By David Shepardson

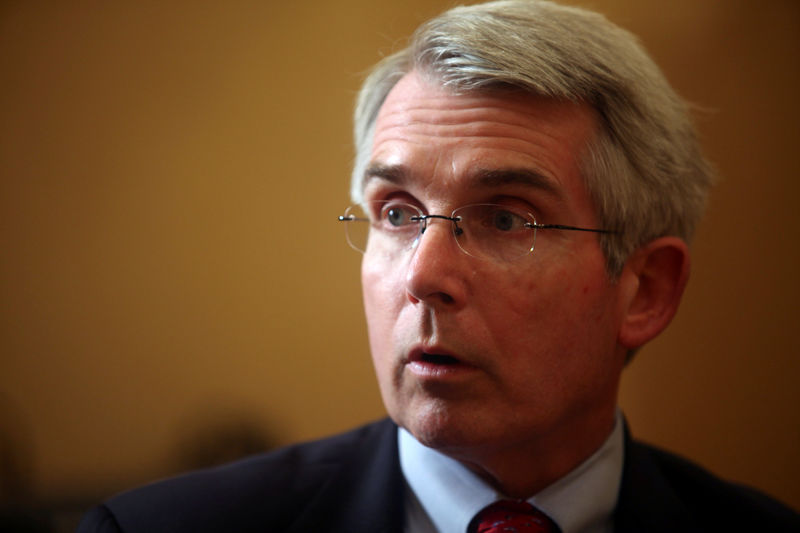

WASHINGTON (Reuters) - Outgoing Amtrak Co-chief Executive Wick Moorman said on Wednesday the money-losing U.S. passenger rail system is considering a less comfortable economy class of seats that could allow it to pack in more passengers.

"We are looking at doing some creative things in terms of creating an economy class," Moorman said at the National Press Club talk in Washington.

He said that seat pitch - the distance between the seatback and the seat in front of it - would be tighter like in airline seats. "There will be some other things that just don't make it quite as comfortable," Moorman said.

Moorman told reporters the railroad is studying the idea and has not made any final decisions.

Amtrak fares can be higher than airline fares but its trains currently offer much more leg room than an economy-class airplane seat.

"We compete very well with the airlines," Moorman said, noting trains on its heavily traveled New York-Washington route do not have middle seats and allow passengers to avoid New York's LaGuardia Airport and lengthy airport security lines.

Amtrak had a record 31.3 million passengers last year, with more than one-third of them in the Northeast Corridor. It operates an average of 300 trains a year on 21,300 miles of tracks, serving 500 destinations in 46 states.

Amtrak struggles to pay for itself. For the year ending Sept. 30, it posted its highest ever total revenue of $3.2 billion. Its unaudited operating loss of $227 million was the smallest since 1973.

Amtrak scored a victory on Monday when a U.S. House Appropriations Committee panel rejected massive budget cuts proposed by the Trump administration that would have ended $630 million in subsidies for Amtrak to operate long-distance train service.

The House panel instead approved $1.4 billion for Amtrak, about what it received last year. It also backed an additional $900 million in new funding for the $24 billion planned Gateway rail project to build a new train tunnel under the Hudson River near New York City. The funding also will pay to repair the existing, century-old tunnel between New York and New Jersey before it becomes unusable in the next decade.

On Wednesday Richard Anderson, a former Delta Air Lines (NYSE:DAL) chief, became president and co-CEO on Wednesday, just two days after Amtrak launched a major renovation of its busiest U.S. hub, New York City's Pennsylvania Station, following years of disruptions and delays along the Northeast Corridor.

Anderson and Moorman, who became CEO in September and recruited Anderson, will share the top job until Moorman steps down on Dec. 31.

The Penn Station repairs, expected to cost $30 million to $40 million over several years, was expedited after recent derailments and other problems from decaying infrastructure caused delays for thousands of commuters throughout the greater New York City area. It is expected to cause major service disruptions across the metropolitan region this summer.

The project has caused a rift between Amtrak, the station owner, and the two states that use most of the hub's track space, New York and New Jersey. Moorman said he is confident the repairs will be completed by early September, or it will finish them on weekends.