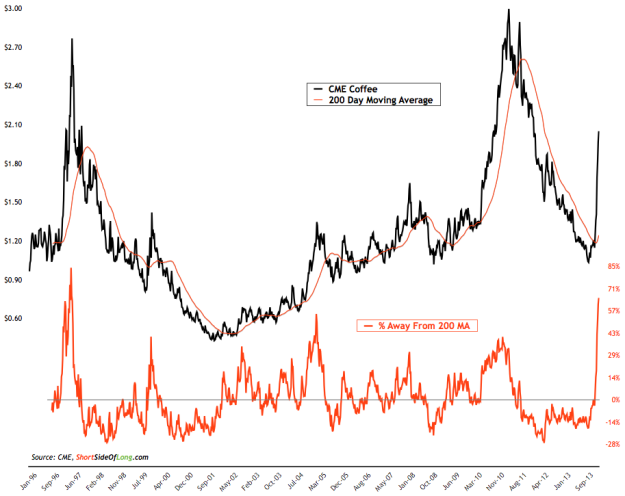

Coffee Price Currently Trading 65% Above 200 Day Moving Average

In the recent update on Coffee, I discussed its extremely overbought levels. However, the prices continues to rise almost vertically. Over the last several years, Coffee has now gone through one of the greatest rallies in the shortest time span, not just relative to its history but also relative to almost any other asset class. The price is currently trading 65% above its 200 day moving average. Let us not forget that in November 2013, Coffee prices stood at $1.00 per pound and only several months later, they trade near $2.05 per pound.

Coffee’s Three Month Performance Is Approaching 80% Gains

According to some of the basic performance indicators seen in Chart 2, which try to objectively gauge where we can find value vs exuberance relative to its history, we can see Coffee has been a tremendous gainer over the last 3 month as well as 12 month period. These types of overbought conditions occur very rarely and usually crash just as quickly as they rose. Those with high risk appetite and strong money management skills might want to consider shorting Coffee around its physiological resistance at $2.00 per pound. Personally, Im not going to short it, as I was happy enough to follow it on the upside.