- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Abbott (ABT) Tops Q4 Earnings And Revenues, Issues Guidance

Abbott (NYSE:ABT) reported fourth-quarter 2017 adjusted earnings from continuing operations of 74 cents per share, beating the Zacks Consensus Estimate by a penny. Earnings improved 13.8% year over year and met the high end of the company’s guided range of 72 cents to 74 cents.

However, reported loss in the quarter came in at 50 cents per share, as against year-ago earnings of 51 cents. Notably, this includes anticipated net expense of $1.46 billion as an impact of U.S. tax reform.

Full-year 2017 adjusted earnings came in at $2.50 per share, in line with the Zacks Consensus Estimate. However, the figure beat the year-ago number by 13.6%.

Fourth-quarter worldwide sales came in at $7.59 billion, up 42.3% year over year on a reported basis. The figure also beat the Zacks Consensus Estimate of $7.37 billion by 2.9%.

On a comparable operational basis (adjusting the impact of foreign exchange, certain acquisitions and divestments), sales increased 7.7% year over year in the reported quarter.

Worldwide sales in the full year came in at $27.39 billion, up 31.3% year over year on a reported basis. The figure also surpassed the Zacks Consensus Estimate of $27.15 billion.

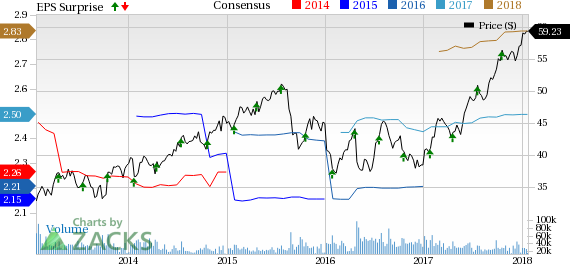

Abbott Laboratories Price, Consensus and EPS Surprise

Quarter in Detail

Abbott operates through four segments — Established Pharmaceuticals Division (“EPD”), Medical Devices, Nutrition and Diagnostics.

EPD sales were up 17% on a reported basis (up 14% on comparable operational basis) to $1.15 billion. This included a positive impact of 3% from currency fluctuations. Sales in key emerging markets increased 15% (up 12.5%), driven by double-digit growth in Latin America, India and China.

The Medical Devices business sales rose 102.2% on a reported basis to $2.74 billion. On a comparable operational basis, sales increased 9.6%.

Cardiovascular and Neuromodulation sales soared 222.5% on a reported basis (up 6.9% on comparable operational basis) on double-digit growth in Electrophysiology, Structural Heart, Heart Failure and Neuromodulation.

Vascular product sales, however, declined 1.9% on a comparable operational basis. Within Rhythm Management, the company saw a sales drop of 8% on a comparable operational basis. However, the company received FDA approval for magnetic resonance (MR)-conditional labeling for its Quadra Assura and Quadra Assura MP cardiac resynchronization therapy defibrillator (CRT-D) devices and its Fortify Assura implantable cardioverter defibrillator (ICD) in the quarter under review.

Diabetes Care sales improved 27.6% on a comparable operational basis, buoyed by double-digit international sales growth, led by continued consumer uptake of FreeStyle Libre — the revolutionary continuous glucose monitoring system of Abbott.

Nutrition sales were up 3% year over year on a reported basis (2% on a comparable operational basis). Foreign exchange drove sales by 1%. Pediatric Nutrition sales increased 1.5% on a comparable operational basis. Adult Nutrition sales were up 2.8% on a comparable operational basis.

Diagnostics sales rose 51.7% year over year on a reported basis (up 6.7% on a comparable operational basis). Core Laboratory and Point of Care Diagnostics sales grew 7.2% and 6.8%, respectively, on a comparable operational basis. Molecular Diagnostics sales were up a nominal 2.4% as strong growth in the infectious disease testing business was partially offset by the planned scale down of the genetics business. Rapid Diagnostics recorded sales of $540 million, driven by solid contributions from infectious disease testing, including flu and strep testing.

Guidance

Abbott issued full-year 2018 guidance. Adjusting for certain net specified items for the full year, adjusted earnings per share from continuing operations are expected in the band of $2.80-$2.90. The current Zacks Consensus Estimate is pegged at $2.83, near the low end of the projected range.

The company also provided first-quarter 2018 adjusted earnings per share guidance. It expects to report adjusted earnings from continuing operations in the range of 57 cents to 59 cents in the quarter. The current Zacks Consensus Estimate of 56 cents is below the projected range.

Our Take

Abbott has steered past the Zacks Consensus Estimate for earnings and sales. We are optimistic about the company’s strong and consistent EPD and Medical Devices performance. We are upbeat about contributions from the company’s other two businesses as well.

The company continues to benefit from the recently completed acquisition of St. Jude Medical, which offers it an industry-leading pipeline across cardiovascular, neuromodulation, diabetes and vision care. We are also upbeat about Abbott’s successful closure of the Alere acquisition. Synergies from the buyout, in the form of revenues from Rapid Diagnostics, have been benefiting the company.

Meanwhile, the company’s emerging market performance has been extremely promising on several strategic developments.

Zacks Rank & Key Picks

Abbott carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical sector are Bio-Rad Laboratories, Inc. (NYSE:BIO) , Intuitive Surgical, Inc. (NASDAQ:ISRG) and Amedisys (NASDAQ:AMED) . Notably, Bio-Rad sports a Zacks Rank #1 (Strong Buy), while Amedisys and Intuitive Surgical carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bio-Rad is expected to release fourth-quarter 2017 results on Feb 22. The Zacks Consensus Estimate for fourth-quarter adjusted EPS is $1.27 and for revenues is $617.2 million.

Amedisys is expected to release fourth-quarter 2017 results on Feb 27. The Zacks Consensus Estimate for fourth-quarter adjusted EPS is 59 cents and for revenues is $394.9 million.

Intuitive Surgical is expected to release fourth-quarter 2017 results on Jan 25. The Zacks Consensus Estimate for fourth-quarter adjusted EPS is pegged at $2.27 and for revenues is $877.2 million.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Abbott Laboratories (ABT): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO): Free Stock Analysis Report

Amedisys Inc (AMED): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Despite the Nasdaq 100’s earlier single-day loss of -3% on 27 January inflicted by Chinese Artificial Intelligence (AI) start-up DeepSeek’s cutting-edge capabilities with lower...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.