- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AUD Pushed By Commodity Recovery

Market Brief

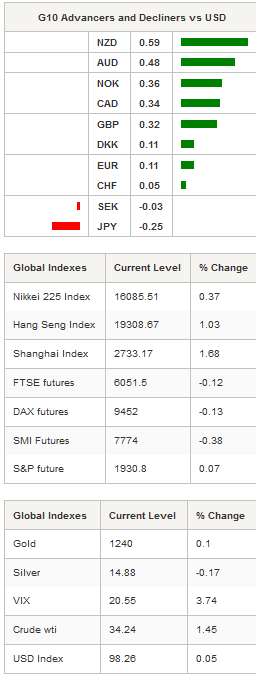

Commodity currencies paired gains during the Asian session as investor sentiment toward commodities continues to gradually improve. Gold continues to push higher, up 0.58% to $1,245 an ounce, as the greenback lost ground against the G10 complex. Palladium was also on fire in Tokyo as the metal surged 1.60%. In the commodity market, futures on iron ore rose sharply overnight amid a cut in the reserve ratio by the PBoC, while crude oil prices kept pushing higher. The West Texas Intermediate crude was up 1.45% to $34.24 a barrel, while its counterpart from the North Sea, the Brent crude, was up 1.15% to $37 a barrel.

This environment proved a major tailwind for the Australian as AUD/USD surged more than 1% from tonight’s low and reached 0.7192 after the RBA decided to keep the cash rate target unchanged at a record low of 2%. The statement was broadly in line with expectations and was even perceived as relatively hawkish, especially when you consider the stable inflation outlook. AUD/USD is on its way to test the strong 0.7250 resistance level (already failed twice to break it to the upside). However, the price action suggests that the pair is lacking momentum as traders started to price back in a potential rate hike by the Federal Reserve. The pair is currently taking a breather at around 0.7180 as the rally loses steam.

The New Zealand dollar was the other big winner in Asia as the kiwi appreciated 0.60% against the greenback in spite of raising expectations for a rate cut from the RBNZ and falling terms of trade. NZD/USD started pushing higher in the late Asian session, rising as much as $0.6640. As stated many times, we maintain our bearish bias on the pair as the policy divergence theme is comes back under the spotlight. On the downside, a support can be found at 0.6566 (low from February 29th), then 0.6547 (low from Feb. 16th).

On the equity market, most Asian regional markets posted strong gains, with mainland Chinese stocks leading the charge, boosted by the PBoC’s RRR cut. The Shanghai Composite was up 1.68%, while the tech-heavy Shenzhen Composite surged 2.32%. In Japan, the Nikkei edged up 0.37%, in Singapore the STI was up 0.21%, while in India the Sensex jumped 2.66%. In Europe, equity futures were trading in negative territory ahead of today’s eurozone PMI figures.

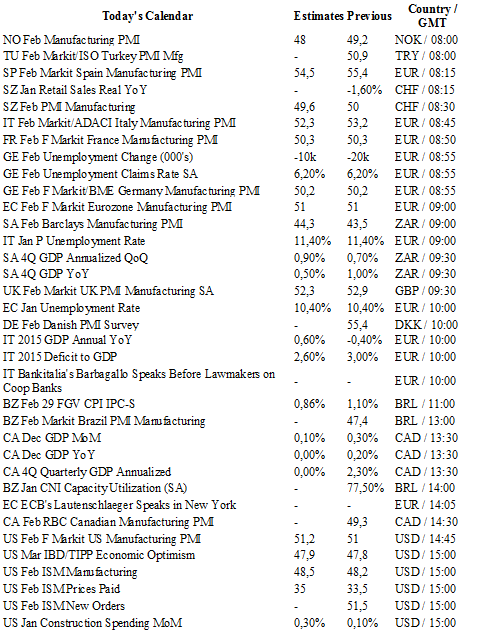

Today traders will be watching manufacturing PMI from Norway; Markit PMI from Turkey, Spain, Italy, France, Germany, the UK, Brazil and the US; PMI manufacturing and retail sales from Switzerland; unemployment rate from Germany; manufacturing PMI from South Africa; unemployment rate from the eurozone; Danish PMI survey; Canadian GDP; ISM manufacturing PMI and ISM price paid from the US.

Currency Tech

EUR/USD

R 2: 1.1068

R 1: 1.0963

CURRENT: 1.0862

S 1: 1.0810

S 2: 1.0711

GBP/USD

R 2: 1.4409

R 1: 1.4168

CURRENT: 1.3944

S 1: 1.3836

S 2: 1.3657

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 113.18

S 1: 110.99

S 2: 105.23

USD/CHF

R 2: 1.0257

R 1: 1.0074

CURRENT: 1.0005

S 1: 0.9847

S 2: 0.9660

Related Articles

An aggressive fiscal spending proposal by Germany has attracted bullish animal spirits into EUR/USD. A significant rally in the longer-end German Bund yields is likely to alter...

USD/JPY trades heavy despite widening yield differentials Non-farm payrolls loom large as traders focus on the unemployment rate. Mixed signals in data could see choppy trade,...

US Dollar Key Points Traders are starting to price in the potential for outright contraction in the US economy. Meanwhile, Germany’s announcement of a €500B infrastructure and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.