- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AvalonBay (AVB) To Post Q4 Earnings: What's In The Offing?

AvalonBay Communities, Inc. (NYSE:AVB) is slated to report fourth-quarter 2017 results on Jan 31, after the market closes.

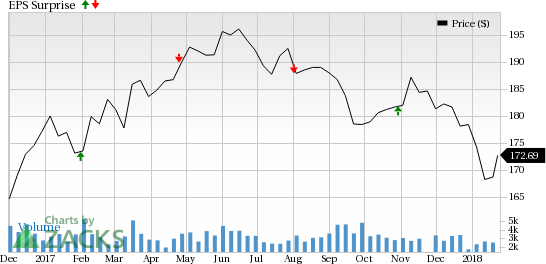

Last quarter, this residential REIT witnessed a negative surprise of 3.10% in terms of funds from operations (FFO) per share.

In the trailing four quarters, the company surpassed estimates on one occasion and missed in the other three. This resulted in an average negative surprise of 1.36%. The graph below depicts the surprise history of the company:

Let’s see how things are shaping up for this announcement.

Factors to Consider

Per a study by the real estate technology and analytics firm, RealPage, Inc. (NASDAQ:RP) , the U.S. apartment market reported moderate rent growth for the calendar year and seasonal pricing cuts in the fourth quarter. While U.S. apartment rents increased at a modest rate of 2.5% in 2017, effective rents for new leases edged down 0.9% during the quarter. Admittedly, the levels of rent growth have moderated from the earlier years. However, national apartment occupancy came in at 95.1% at the end of fourth-quarter 2017, remaining stable year over year.

AvalonBay is well-poised to grow on the back of rising demand from household formation and favorable demographics. Also, increasing consumer confidence on the back of job growth, higher wages and a healthier balance sheet promise bright prospects for this Arlington, VA-based REIT.

In fact, the company is also likely to continue experiencing high occupancy. Although the pace of rental growth has slowed down from the bygone years, it is now likely to achieve stability. The Zacks Consensus Estimate for fourth-quarter revenues is currently pegged at $555.2 million, denoting an expected increase of 7.1% year over year.

However, fourth quarter is seasonally the slower one. Moreover, there is presence of elevated supply in quite a few of the company’s markets. Hence, any robust growth in its stabilized portfolio is likely to remain restricted in the yet-to-be-reported quarter. In addition, there is high concession activity amid higher supply, which remains a concern.

Additionally, prior to fourth-quarter earnings release, there is lack of any solid catalyst for raising optimism about the company’s business activities and prospects. As such, the Zacks Consensus Estimate for FFO per share in the soon-to-be-reported quarter remained unchanged at $2.24, over the past month. Nevertheless, this indicates a 5.7% increase year over year.

Earnings Whispers

Our proven model does not conclusively show that AvalonBay is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a bullish Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here, as you will see below.

Zacks ESP: AvalonBay has an Earnings ESP of -0.07%, representing the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: AvalonBay’s Zacks Rank #3 increases the predictive power of ESP. However, we also need to have a positive ESP to be confident about an earnings surprise.

Stocks That Warrant a Look

Here are a few stocks in the REIT space that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this time around:

CubeSmart (NYSE:CUBE) , slated to release fourth-quarter results on Feb 15, has an Earnings ESP of +1.10% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

EPR Properties (NYSE:EPR) , expected to report quarterly numbers around Feb 27, has an Earnings ESP of +0.69% and a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

RealPage, Inc. (RP): Free Stock Analysis Report

EPR Properties (EPR): Free Stock Analysis Report

AvalonBay Communities, Inc. (AVB): Free Stock Analysis Report

CubeSmart (CUBE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.