- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AUD/USD And EUR/AUD Analysis: March 06, 2018

The Reserve Bank of Australia (RBA) left interest rates unchanged at a record low of 1.50% at its monetary policy meeting. There was little reaction from the Australian Dollar, as the decision was already priced in by the market. Interest rates are expected to remain unchanged until early 2019. The RBA stated that the country’s gross domestic product (GDP) will “grow faster in 2018 than it did in 2017” but removed reference to expectations of “above 3 percent” growth over the next couple of years. This change has led to a downgrade in GDP forecasts for the fourth-quarter, which are due to be released on Wednesday.

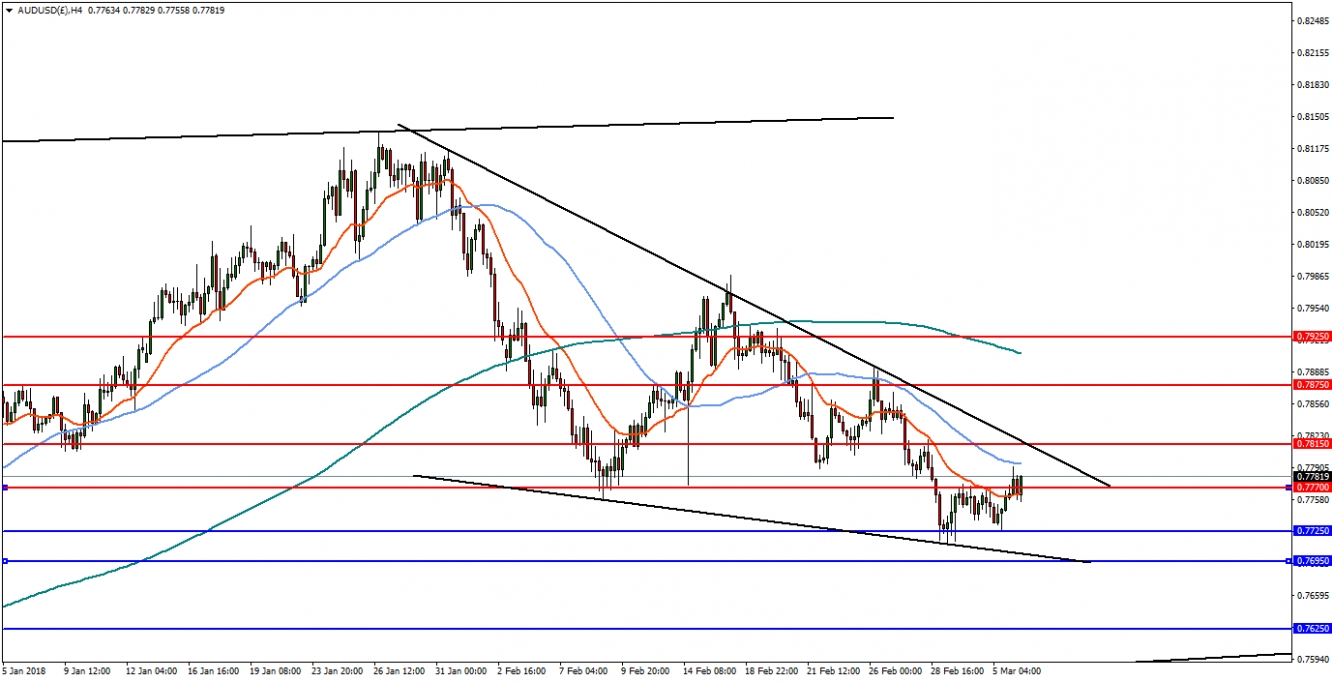

AUDUSD has found support at the 0.7700-0.7725 zone, which previously acted as resistance during 2016. In the 4-hourly timeframe, the pair is seen to be trading in a descending wedge and a break of 0.7815 could lead to a bullish reversal, with resistance at 0.7875 and 0.7925. However, a break below support at 0.7725 is needed to continue the downtrend with support at 0.7695.

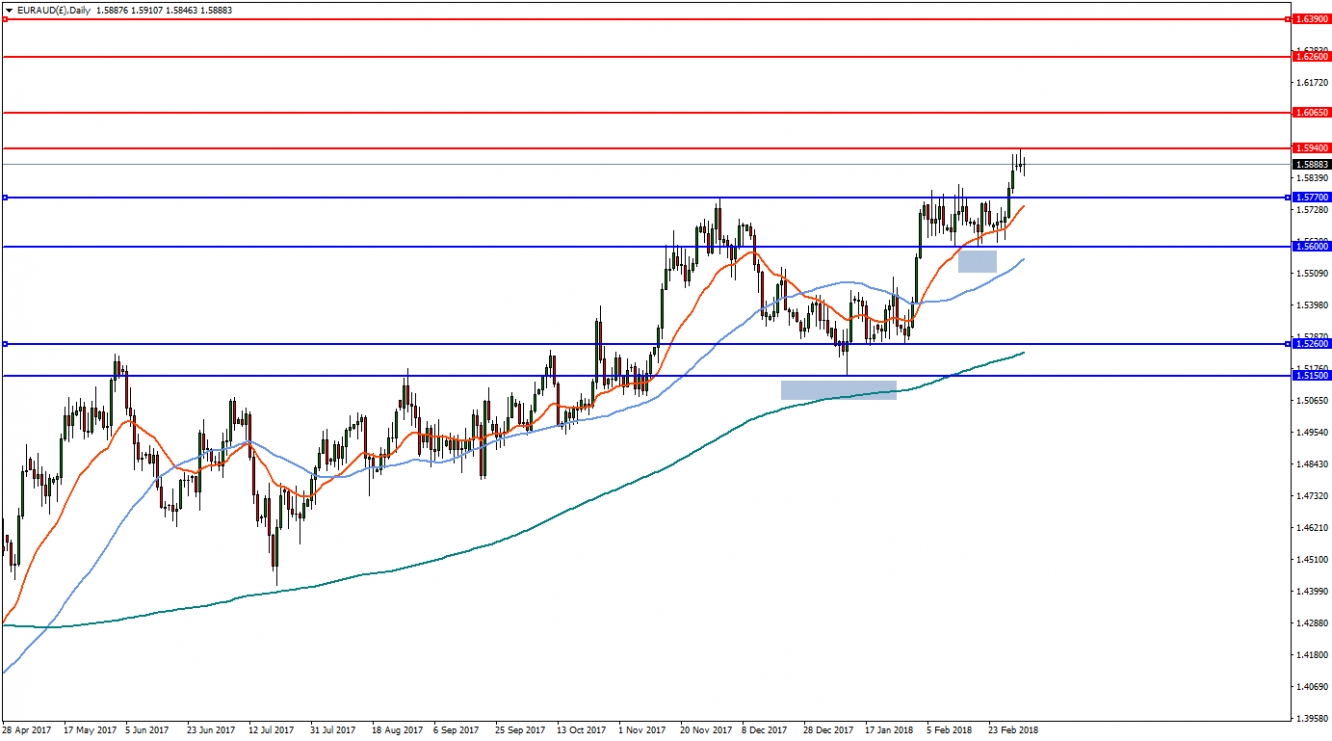

After breaking above the key 1.5150 level, EUR/AUD has continued trending higher and has now formed a cup and handle pattern in the daily timeframe. The measured target for such a pattern is 1.6390. The pair needs to trade above 1.5770 for a continued bullish move toward the target, with immediate resistance at 1.5940 and 1.6065. A reversal and break below 1.5770 would negate the outlook, with downside support at 1.5600 and then the 200MA at 1.5260.

Related Articles

Trump confirms 25% tariffs on Mexico, Canada, and a fresh 10% on China GBP/USD struggles as risk-off flows boost the U.S. dollar Core PCE inflation data in focus amid U.S. growth...

The Canadian dollar is calm in the European session, trading at 1.4438, up 0.02% on the day. Later today, Canada releases GDP and the US publishes the Core PCE Price...

USD/CAD recoups drop below EMAs as March tariffs become reality Technical indicators suggest quick rebound is fragile; focus on 1.4470 USD/CAD made a strong comeback just when...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.