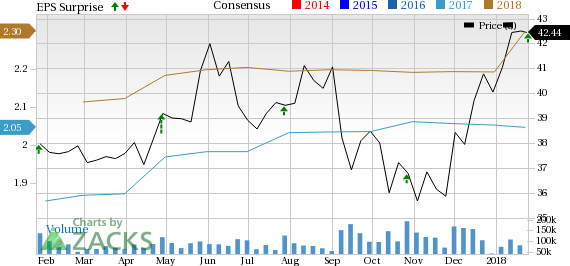

Comcast (CMCSA) Beats Earnings, Revenue Estimates In Q4

Comcast Corporation (NASDAQ:CMCSA) reported impressive financial results in the fourth quarter of 2017. Both the top and the bottom line surpassed the Zacks Consensus Estimate.

Comcast carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Net Income

GAAP net income was $15,035 million compared with $2,417 million in the prior-year quarter. Quarterly adjusted earnings per share of 49 cents beat the Zacks Consensus Estimate of 47 cents.

Revenue

Total revenues were $21,915 million, up 4.2% year over year and outperformed the Zacks Consensus Estimate of $21,804 million.

Operating Metrics

Operating income was $4,107 million compared with $4,264 million in the year-ago quarter. Adjusted EBITDA was $6,751 million, down 0.1% year over year.

Cash Flow and Liquidity

In fourth-quarter 2017, Comcast generated $5,442 million of cash from operations compared with $5,836 million in the year-ago quarter. Free cash flow was $2,048 million compared with $2,607 million in the year-ago quarter.

As of Dec 31 2017, cash and cash equivalents were $3,428 million, up from $3,301 million at the end of 2016. Total debt was $59,422 million compared with $55,566 million at the end of 2016.

Dividend Hike and Share Repurchase Program

During the quarter under review, Comcast paid dividends of $736 million and repurchased 32.4 million common shares for $1.2 billion. For the full year, the company made four cash dividend payments of $2.9 billion and repurchased 130.9 million of its common shares for $5.0 billion, resulting in a total of $7.9 billion capital return to shareholders.

As of Dec 31, 2017, Comcast had $7.0 billion available under its share repurchase authorization. It expects to repurchase at least $5.0 billion of its Class A common stock during 2018, which is subject to market conditions.

Additionally, Comcast announced that it has increased dividend by 21% to 76 cents per share on an annualized basis. Accordingly, the board of directors declared a quarterly cash dividend of 19 cents on the company’s common stock. The dividend will be paid on Apr 25, 2018 to shareholders of record as of Apr 4, 2018.

Cable Communications Segment

Total revenues were $13,282 million, up 3.4% on a year-over-year basis. Video revenues were $5,733 million, increasing 1.5% from the prior-year quarter. High-Speed Internet revenues totaled $3,775 million, up 8.4% year over year. Voice revenues were $832 million, down 4.6% year over year.

Advertising revenues totaled $629 million, declining 12.4% from the year-ago quarter. Business Services revenues were $1,620 million, increasing 12.2% year over year. Other revenues were $693 million, up 2.3% from the prior-year quarter.

Adjusted EBITDA was $5,406 million, increasing 4.2% year over year. Adjusted EBITDA margin increased to 40.7% from 40.4% in the year-ago quarter.

As of Dec 31, 2017, Comcast had 25.869 million (up 4.7% year over year) high-speed Internet customers, 11.552 million (down 1.2% year over year) voice customers, 22.357 million (down 0.7% year over year) video customers and 1.131 million (up 26.8% year over year) security and automation customers.

The company gained a net of 350,000 high-speed Internet customers and 52,000 security and automation customers, but lost 13,000 voice customers and 33,000 video customers in the reported quarter. Comcast gained 73,000 double-play subscribers and 140,000 single-play subscribers, but lost 3,000 triple and quad product customers.

NBC Universal Segment

Total revenues in this segment were $8,784 million, up 3.9% year over year. Cable Networks revenues were $2,691 million, up 7.5% year over year. Broadcast TV revenues came in at $2,964 million, rallying 4.1% year over year. Filmed Entertainment revenues were $1,738 million, declining 5.2% from the year-ago quarter. Theme Parks revenues were $1,461 million, increasing 8.7% year over year.

Adjusted EBITDA was $1,883 million, reflecting an increase of 6.4% year over year.

Latest Developments

Comcast initiated the nationwide rollout of the DOCSIS 3.1 technology, with its latest xFi Advanced Gateway. Further, the company completed the nationwide rollout of its wireless services under the Xfinity Mobile brand, with plans to include YouTube in its X1 video platform. Notably, Comcast is entering into the highly competitive U.S. wireless market to compete with big players like Verizon Communications Inc. (NYSE:VZ) , AT&T Inc. (NYSE:T) , T-Mobile US Inc. (NYSE:T) and Sprint.

Business Services have been witnessing strong momentum and continue to present attractive prospects. Comcast has started deploying fiber-based 2 gigabits per second (2 Gbps) residential broadband Internet services in certain regions. Comcast is venturing into residential solar programs with a 40-month deal with Sunrun.

The company is working toward 5G network deployment and continues to expand its theme park business. With this, Comcast aims to check customer churn and provide viewers with more streaming options.

Despite such efforts, the company continues to suffer from video subscriber losses due to cord-cutting.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

T-Mobile US, Inc. (TMUS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.