- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cheniere Energy (LNG) Q4 Earnings Beat On Pricing, Volumes

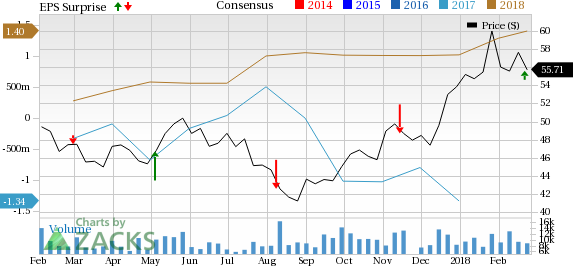

U.S. gas exporter Cheniere Energy, Inc. (NYSE:LNG) reported strong fourth-quarter results on robust production volumes and strong pricing. The company’s net income per share came in at 54 cents, ahead of the Zacks Consensus Estimate of 49 cents and the comparable 2016 period profit of 48 cents.

The U.S.-gas exporter’s quarterly revenues jumped to $1,746 million from $572 million recorded in the year-ago quarter, reflecting massive jump of 205.2%. The top line surge led to the generation of $523 million as adjusted EBITDA -- against $136 million in fourth-quarter 2016. Further, the revenue also surpassed the Zacks Consensus Estimate of $1,454 million.

During the quarter, the company shipped 70 cargoes from Sabine Pass liquefied natural gas terminal in Louisiana. Total volumes lifted in the reported quarter were 252 trillion British thermal units.

Costs & Expenses

Overall costs and expenses soared 190% to $1,305 million from the same quarter last year. The increase is mainly attributed to the higher cost of sales which jumped to $980 million compared with $229 million in the prior-year quarter, while operating and maintenance expenses rose 87.7% year-over-year to $137 million. Depreciation and amortization expenses also increased from $68 million a year ago to $104 million in the reported quarter.

Balance Sheet

As of Dec 31, 2017, Cheniere Energy had approximately $722 million in cash and cash equivalents and $25,336 million in net long-term debt.

Guidance

Cheniere Energy raised its EBITDA guidance for full-year 2018 following the better-than-expected profit. The upbeat forecast reflects higher-than-anticipated realized margins on marketing volumes. The adjusted EBITDA is now expected to be between $2,000 million and $2,200 million, compared to the prior guidance of anything between $1,900 million and $2,100 million. Meanwhile, distributable cash flow is likely to be between $200 million and $400 million, in line with the previous prediction.

Progress Report

Sabine Pass Liquefaction Project (SPL): Altogether, Cheniere Energy intends to construct up to six trains at Sabine Pass with each train expected to have a capacity of about 4.5 million tons per annum. In October, the company announced the completion of the fourth liquefaction train – on budget and before time. With the completion of Train 4, total capacity at the export terminal has risen from 13.5 million tons per annum (Mtpa) to 18 Mtpa. Train 5 is under construction and is expected to begin exporting in the second half of 2019. Train 6 is being commercialized and has secured the necessary regulatory approvals.

Sabine Pass is North America’s first large-scale liquefied gas export facility. The 2.6 billion cubic feet per day Sabine Pass terminal in Cameron Parish, Louisiana opened in Feb 2016.

Corpus Christi Liquefaction Project (CCL): Cheniere Energy’s Corpus Christi LNG project, under which the company intends to develop three trains, is also expected to come online in 2019. Trains 1 and 2 are under construction, while Train 3 is being commercialized and has the necessary approvals in place. The company made significant headway toward the unit’s final investment decision by signing three long-term Sale and Purchase Agreements – two with PetroChina Company Limited (NYSE:PTR) and another with commodity trader Trafigura.

Corpus Christi Expansion Project: Cheniere Energy intends to develop seven midscale liquefaction trains adjacent to the CCL Project. The company has initiated the regulatory approval process regarding same. The total production capacities for these trains are expected to be approximately 9.5 Mtpa.

Zacks Rank & Stock Picks

Cheniere Energy holds a Zacks Rank #3 (Hold).

Meanwhile, one can look at better-ranked energy players like Concho Resources Inc. (NYSE:CXO) and Pioneer Natural Resources Company (NYSE:PXD) . Both the companies sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Based in Midland, TX, Concho Resources is an independent oil and gas exploration and production company with producing properties mainly in the Permian Basin of southeast New Mexico and west Texas. It has a 100% track of outperforming estimates over the last four quarters at an average rate of 48.89%.

Irving, TX-based Pioneer Natural Resources Company is an independent oil and gas exploration and production company, the asset base of which is anchored by the Spraberry oil field located in West Texas, the Hugoton gas field in Southwest Kansas and the West Panhandle gas field in Texas Panhandle. The 2018 Zacks Consensus Estimate for this company is $5.75, representing some 166.2% earnings per share growth over 2017. Next year’s average forecast is $8.30, pointing to another 44.2% growth.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

PetroChina Company Limited (PTR): Free Stock Analysis Report

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

Concho Resources Inc. (CXO): Free Stock Analysis Report

Cheniere Energy, Inc. (LNG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.