- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

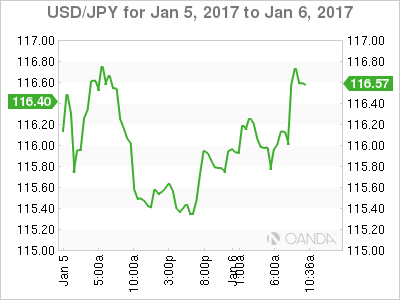

Yen At 116, US Employment Numbers Next

USD/JPY has posted slight gains on Friday, as the pair trades at the 116 line. On the economic front, there are no Japanese releases to wrap up the week. In the US, the spotlight is on employment numbers, with three key events – Nonfarm Payrolls, Average Hourly Earnings and Unemployment Rate. Traders should be prepared for possible volatility in the currency markets in the North American session.

The US dollar retreated in the Thursday session, following the release of the Federal minutes from the December meeting. The Japanese yen joined the bandwagon, gaining 1.5% on Thursday. The Federal Reserve minutes were cautious in tone, with Fed policymakers essentially saying that monetary policy in the coming months will be dictated in large part by the economic platform of the incoming Trump administration. FOMC members are concerned about higher inflation levels, given the “prospects for more expansionary fiscal policies in the coming years”. This is a clear reference to president-elect Trump’s plans to increase fiscal spending and cut taxes, which would likely result in higher inflation, something the US hasn’t had to deal with for years. Still, policymakers appear unchanged in their view that gradual rate hikes remains an appropriate monetary policy. The Fed members acknowledged that there is “considerable uncertainty” regarding future fiscal and economic programs. Many analysts are predicting another rate hike in June, but this could of course change, depending on the performance of the US economy in the first half of 2017.

Friday (January 6)

- 8:30 US Average Hourly Earnings. Estimate 0.3%

- 8:30 US Nonfarm Employment Change. Estimate 175K

- 8:30 US Unemployment Change. Estimate 4.7%

- 8:30 US Trade Balance. Estimate -42.2B

- 10:00 US Factory Orders. Estimate -2.1%

- 12:15 US FOMC Charles Evans Speech

*All release times are GMT

*Key events are in bold

USD/JPY for Friday, January 6, 2017

USD/JPY January 6 at 6:00 EST

Open: 115.34 High: 116.39 Low: 115.23 Close: 115.96

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 113.80 | 114.83 | 115.88 | 116.88 | 118.05 | 118.85 |

- USD/JPY posted gains in the Asian session. In European trade, the pair posted gains but has retracted

- 115.88 is a weak support

- 116.88 is the next resistance line

- Current range: 115.88 to 116.88

Further levels in both directions:

- Below: 115.88, 114.83 and 113.80

- Above: 116.88, 118.05, 118.85 and 119.83

OANDA’s Open Positions Ratio

USD/JPY ratio is unchanged in the Friday session. Currently, short positions have a majority (54%), indicative of slight trader bias towards USD/JPY continuing to move to lower ground.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.