Awful weather conditions in Brazil are the “catalyst” for a super squeeze on hedge funds, which have been shorting Coffee since late 2011. Market participants continue to be extremely negative on the majority of Agricultural commodities, while supply and demand remains favourable in the long term.

Basically, it comes down to the fact that Coffee at $1.00 per pound is not going to be a sustainable price level in the long term. After all, Arabica Coffee first traded at around $1.00 per pound all the way back in 1954. And, as we all know, one dollar in 1954 is not nearly comparable to the value of one dollar today.

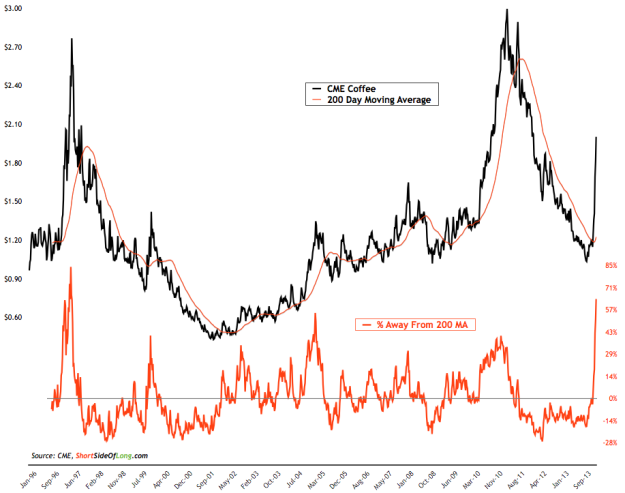

Chart 1: Mother of all short squeezes in Coffee right now…

If we were to use (and also trust) US CPI numbers, Coffee prices reached highs of almost $8.00 per pound in 1954 when using today's dollars. In real terms, prices also reached over $12.00 per pound in 1977. Therefore, we can see that these agricultural commodities remain DIRT CHEAP on a historical basis, especially when we adjusted for inflation.

Having said that, Coffee prices are now over 60% above their 200 day moving average. This is not a time to be chasing bulls and jumping into the long side. As we can see in the chart above, current technical conditions are the second most overbought level in two decades. Expect a serious correction when the trend runs out of steam!